31172 Siercks Rd Scappoose, OR 97056

Estimated Value: $544,279 - $604,000

4

Beds

1

Bath

2,556

Sq Ft

$225/Sq Ft

Est. Value

About This Home

This home is located at 31172 Siercks Rd, Scappoose, OR 97056 and is currently estimated at $574,140, approximately $224 per square foot. 31172 Siercks Rd is a home located in Columbia County with nearby schools including Scappoose High School and Scappoose Adventist School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 27, 2017

Sold by

Tappendorf Debra J

Bought by

Smith Jason A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$294,566

Outstanding Balance

$243,883

Interest Rate

4.37%

Mortgage Type

FHA

Estimated Equity

$330,257

Purchase Details

Closed on

Jul 16, 2007

Sold by

Calcagno Clyde J and Calcagno Deborah L

Bought by

Tappendorf Debra J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

6.51%

Mortgage Type

Unknown

Purchase Details

Closed on

Mar 23, 2006

Sold by

Vernaza Loron J

Bought by

Calcagno Clyde J and Calcagno Deborah L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smith Jason A | $300,000 | Columbia County Title | |

| Tappendorf Debra J | $325,000 | Ticor Title | |

| Calcagno Clyde J | $313,500 | Ticor Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Smith Jason A | $294,566 | |

| Previous Owner | Tappendorf Debra J | $200,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,122 | $154,400 | $80,990 | $73,410 |

| 2024 | $2,054 | $149,910 | $78,630 | $71,280 |

| 2023 | $2,045 | $145,550 | $73,140 | $72,410 |

| 2022 | $1,956 | $141,320 | $70,610 | $70,710 |

| 2021 | $1,902 | $137,210 | $68,990 | $68,220 |

| 2020 | $1,750 | $133,220 | $60,910 | $72,310 |

| 2019 | $1,707 | $129,340 | $43,254 | $86,086 |

| 2018 | $1,236 | $91,999 | $54,284 | $37,715 |

| 2017 | $1,218 | $89,330 | $56,560 | $32,770 |

| 2016 | $1,209 | $86,730 | $54,910 | $31,820 |

| 2015 | $1,144 | $84,210 | $53,680 | $30,530 |

| 2014 | $1,119 | $81,760 | $43,290 | $38,470 |

Source: Public Records

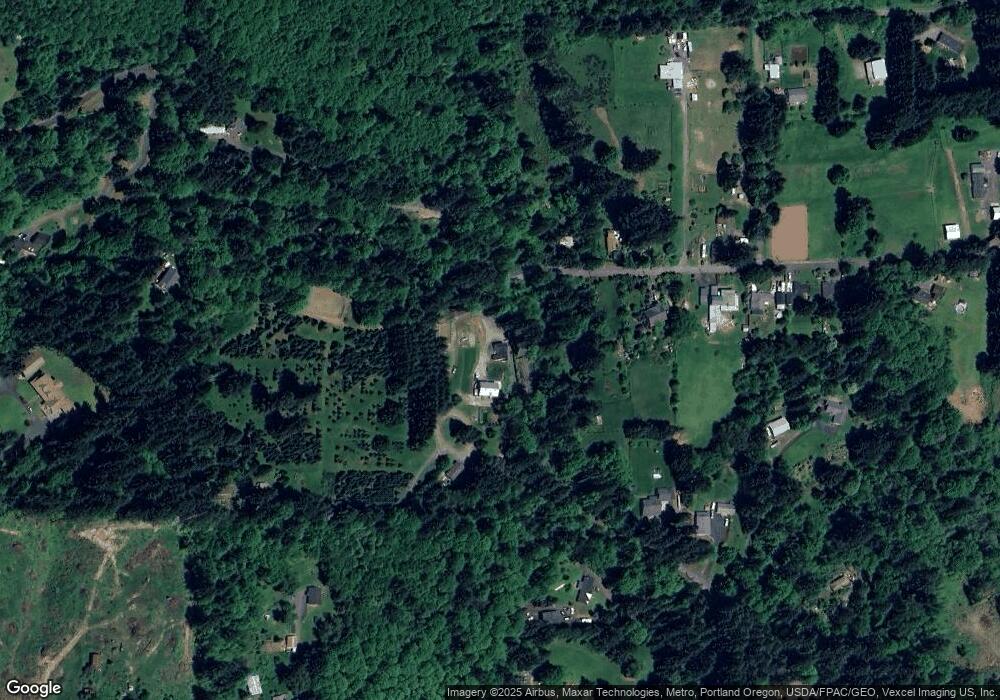

Map

Nearby Homes

- 31287 New Kirk Rd

- 31444 New Kirk Rd

- 0 Armstrong Rd Unit 101 23014009

- 0 Reid Rd

- 32005 Scappoose Vernonia Hwy

- 55496 Pioneer Rd

- 0 Viewcrest Dr Unit 24577481

- 32650 Oester Rd

- 0 Oester Rd

- 55051 Fullerton Rd

- 0 Parcel 1 Peter St St Unit 174014860

- 0 Peter St Unit 1S 480042051

- 32991 Rodney St

- 33062 Bellcrest Rd

- 30004 Scappoose Vernonia Hwy

- 32952 NW Ridge Dr

- 32373 Jp West Rd

- 54886 Fullerton Rd

- 32904 NW View Terrace Place

- 53194 Columbia River Hwy

- 0 Newkirk Rd

- 31198 Siercks Rd

- 31191 New Kirk Rd

- 31223 New Kirk Rd

- 31232 New Kirk Rd

- 31235 Siercks Rd

- 31264 New Kirk Rd

- 31261 New Kirk Rd Unit 31273

- 31288 New Kirk Rd

- 31253 Pisgah Home Rd

- 31223 Newkirk Rd

- 31233 Newkirk Rd

- 31304 New Kirk Rd

- 31330 New Kirk Rd

- 0 New Kirk Rd

- 31281 Siercks Rd

- 31045 Pisgah Home Rd

- 31157 Siercks Rd

- 31281 New Kirk Rd

- 31360 New Kirk Rd