311 Princeton Ln Unit 50LG31 Glenview, IL 60026

The Willows NeighborhoodEstimated Value: $521,000 - $594,000

2

Beds

--

Bath

2,100

Sq Ft

$263/Sq Ft

Est. Value

About This Home

This home is located at 311 Princeton Ln Unit 50LG31, Glenview, IL 60026 and is currently estimated at $551,253, approximately $262 per square foot. 311 Princeton Ln Unit 50LG31 is a home located in Cook County with nearby schools including Willowbrook Elementary School, Maple School, and Glenbrook South High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 13, 2024

Sold by

Claire Meyers Trust and Meyers Claire

Bought by

Hoffman Aaron E and Hoffman Sarah P

Current Estimated Value

Purchase Details

Closed on

Feb 22, 2022

Sold by

Meyers James D and Meyers Claire K

Bought by

Meyers Claire and Claire Myers Trust

Purchase Details

Closed on

Aug 23, 2013

Sold by

Goldenberg Stewart and Goldenberg Sheryl

Bought by

Meyers James D and Meyers Claire K

Purchase Details

Closed on

Aug 22, 2013

Sold by

Goldenberg Roger and Goldenberg Leo

Bought by

Meyers James D and Meyers Claire K

Purchase Details

Closed on

Aug 17, 1999

Sold by

Goldenberg Leo and Goldenberg Raquel

Bought by

Goldenberg Leo and Goldenberg Raquel

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hoffman Aaron E | $525,000 | Chicago Title | |

| Hoffman Aaron E | $525,000 | Chicago Title Insurance Compan | |

| Meyers Claire | -- | -- | |

| Meyers James D | -- | First American Title | |

| Meyers James D | $305,000 | First American Title | |

| Meyers James D | -- | First American Title | |

| Goldenberg Leo | -- | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,229 | $49,036 | $11,532 | $37,504 |

| 2024 | $7,229 | $37,173 | $9,785 | $27,388 |

| 2023 | $7,005 | $37,173 | $9,785 | $27,388 |

| 2022 | $7,005 | $37,173 | $9,785 | $27,388 |

| 2021 | $6,988 | $33,303 | $8,212 | $25,091 |

| 2020 | $6,997 | $33,303 | $8,212 | $25,091 |

| 2019 | $6,744 | $36,781 | $8,212 | $28,569 |

| 2018 | $7,290 | $36,311 | $7,163 | $29,148 |

| 2017 | $7,170 | $36,311 | $7,163 | $29,148 |

| 2016 | $6,907 | $36,311 | $7,163 | $29,148 |

| 2015 | $5,681 | $28,081 | $5,766 | $22,315 |

| 2014 | $5,599 | $28,081 | $5,766 | $22,315 |

| 2013 | $5,501 | $28,081 | $5,766 | $22,315 |

Source: Public Records

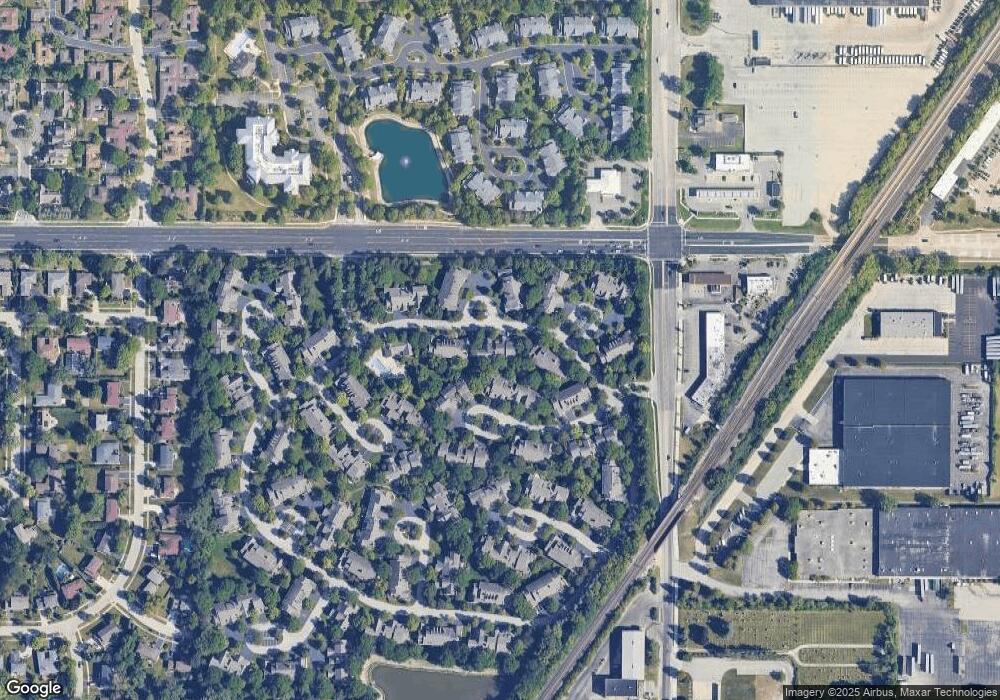

Map

Nearby Homes

- 102 Yale Ct Unit 34LH10

- 2050 Valencia Dr Unit 300C

- 2050 Valencia Dr Unit 405C

- 2571 Essex Dr

- 2431 Cobblewood Dr Unit 9

- 2137 Dauntless Dr

- 2230 Goldenrod Ln

- 2408 Violet St

- 1941 Kingsley Cir

- 1904 Somerset Ln Unit 48

- 1817 Somerset Ln Unit 24

- 1772 Lancaster Way

- 3820 Kiess Dr

- 3800 Kiess Dr

- 1943 Sunnyside Cir

- 3005 Highland Rd

- 1914 Farnsworth Ln Unit 208

- 1867 Admiral Ct Unit 91

- 2150 Founders Dr Unit 247

- 2150 Founders Dr Unit 234

- 313 Princeton Ln Unit 50LH31

- 305 Princeton Ln Unit 51RK30

- 317 Princeton Ln Unit 50RG31

- 121 Harvard Ct Unit 25RI12

- 303 Princeton Ln Unit 51MI30

- 100 Bucknel Ct Unit 29

- 117 Harvard Ct Unit 24LJ11

- 123 Harvard Ct Unit 25MK12

- 301 Princeton Ln Unit 51LJ30

- 101 Bucknel Ct

- 102 Bucknel Ct Unit 53LH10

- 102 Bucknel Ct Unit 52LG107

- 102 Bucknel Ct Unit 102

- 115 Harvard Ct Unit 24LI11

- 125 Harvard Ct Unit 25LI12

- 104 Bucknel Ct Unit 53RH10

- 104 Bucknel Ct Unit 104

- 324 Princeton Ln Unit 54RK32

- 106 Bucknel Ct Unit 53RG10

- 106 Bucknel Ct

Your Personal Tour Guide

Ask me questions while you tour the home.