Estimated Value: $264,000 - $297,000

--

Bed

2

Baths

1,549

Sq Ft

$177/Sq Ft

Est. Value

About This Home

This home is located at 3109 Vineyard, Tyler, TX 75701 and is currently estimated at $273,850, approximately $176 per square foot. 3109 Vineyard is a home located in Smith County with nearby schools including Birdwell Dual Language Immersion School, Hogg Middle School, and Tyler Legacy High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 17, 2017

Sold by

Ortega Lucia and Ortega Garcia Lucia

Bought by

Zatarain Miguel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$95,000

Outstanding Balance

$47,441

Interest Rate

4.19%

Mortgage Type

Commercial

Estimated Equity

$226,409

Purchase Details

Closed on

Sep 15, 2006

Sold by

Starr Capital Investments Ltd

Bought by

Zatarain Miguel A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,650

Interest Rate

6.64%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zatarain Miguel | -- | None Available | |

| Zatarain Miguel A | -- | Smith County Title Company | |

| Zatarain Miguel A | -- | Smith County Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Zatarain Miguel | $95,000 | |

| Previous Owner | Zatarain Miguel A | $58,650 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,162 | $303,728 | $41,583 | $262,145 |

| 2024 | $2,162 | $235,602 | $32,638 | $278,166 |

| 2023 | $3,734 | $264,470 | $32,638 | $231,832 |

| 2022 | $3,815 | $210,969 | $32,638 | $178,331 |

| 2021 | $3,714 | $177,012 | $32,638 | $144,374 |

| 2020 | $3,572 | $168,958 | $32,638 | $136,320 |

| 2019 | $3,318 | $151,741 | $28,806 | $122,935 |

| 2018 | $3,175 | $145,997 | $28,806 | $117,191 |

| 2017 | $3,117 | $145,997 | $28,806 | $117,191 |

| 2016 | $3,037 | $142,231 | $28,806 | $113,425 |

| 2015 | $2,735 | $138,774 | $28,806 | $109,968 |

| 2014 | $2,735 | $139,853 | $28,806 | $111,047 |

Source: Public Records

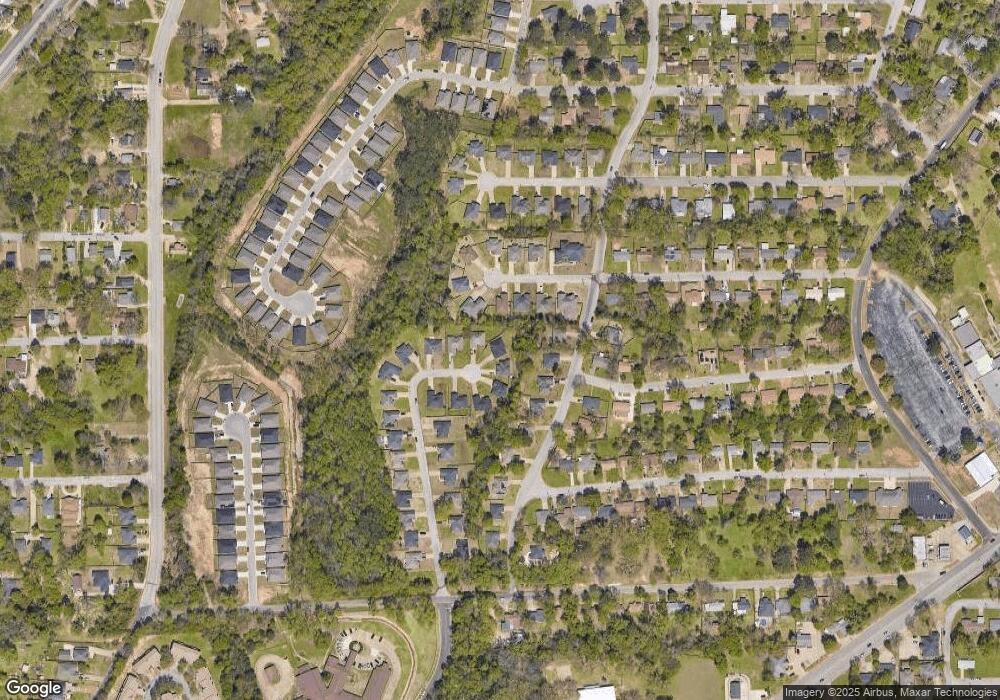

Map

Nearby Homes

- 1672 Alamo Crossing

- 1506 Bowie Dr

- 2922 W Azalea Dr

- 3413 Iberville Dr

- 3426 Bienville Dr

- 1209 Terre Haute Dr

- 3425 Iberville Dr

- 2922 Frankston Hwy

- 3048 Concord Place

- 3045 Concord Place

- 1408 Old Noonday Rd

- 3012 Frankston Hwy

- 3016 Frankston Hwy

- 1531 Woodland Hills Dr

- 3404 Silverwood Dr

- 2319 Luther St

- 3505 Cloverdale Dr

- 1111 Beechwood Dr

- 2900 S Robertson Ave

- 3501 Silverwood Dr

- 3105 Vineyard

- 3113 Vineyard

- 3113 3113 Vineyard

- 1732 1732 Austin

- 1726 Austin Dr

- 3095 San Jacinto Dr

- 3110 3110 Vineyard

- 3085 San Jacinto Dr

- 3110 Vineyard

- 3117 Vineyard

- 3105 San Jacinto Dr

- 1720 Austin Dr

- 1738 Austin Dr

- 3114 Vineyard

- 3115 San Jacinto Dr

- 1714 Austin Dr

- 1744 1744 Austin

- 3121 Vineyard

- 3118 Vineyard

- 3118 3118 Vineyard Ave