3103 Monarch San Antonio, TX 78259

Encino Park NeighborhoodEstimated Value: $572,000 - $614,000

5

Beds

5

Baths

3,860

Sq Ft

$154/Sq Ft

Est. Value

About This Home

This home is located at 3103 Monarch, San Antonio, TX 78259 and is currently estimated at $596,089, approximately $154 per square foot. 3103 Monarch is a home located in Bexar County with nearby schools including Encino Park Elementary School, Tejeda Middle School, and Johnson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 16, 2024

Sold by

Jorgensen Matthew Ray and Jorgensen Dana Diane

Bought by

Slo Grown Family Living Trust and Jorgensen

Current Estimated Value

Purchase Details

Closed on

Jul 24, 2013

Sold by

Mathur Nitin and Mandal Binita

Bought by

Jorgensen Matthew Ray and Jorgensen Dana Diane

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

3.99%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 29, 2012

Sold by

The Robert A & Elizabeth A Jones Revocab

Bought by

Mathur Nitin and Mandal Binita

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$328,500

Interest Rate

3.56%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 22, 2010

Sold by

Jones Robert A and Jones Elizabeth A

Bought by

The Robert & Elizabeth A Jones Revocable

Purchase Details

Closed on

Jul 25, 2006

Sold by

Highland Homes San Antonio Ltd

Bought by

Jones Robert A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$285,742

Interest Rate

6.37%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Slo Grown Family Living Trust | -- | None Listed On Document | |

| Slo Grown Family Living Trust | -- | None Listed On Document | |

| Jorgensen Matthew Ray | -- | None Available | |

| Mathur Nitin | -- | Chicago Title | |

| The Robert & Elizabeth A Jones Revocable | -- | None Available | |

| Jones Robert A | -- | Lalt |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jorgensen Matthew Ray | $200,000 | |

| Previous Owner | Mathur Nitin | $328,500 | |

| Previous Owner | Jones Robert A | $285,742 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,328 | $545,000 | $78,020 | $466,980 |

| 2024 | $10,328 | $551,034 | $78,020 | $481,980 |

| 2023 | $10,328 | $500,940 | $78,020 | $476,980 |

| 2022 | $11,237 | $455,400 | $67,960 | $440,840 |

| 2021 | $10,577 | $414,000 | $61,740 | $352,260 |

| 2020 | $10,373 | $400,000 | $61,740 | $338,260 |

| 2019 | $10,174 | $382,000 | $67,730 | $314,270 |

| 2018 | $9,738 | $364,730 | $67,730 | $297,000 |

| 2017 | $9,919 | $368,080 | $67,730 | $300,350 |

| 2016 | $9,836 | $365,000 | $67,730 | $297,270 |

| 2015 | $9,203 | $338,000 | $52,920 | $285,080 |

| 2014 | $9,203 | $333,000 | $0 | $0 |

Source: Public Records

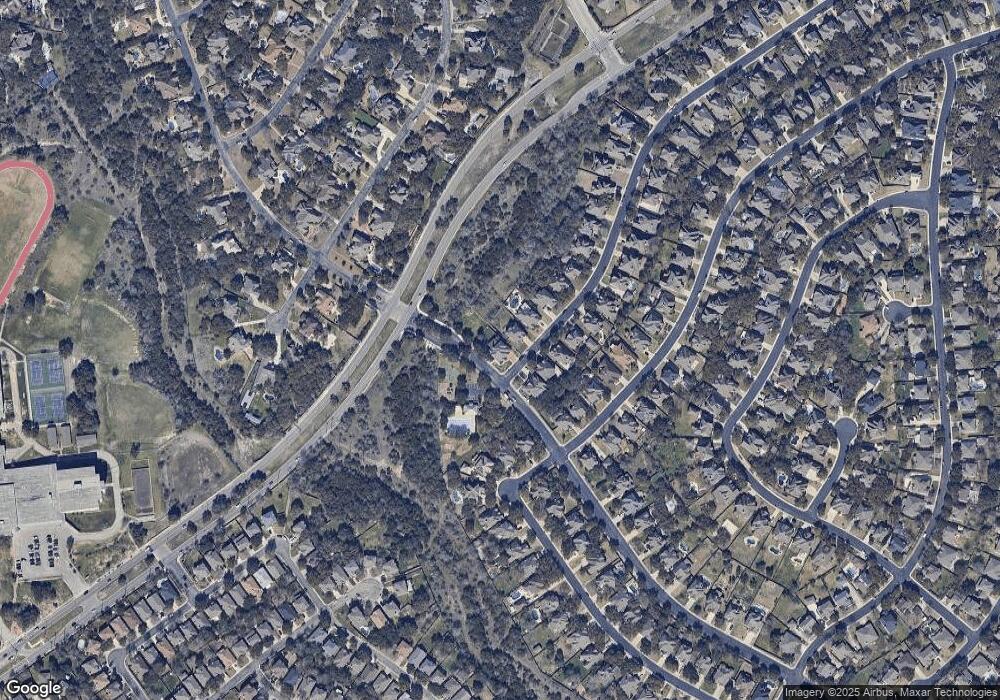

Map

Nearby Homes

- 3330 Edge View

- 3007 Sable Creek

- 3515 Edge View

- 2703 Rio Brazos

- 3526 Blackstone Run

- 12615 Terrace Hollow

- 2611 Rio Brazos

- 21510 Rio Colorado

- 21211 Rio Sabinal

- 3503 Windy Ridge Ct

- 8 Sable Forest

- 21402 Encino Lookout

- 24 Sable Forest

- 3119 Ambar Cala

- 21726 Luisa

- 3406 Maitland

- 131 Impala Cir

- 22418 Roan Forest

- 22415 Roan Forest

- 139 Impala Cir