310 Foxtail Ln Spring City, PA 19475

Estimated Value: $559,000 - $602,000

4

Beds

4

Baths

2,682

Sq Ft

$217/Sq Ft

Est. Value

About This Home

This home is located at 310 Foxtail Ln, Spring City, PA 19475 and is currently estimated at $580,845, approximately $216 per square foot. 310 Foxtail Ln is a home located in Chester County with nearby schools including East Vincent Elementary School, Owen J Roberts Middle School, and Owen J Roberts High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 30, 2009

Sold by

Smolij Mark I and Smolij Jessica A

Bought by

Kay Warren E and Kay Carla J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$272,000

Outstanding Balance

$171,948

Interest Rate

4.94%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$408,897

Purchase Details

Closed on

Aug 8, 2003

Sold by

Smolij Mark I and Smolij Jessica A

Bought by

Smolij Mark I and Smolij Jessica A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,000

Interest Rate

5.46%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 26, 2001

Sold by

Nvr Inc

Bought by

Smolij Mark I and Mazeski Jessica A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$169,200

Interest Rate

6.88%

Purchase Details

Closed on

Jan 25, 2001

Sold by

Westrum East Vincent Lp

Bought by

Nvr Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kay Warren E | $317,000 | None Available | |

| Smolij Mark I | -- | -- | |

| Smolij Mark I | $211,515 | -- | |

| Nvr Inc | $51,480 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kay Warren E | $272,000 | |

| Previous Owner | Smolij Mark I | $168,000 | |

| Previous Owner | Smolij Mark I | $169,200 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,908 | $192,530 | $45,610 | $146,920 |

| 2024 | $7,908 | $192,530 | $45,610 | $146,920 |

| 2023 | $7,794 | $192,530 | $45,610 | $146,920 |

| 2022 | $7,667 | $192,530 | $45,610 | $146,920 |

| 2021 | $7,535 | $192,530 | $45,610 | $146,920 |

| 2020 | $7,340 | $192,530 | $45,610 | $146,920 |

| 2019 | $7,202 | $192,530 | $45,610 | $146,920 |

| 2018 | $7,119 | $192,530 | $45,610 | $146,920 |

| 2017 | $6,950 | $192,530 | $45,610 | $146,920 |

| 2016 | $5,927 | $192,530 | $45,610 | $146,920 |

| 2015 | $5,927 | $192,530 | $45,610 | $146,920 |

| 2014 | $5,927 | $192,530 | $45,610 | $146,920 |

Source: Public Records

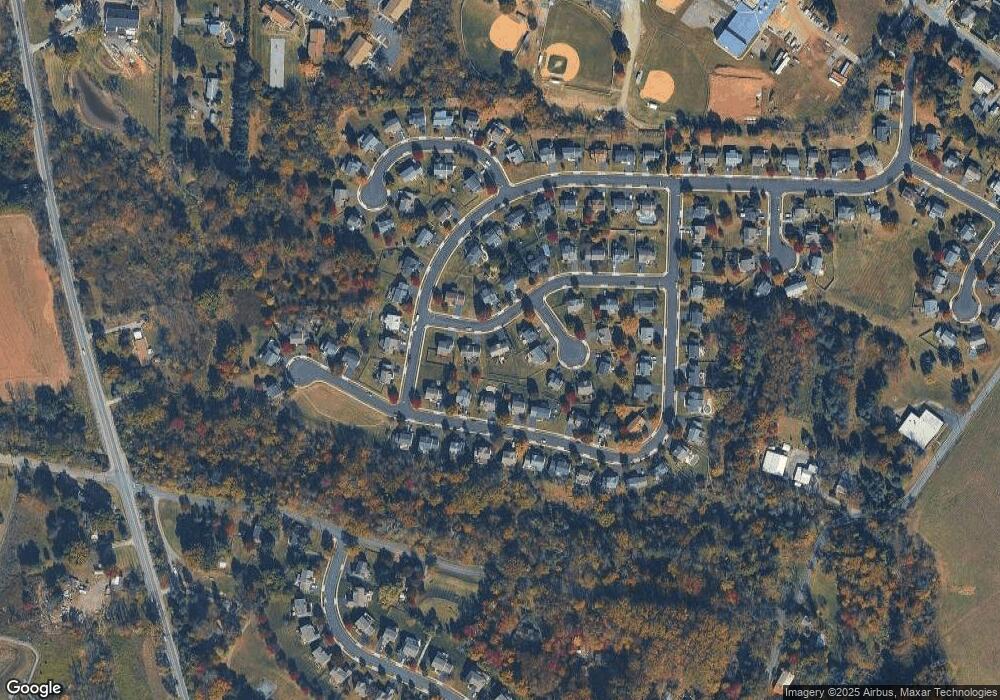

Map

Nearby Homes

- 507 Park Rd

- 841 Cypress Ave

- 256 Chestnut St

- 865 Cypress Ave

- 114 Linden Dr

- 431 Broad St

- 887 Aspen Ave

- 205 S And k St

- 149 Poplar St

- 54 N Church St

- 284 Stony Run Rd

- 235 2nd Ave Unit 2

- 229 2nd Ave

- 227 2nd Ave Unit 6

- 24 Cameron Ct Unit CONDO 24

- 64 Rogerson Ct

- 213 Eadie Way

- 828 Spring City Rd

- 210 New St Unit 84

- 5 Madison Dr

- 312 Foxtail Ln

- 21 Brookside Ct

- 23 Brookside Ct

- 423 Winding Stream Rd

- 421 Winding Stream Rd

- 425 Winding Stream Rd

- 25 Brookside Ct

- 314 Foxtail Ln

- 313 Foxtail Ln

- 419 Winding Stream Rd

- 427 Winding Stream Rd

- 315 Foxtail Ln

- 311 Foxtail Ln

- 306 Foxtail Ln

- 29 Brookside Ct

- 417 Winding Stream Rd

- 434 Winding Stream Rd

- 436 Winding Stream Rd

- 432 Winding Stream Rd

- 24 Brookside Ct