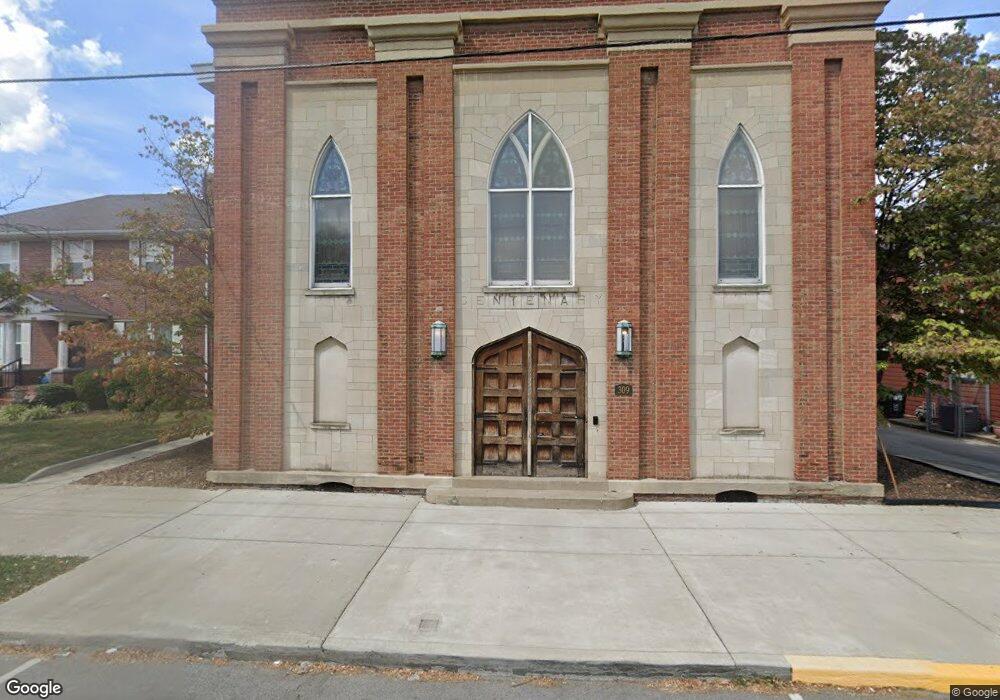

309 E Spring St New Albany, IN 47150

Estimated Value: $316,000

4

Beds

2

Baths

26,537

Sq Ft

$12/Sq Ft

Est. Value

About This Home

This home is located at 309 E Spring St, New Albany, IN 47150 and is currently estimated at $316,000, approximately $11 per square foot. 309 E Spring St is a home located in Floyd County with nearby schools including S. Ellen Jones Elementary School, Hazelwood Middle School, and New Albany Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 3, 2022

Sold by

Centenary On S Spring Llc

Bought by

Lofts On 3Rd Holdings Llc

Current Estimated Value

Purchase Details

Closed on

Apr 20, 2020

Sold by

Centenary United Methodist Church Of New

Bought by

Centenary On Spring Llc

Purchase Details

Closed on

Nov 7, 2005

Sold by

Malison Ronald C and Braden David A

Bought by

Centenary United Methodist Church Of New

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lofts On 3Rd Holdings Llc | -- | None Listed On Document | |

| Centenary On Spring Llc | -- | None Available | |

| Centenary United Methodist Church Of New | -- | None Available |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $126,839 | $1,655,800 | $101,700 | $1,554,100 |

| 2023 | $126,839 | $4,600,700 | $101,700 | $4,499,000 |

| 2022 | $128,246 | $4,650,700 | $101,700 | $4,549,000 |

| 2021 | $18,507 | $842,100 | $101,700 | $740,400 |

| 2020 | $3,374 | $842,300 | $101,700 | $740,600 |

| 2019 | $3,267 | $842,300 | $101,700 | $740,600 |

| 2018 | $3,037 | $834,200 | $101,700 | $732,500 |

| 2017 | $2,369 | $823,600 | $101,700 | $721,900 |

| 2016 | $2,681 | $815,700 | $101,700 | $714,000 |

| 2014 | $2,934 | $874,700 | $101,700 | $773,000 |

| 2013 | -- | $848,600 | $101,700 | $746,900 |

Source: Public Records

Map

Nearby Homes

- 1120 Ekin Ave

- 1217 E Spring St

- 418 E 13th St

- 1030 Prospect St

- 1132 Greenaway Place

- 1110 Chartres St

- 325 E 14th St

- 1313 Culbertson Ave

- 1120 Chartres St

- 1108 State St

- 235 Cherry St

- 1139 Beeler St

- 335 E 15th St

- 655 W 7th St

- 220 W 8th St

- 336 E 16th St

- 1406 Chartres St

- 425 W 8th St

- 1409 Locust St

- 1525 E Oak St