3113 S 700 W New Palestine, IN 46163

Estimated Value: $963,000 - $1,238,101

2

Beds

1

Bath

2,198

Sq Ft

$501/Sq Ft

Est. Value

About This Home

This home is located at 3113 S 700 W, New Palestine, IN 46163 and is currently estimated at $1,100,551, approximately $500 per square foot. 3113 S 700 W is a home located in Hancock County with nearby schools including Sugar Creek Elementary School, New Palestine Jr High School, and New Palestine High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 19, 2017

Sold by

Sanford Mark W

Bought by

Sanford Mark W and Sanford Lori

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$862,500

Outstanding Balance

$514,888

Interest Rate

3.78%

Mortgage Type

New Conventional

Estimated Equity

$585,663

Purchase Details

Closed on

Feb 15, 2017

Sold by

Sanford Investments Llp

Bought by

Wilkins Joseph and Wilkins Daryn

Purchase Details

Closed on

Nov 2, 2016

Sold by

Turner Phyllis G

Bought by

Sanford Investments Llp

Purchase Details

Closed on

Sep 18, 2013

Sold by

Turner Phyllis G

Bought by

Evangelical Luthern Church

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sanford Mark W | -- | Fidelity National Title | |

| Wilkins Joseph | -- | First American Title | |

| Sanford Investments Llp | $400,000 | -- | |

| Evangelical Luthern Church | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sanford Mark W | $862,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $11,466 | $1,076,000 | $192,500 | $883,500 |

| 2023 | $11,485 | $949,000 | $192,500 | $756,500 |

| 2022 | $9,161 | $866,900 | $117,200 | $749,700 |

| 2021 | $8,665 | $827,000 | $117,200 | $709,800 |

| 2020 | $8,486 | $813,800 | $117,200 | $696,600 |

| 2019 | $7,600 | $726,000 | $75,300 | $650,700 |

| 2018 | $390 | $52,100 | $51,200 | $900 |

| 2017 | $2,367 | $119,300 | $72,600 | $46,700 |

| 2016 | $2,588 | $128,800 | $82,900 | $45,900 |

| 2014 | $2,611 | $129,200 | $83,400 | $45,800 |

| 2013 | $2,611 | $222,500 | $149,400 | $73,100 |

Source: Public Records

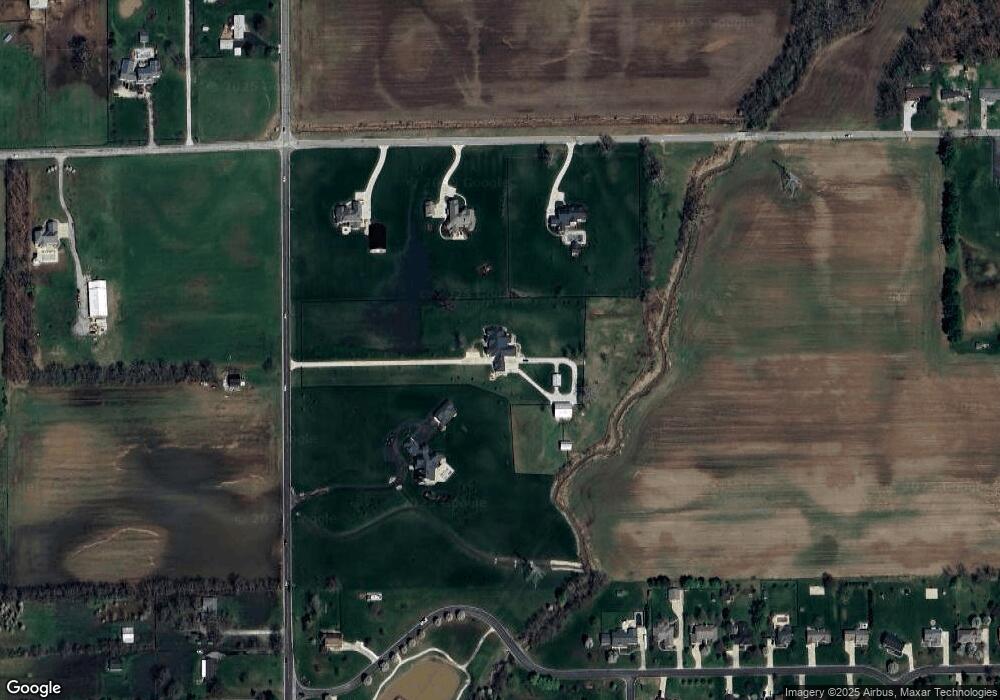

Map

Nearby Homes

- 2974 S Kings Way

- 6589 S Kings Way

- 2639 S Kings Way

- 2460 S Wildflower Ln

- 2419 S Wildflower Ln

- 6127 W David Wayne Dr

- 6922 W Briarwood Blvd

- 0 W 600 S Unit MBR22040612

- 6084 W Deer Run Dr

- 3756 S Fallow Trail

- 5976 W Countryside Dr

- 7264 W Beyers Ct

- 6238 W Us Highway 52

- 4980 S Canton Cir

- 2433 S Copperstone Dr

- 7204 W Christian Dr

- 3948 S Woodfield Dr

- 7888 Magnolia St

- Dayton Plan at Fields at Sugar Creek

- Johnstown Plan at Fields at Sugar Creek

- 6837 W 300 S

- 6899 W 300 S

- 3189 S 700 W

- 6973 W 300 S

- 6973 W 300 S

- 6780 W Willow Grove Dr

- 6758 W Willow Grove Dr

- 6736 W Willow Grove Dr

- 6726 W Willow Grove Dr

- 3330 S Southway Dr

- 6718 W Willow Grove Dr

- 6950 W Willow Grove Dr

- 6771 W Willow Grove Dr

- 6743 W Willow Grove Dr

- 6731 W Willow Grove Dr

- 3362 S Southway Dr

- 6710 W Willow Grove Dr

- 6638 W 300 S

- 3357 S Southway Dr

- 6719 W Willow Grove Dr