3111 SE 24th Ave Ocala, FL 34471

Southeast Ocala NeighborhoodEstimated Value: $436,812 - $647,000

3

Beds

3

Baths

2,579

Sq Ft

$204/Sq Ft

Est. Value

About This Home

This home is located at 3111 SE 24th Ave, Ocala, FL 34471 and is currently estimated at $524,953, approximately $203 per square foot. 3111 SE 24th Ave is a home located in Marion County with nearby schools including South Ocala Elementary School, Osceola Middle School, and Forest High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 6, 2015

Sold by

Alfrey Carl G and Alfrey Judith B

Bought by

Alfrey Carl Graves and Alfrey Judith Baker

Current Estimated Value

Purchase Details

Closed on

Jun 16, 2004

Sold by

Kaplan Lee Charles

Bought by

Alfrey Carl G and Alfrey Judith B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$233,000

Outstanding Balance

$113,297

Interest Rate

6.25%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$411,656

Purchase Details

Closed on

Apr 28, 2000

Sold by

Center State Construction Inc

Bought by

Kaplan Kelley J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,000

Interest Rate

8.23%

Purchase Details

Closed on

Apr 27, 2000

Sold by

Rowley Steve and Rowley Chandra

Bought by

Kaplan Kelley J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,000

Interest Rate

8.23%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Alfrey Carl Graves | -- | Attorney | |

| Alfrey Carl G | $269,900 | Advanced Title & Settlement | |

| Kaplan Lee Charles | $99,800 | Advanced Title & Settlement | |

| Kaplan Kelley J | $129,000 | Cornerstone Title Llc | |

| Kaplan Kelley J | $129,000 | Cornerstone Title Llc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Alfrey Carl G | $233,000 | |

| Previous Owner | Kaplan Kelley J | $215,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,660 | $228,387 | -- | -- |

| 2024 | $3,605 | $221,950 | -- | -- |

| 2023 | $3,514 | $215,485 | $0 | $0 |

| 2022 | $3,218 | $209,209 | $0 | $0 |

| 2021 | $3,209 | $203,116 | $0 | $0 |

| 2020 | $2,924 | $200,312 | $0 | $0 |

| 2019 | $2,872 | $195,808 | $0 | $0 |

| 2018 | $2,766 | $192,157 | $0 | $0 |

| 2017 | $2,742 | $188,205 | $0 | $0 |

| 2016 | $2,709 | $184,334 | $0 | $0 |

| 2015 | $2,731 | $183,053 | $0 | $0 |

| 2014 | $2,509 | $181,600 | $0 | $0 |

Source: Public Records

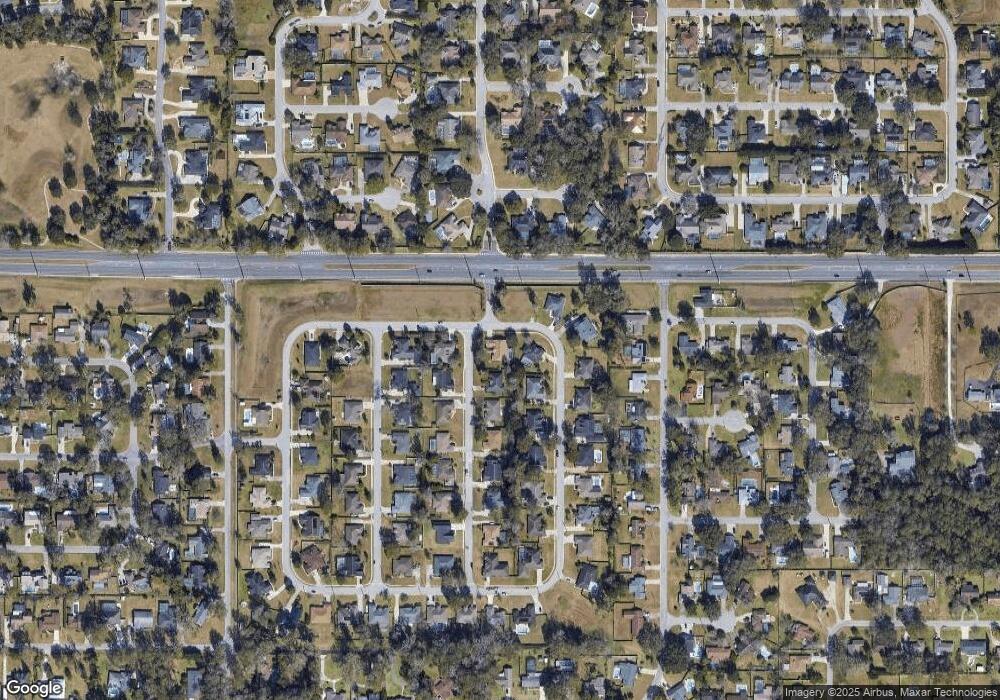

Map

Nearby Homes

- 2319 SE 30th Place

- 2320 SE 33rd Place

- 2315 SE 31st Place

- 2305 SE 30th St

- 2601 SE 30th Place

- 3470 SE 25th Ave

- 2931 SE 23rd Ave

- 2910 SE 23rd Ave

- 2704 SE 31st St

- 2045 SE 32nd St

- 2411 SE 27th St

- 2542 SE 27th St

- 2614 SE 25th Ct

- 1934 SE 37th St

- 2019 SE 29th St

- 3644 SE 22nd Ave

- 2580 SE 37th St

- 3635 SE 19th Ave

- 2375 SE 39th St

- 2131 SE 25th St

- 3115 SE 24th Ave

- 0 SE 24th Terrace Unit E4 MFROM661069

- 0 SE 24th Terrace Unit D6 MFROM661070

- 0 SE 24th Terrace Unit LOT 6 G5057049

- 0 SE 24th Terrace Unit LOT 4 G5056814

- 0 SE 24th Terrace Unit OM610727

- 0 SE 24th Terrace Unit 150962

- 2406 SE 31st Place

- 3110 SE 24th Ave

- 3108 SE 24th Terrace

- 2403 SE 31st Place

- 3119 SE 24th Ave

- 3114 SE 24th Ave

- 3119 SE 24th Ave

- 3118 SE 24th Ave

- 3112 SE 24th Terrace

- 3101 SE 23rd Terrace

- 3105 SE 24th Terrace

- 3201 SE 24th Ave

- 3109 SE 24th Terrace

Your Personal Tour Guide

Ask me questions while you tour the home.