Estimated Value: $66,000 - $220,000

3

Beds

3

Baths

1,963

Sq Ft

$57/Sq Ft

Est. Value

About This Home

This home is located at 312 E Central, Tryon, OK 74875 and is currently estimated at $110,917, approximately $56 per square foot. 312 E Central is a home located in Lincoln County with nearby schools including Perkins-Tryon Elementary School, Perkins-Tryon Intermediate Elementary School, and Perkins-Tryon Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 14, 2022

Sold by

Lee Hughlett Casey

Bought by

Paramount Construction Services Llc

Current Estimated Value

Purchase Details

Closed on

Feb 8, 2017

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Hughlett Casey Lee

Purchase Details

Closed on

Feb 23, 2004

Sold by

Bank One Na Trs Bear Stea

Bought by

Russell Daniel L and Russell Julie A

Purchase Details

Closed on

Nov 10, 2003

Sold by

Mcnelly Thomas D Sheriff

Bought by

Bank One Na Trs Bear Stea

Purchase Details

Closed on

Jun 3, 2002

Sold by

Breeden Franklin J

Bought by

Breeden Jeanette A

Purchase Details

Closed on

Mar 6, 1997

Sold by

Diekan Richard T and Diekan Patrici

Bought by

Breeden Frank J and Breeden Jeannett

Purchase Details

Closed on

Jan 21, 1992

Sold by

Horton Keith R

Bought by

Itt Financial Service Inc

Purchase Details

Closed on

Oct 28, 1990

Sold by

Horton Donna Jean

Bought by

Horton Keith R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Paramount Construction Services Llc | $42,500 | American Eagle Title | |

| Hughlett Casey Lee | $36,500 | None Available | |

| Russell Daniel L | $32,500 | -- | |

| Bank One Na Trs Bear Stea | -- | -- | |

| Breeden Jeanette A | -- | -- | |

| Breeden Frank J | $68,500 | -- | |

| Itt Financial Service Inc | -- | -- | |

| Horton Keith R | -- | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $223 | $2,236 | $1,535 | $701 |

| 2024 | $216 | $2,236 | $1,535 | $701 |

| 2023 | $216 | $5,805 | $1,532 | $4,273 |

| 2022 | $744 | $7,586 | $1,431 | $6,155 |

| 2021 | $707 | $7,224 | $811 | $6,413 |

| 2020 | $699 | $7,141 | $811 | $6,330 |

| 2019 | $695 | $6,970 | $811 | $6,159 |

| 2018 | $694 | $6,982 | $811 | $6,171 |

| 2017 | $721 | $7,199 | $811 | $6,388 |

| 2016 | $701 | $7,160 | $809 | $6,351 |

| 2015 | $668 | $6,820 | $721 | $6,099 |

| 2014 | $652 | $6,495 | $675 | $5,820 |

Source: Public Records

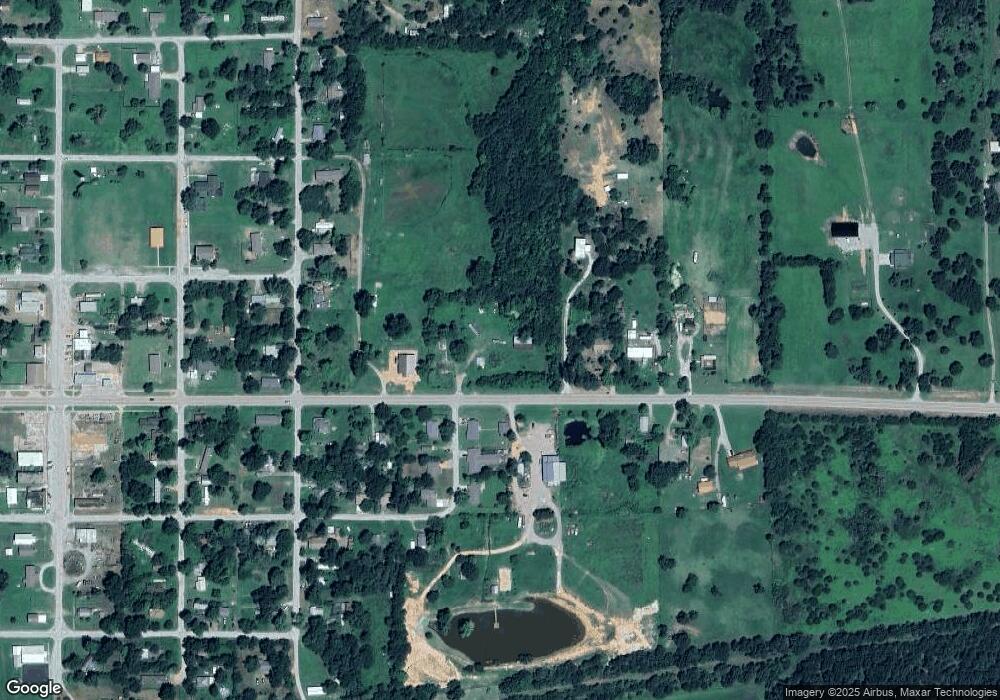

Map

Nearby Homes

Your Personal Tour Guide

Ask me questions while you tour the home.