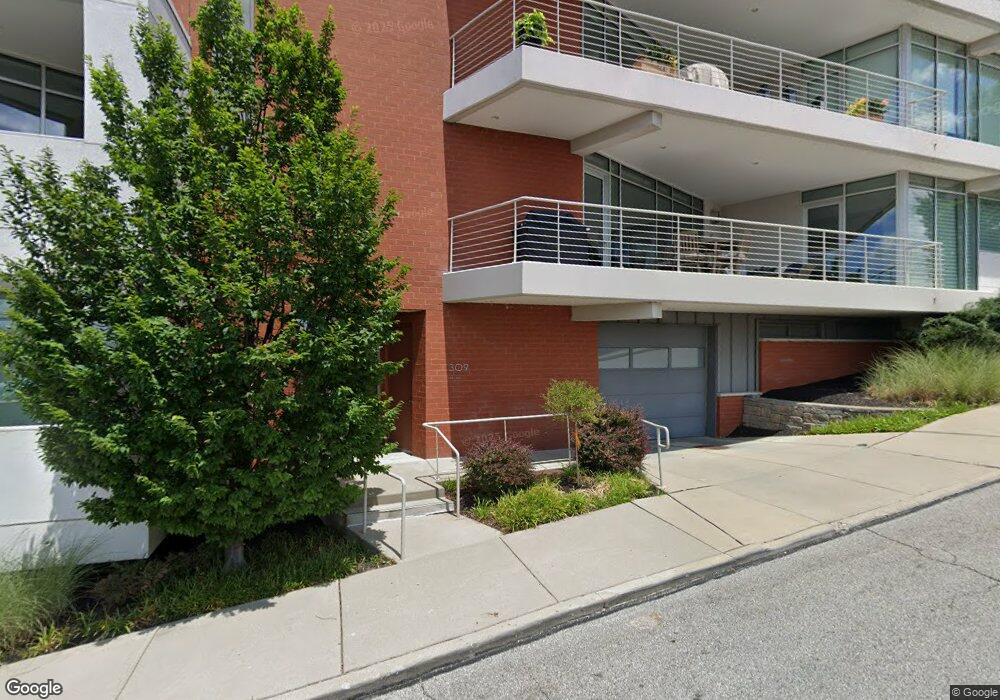

309 Oregon St Cincinnati, OH 45202

Mount Adams NeighborhoodEstimated Value: $487,000

Studio

--

Bath

--

Sq Ft

0.36

Acres

About This Home

This home is located at 309 Oregon St, Cincinnati, OH 45202 and is currently estimated at $487,000. 309 Oregon St is a home located in Hamilton County with nearby schools including Robert A. Taft Information Technology High School, Withrow University High School, and Clark Montessori High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 16, 2023

Sold by

Mathile Timothy Tr

Bought by

Randy T Slovin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Interest Rate

6.69%

Purchase Details

Closed on

May 29, 2020

Sold by

Florez Francis X and Plecha Christine F

Bought by

Mathile Timothy L and The Timothy L Mathile Trust

Purchase Details

Closed on

Dec 30, 2014

Sold by

Vail Terra Llc

Bought by

Florez Francis and Plecha Christine E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$700,000

Interest Rate

3.12%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Randy T Slovin | $1,000,000 | -- | |

| Mathile Timothy L | $865,000 | None Available | |

| Florez Francis | $875,000 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Randy T Slovin | -- | |

| Previous Owner | Florez Francis | $700,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $286 | $4,473 | $1,050 | $3,423 |

| 2024 | $286 | $4,473 | $1,050 | $3,423 |

| 2023 | $286 | $4,473 | $1,050 | $3,423 |

| 2022 | $238 | $3,332 | $700 | $2,632 |

| 2021 | $233 | $3,332 | $700 | $2,632 |

| 2020 | $233 | $3,332 | $700 | $2,632 |

| 2019 | $256 | $3,332 | $700 | $2,632 |

| 2018 | $256 | $3,332 | $700 | $2,632 |

| 2017 | $247 | $3,332 | $700 | $2,632 |

| 2016 | $480 | $6,346 | $700 | $5,646 |

| 2015 | $429 | $6,346 | $700 | $5,646 |

| 2014 | $432 | $6,346 | $700 | $5,646 |

| 2013 | $439 | $6,346 | $700 | $5,646 |

Source: Public Records

Map

Nearby Homes

- 325 Oregon St

- 327 Oregon St

- 330 Oregon St

- 341 Oregon St

- 380 Baum St

- 380 Baum St Unit 5B

- 900 Adams Crossing

- 310 Oregon St

- 328 Oregon St

- 1054 Saint Paul Place

- 506 Baum St Unit 1

- 1112 Fuller St

- 429 Oregon St

- 915 Monastery St

- 1120 Fuller St

- 961 Hatch St

- 982 Hatch St

- 905 Paradrome St

- 1238 Elsinore Ave

- 1240 Elsinore Ave

Your Personal Tour Guide

Ask me questions while you tour the home.