Estimated Value: $268,000 - $322,905

3

Beds

3

Baths

1,600

Sq Ft

$191/Sq Ft

Est. Value

About This Home

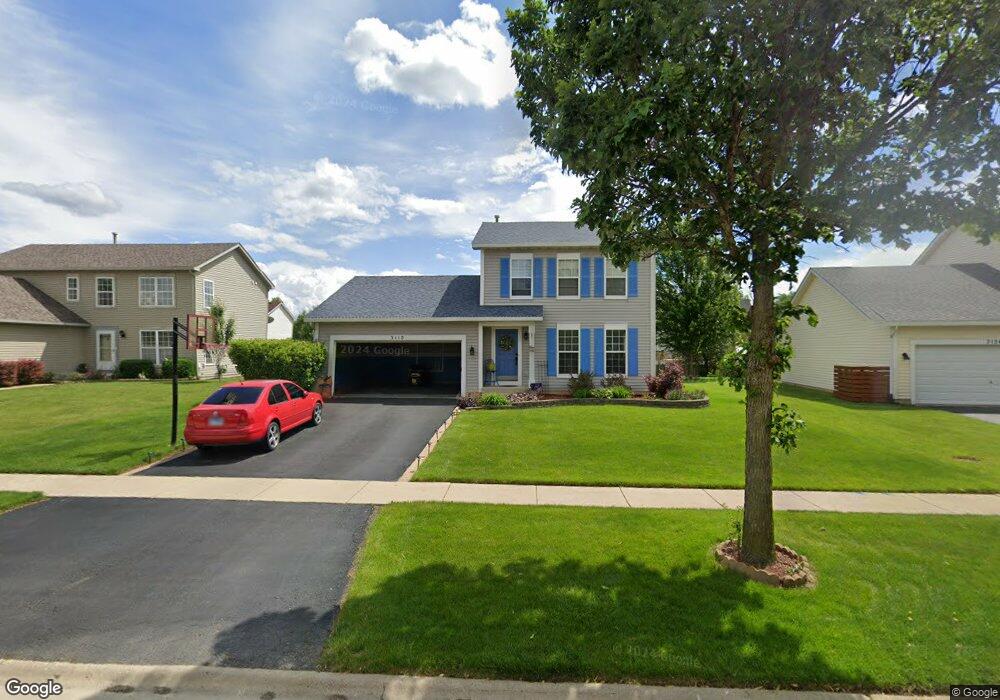

This home is located at 3110 Allen St, Plano, IL 60545 and is currently estimated at $305,226, approximately $190 per square foot. 3110 Allen St is a home located in Kendall County with nearby schools including P.H. Miller Elementary School, Emily G. Johns School, and Centennial Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2011

Sold by

North Shore Bank Fsb

Bought by

Vazquez Rigoberto and Vazquez Elia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$92,493

Outstanding Balance

$64,217

Interest Rate

4.4%

Mortgage Type

FHA

Estimated Equity

$241,009

Purchase Details

Closed on

Jul 1, 2011

Sold by

Silve Fidel

Bought by

North Shore Bank Fsb

Purchase Details

Closed on

Oct 26, 2006

Sold by

Powell Boone J and Powell Angela

Bought by

Silva Fidel and Alanis Everardo Zamora

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$203,300

Interest Rate

6.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jan 31, 2005

Sold by

Lakewood Springs Llc

Bought by

Powell Boone J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,200

Interest Rate

5.37%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vazquez Rigoberto | $95,000 | Chicago Title Insurance Co | |

| North Shore Bank Fsb | -- | None Available | |

| Silva Fidel | $214,000 | Chicago Title Insurance Co | |

| Powell Boone J | $180,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vazquez Rigoberto | $92,493 | |

| Previous Owner | Silva Fidel | $203,300 | |

| Previous Owner | Powell Boone J | $171,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,742 | $93,640 | $9,377 | $84,263 |

| 2023 | $8,044 | $83,287 | $8,340 | $74,947 |

| 2022 | $8,044 | $75,992 | $7,610 | $68,382 |

| 2021 | $7,629 | $71,294 | $7,140 | $64,154 |

| 2020 | $7,406 | $67,523 | $7,000 | $60,523 |

| 2019 | $7,310 | $65,473 | $6,713 | $58,760 |

| 2018 | $6,881 | $58,694 | $6,393 | $52,301 |

| 2017 | $6,728 | $53,511 | $6,393 | $47,118 |

| 2016 | $6,292 | $45,658 | $6,393 | $39,265 |

| 2015 | $5,429 | $34,657 | $5,250 | $29,407 |

| 2014 | -- | $31,979 | $5,000 | $26,979 |

| 2013 | -- | $28,680 | $7,322 | $21,358 |

Source: Public Records

Map

Nearby Homes

- 3304 Alyssa St Unit 2A

- 3305 Paige St Unit 2A

- 3407 Tamaira St

- 3707 Munson St

- 3742 Pope Ct Unit 7403

- 3839 Munson St Unit 7054

- 3649 Bailey St

- 11948 Andrew St

- 306 Waubonsee Dr

- 2813 Hoffman St

- 4219 Cummins St

- 331 Gregory Ln

- 11921 Andrew St

- 4311 Cummins St

- 3928 Kristen Ct

- 4310 Klatt St

- 114 Schmidt Ct

- 407 Keller St

- 3119 Hoffman St

- Lot 11 Ashley Ln

- 3204 Allen St

- 3106 Allen St

- 3201 Veronica St

- 3207 Veronica St Unit 2A

- 3208 Allen St Unit 2A

- 3113 Veronica St

- 3102 Allen St

- 3109 Veronica St

- 3109 Allen St

- 3211 Veronica St

- 3207 Allen St

- 3300 Allen St

- 3105 Veronica St

- 3215 Veronica St

- 3100 Edward St Unit 2A

- 3305 Allen St Unit 2A

- 3219 Veronica St

- 3304 Allen St Unit 2A

- 3021 Edward St

- 3200 Veronica St