310 E Fort George Way Unit C 17 Sunset, SC 29685

Shady Grove NeighborhoodEstimated Value: $3,531,000 - $4,093,000

4

Beds

6

Baths

4,128

Sq Ft

$936/Sq Ft

Est. Value

About This Home

This home is located at 310 E Fort George Way Unit C 17, Sunset, SC 29685 and is currently estimated at $3,861,942, approximately $935 per square foot. 310 E Fort George Way Unit C 17 is a home located in Pickens County with nearby schools including Hagood Elementary School, Pickens Middle School, and Pickens High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 1, 2021

Sold by

Farina F William F and Farina Susan P

Bought by

Chang George Lee

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,816,500

Outstanding Balance

$1,628,363

Interest Rate

2.7%

Mortgage Type

New Conventional

Estimated Equity

$2,233,579

Purchase Details

Closed on

Nov 14, 2007

Sold by

Kastle Developers Llc

Bought by

Farina F William and Farina Susan P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$251,250

Interest Rate

6.36%

Purchase Details

Closed on

Aug 24, 2006

Sold by

Strand Richard and Strand Kathryn

Bought by

Kastle Developers Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$521,490

Interest Rate

6.73%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chang George Lee | $2,595,000 | None Available | |

| Farina F William | $670,000 | None Available | |

| Kastle Developers Llc | $479,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chang George Lee | $1,816,500 | |

| Previous Owner | Farina F William | $251,250 | |

| Previous Owner | Kastle Developers Llc | $521,490 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $37,417 | $155,700 | $24,000 | $131,700 |

| 2023 | $37,417 | $155,700 | $24,000 | $131,700 |

| 2022 | $37,547 | $155,700 | $24,000 | $131,700 |

| 2021 | $21,918 | $93,260 | $23,400 | $69,860 |

| 2020 | $21,057 | $93,260 | $23,400 | $69,860 |

| 2019 | $21,186 | $93,260 | $23,400 | $69,860 |

| 2018 | $25,036 | $105,860 | $24,000 | $81,860 |

| 2017 | $28,967 | $105,860 | $24,000 | $81,860 |

| 2015 | $28,457 | $122,890 | $0 | $0 |

| 2008 | -- | $40,200 | $40,200 | $0 |

Source: Public Records

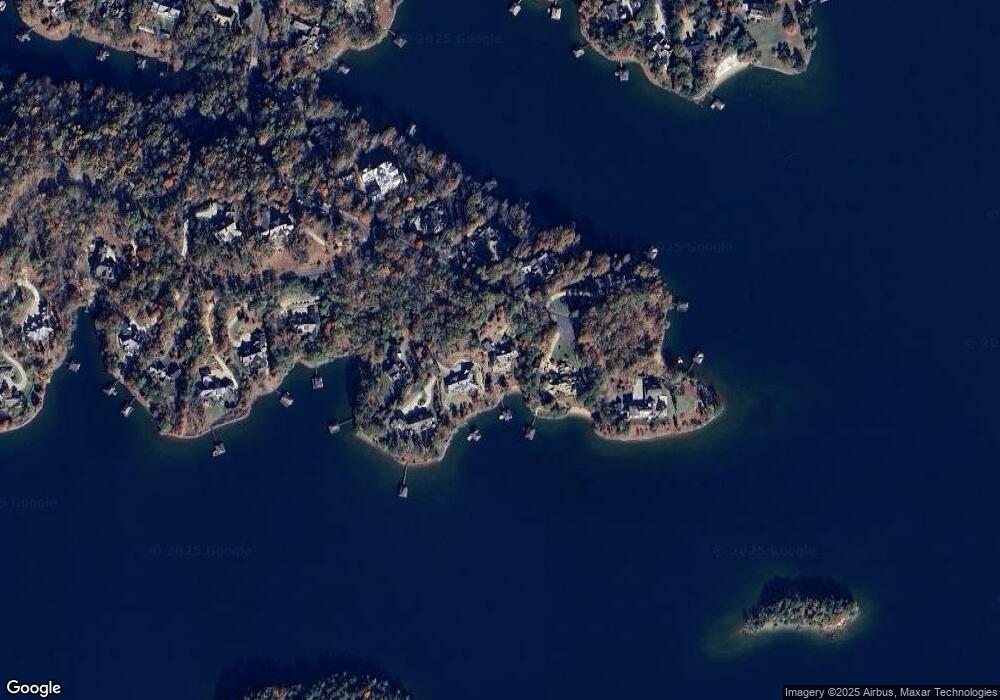

Map

Nearby Homes

- 311 S Cove Rd

- 107 S Turtle Rock Rd

- 201 Deep Cove Point

- 147 S Falls Rd

- 130 River Ridge Rd

- 103 Cato Ct

- 00 Murphy Rd

- 00 Murphy Rd Unit 3.2 acres S. Side Mu

- 503 Driftwood Ct

- 703 Misty Dawn Ct

- Lot 6 Bentwood Way

- 108 Cool Water Ct

- 909 Woodlake Way

- EWP #23 S Edgewater Dr

- 194 Cool Water Way

- 344 Long Cove Trail

- 109 Vaughn Ct

- 335 Long Cove Trail

- 108 Ivy Hollow Ct

- 117 Misty Water Loop

- 310 E Fort George Way

- 105 Prince Ln Unit C 19

- 105 Prince Ln

- 105 Prince Ln Unit Lot C 19

- 314 E Fort George Way

- 314 E Fort George Way Unit C16

- 306 E Fort George Way Unit C 18

- 00 E Fort George Way

- 309 E Fort George Way Unit C12

- 309 E Fort George Way

- 105 E Fort George Way

- 305 E Fort George Way

- 313 E Fort George Way

- 106 Prince Ln

- 318 E Fort George Way Unit The Reserve at Lake

- 318 E Fort George Way Unit C15

- 301 E Fort George Way

- 401 W Fort George Way

- 401 W Fort George Way Unit C 36

- 217 E Fort George Way