Estimated Value: $172,000 - $230,498

2

Beds

3

Baths

979

Sq Ft

$203/Sq Ft

Est. Value

About This Home

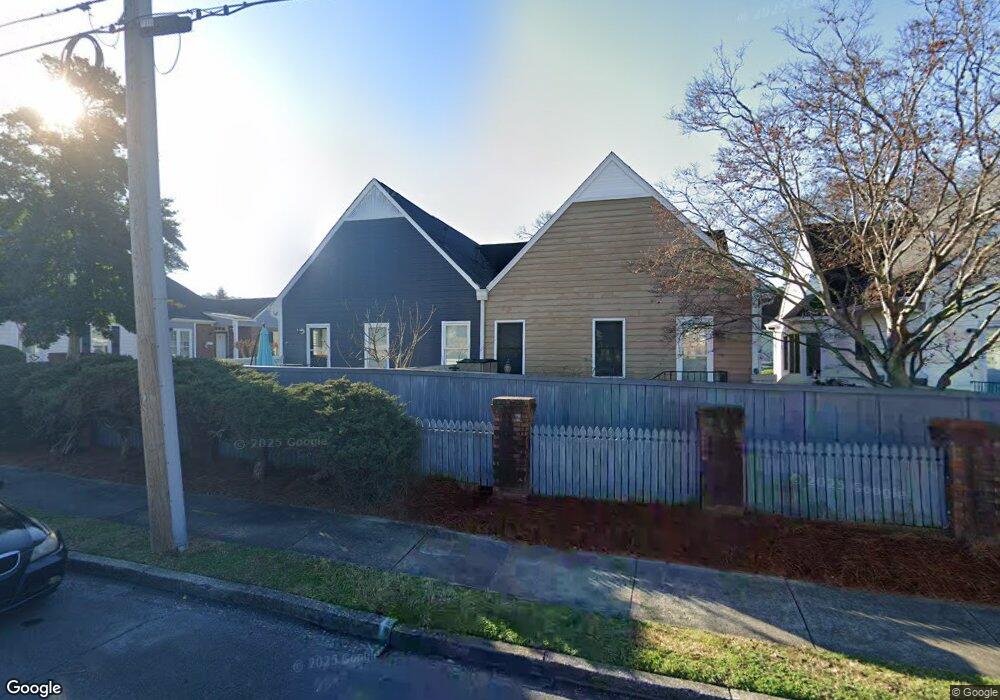

This home is located at 312 SW E 7th Unit 8, Rome, GA 30161 and is currently estimated at $198,375, approximately $202 per square foot. 312 SW E 7th Unit 8 is a home located in Floyd County with nearby schools including Rome High School, St. Mary School, and Darlington School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 22, 2019

Sold by

Ray Diane Lynn

Bought by

Nevarez Alejandro

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$73,600

Outstanding Balance

$46,486

Interest Rate

3.75%

Mortgage Type

New Conventional

Estimated Equity

$151,889

Purchase Details

Closed on

May 25, 1999

Sold by

Robinson M Wayne Builder- Developer Inc

Bought by

Ray Diane Lynn

Purchase Details

Closed on

Jun 7, 1996

Sold by

Allen Jeffrey H

Bought by

Robinson M Wayne Builder- Developer Inc

Purchase Details

Closed on

Jun 28, 1994

Sold by

Billings Tom and Terri Billings

Bought by

Allen Jeffrey H

Purchase Details

Closed on

May 16, 1994

Sold by

Griffin George

Bought by

Billings Tom and Terri Billings

Purchase Details

Closed on

Oct 12, 1992

Sold by

Saucerman Larry G

Bought by

Griffin George

Purchase Details

Closed on

Dec 21, 1989

Sold by

Liverett John Andrew

Bought by

Saucerman Larry G

Purchase Details

Closed on

Jun 9, 1988

Bought by

Liverett John Andrew

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nevarez Alejandro | $92,000 | -- | |

| Ray Diane Lynn | $84,500 | -- | |

| Robinson M Wayne Builder- Developer Inc | $75,000 | -- | |

| Allen Jeffrey H | $78,500 | -- | |

| Billings Tom | $75,000 | -- | |

| Griffin George | $66,500 | -- | |

| Saucerman Larry G | $71,000 | -- | |

| Liverett John Andrew | $54,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Nevarez Alejandro | $73,600 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,850 | $70,461 | $11,191 | $59,270 |

| 2024 | $1,850 | $65,674 | $10,173 | $55,501 |

| 2023 | $1,712 | $58,708 | $9,137 | $49,571 |

| 2022 | $1,605 | $48,970 | $7,562 | $41,408 |

| 2021 | $1,553 | $44,519 | $7,014 | $37,505 |

| 2020 | $1,328 | $41,952 | $5,395 | $36,557 |

| 2019 | $1,518 | $49,900 | $5,395 | $44,505 |

| 2018 | $1,477 | $47,573 | $5,395 | $42,178 |

| 2017 | $1,433 | $45,051 | $5,126 | $39,925 |

| 2016 | $1,374 | $41,459 | $5,360 | $36,099 |

| 2015 | $1,305 | $41,459 | $5,360 | $36,099 |

| 2014 | $1,305 | $41,459 | $5,360 | $36,099 |

Source: Public Records

Map

Nearby Homes

- 209 Moultrie Ln SE

- 801 Maple Ave SW

- 311 Roswell Ave SE

- 2 Coral Ave SW

- 9 Eastridge Ct SW

- 416 E 9th St SE

- 415 E 10th St SE

- 31 Notasulga Dr SW

- 307 E 11th St SE

- 803/805 Maple Ave SW

- 803/80 Maple Ave SW

- 320 E 3rd Ave

- 29 Pear St

- 162 E 11th St SE

- 166 E 11th St SW

- 1 E 11th St SW

- 170 E 11th St SW

- 168 E 11th St SE

- 164 E 11th St SE

- 811 Collinwood Rd SE

- 312 2 E 7th St Unit 2

- 312 SW E 7th

- 312 SW E 7th Unit 9

- 313 E 7th St SW

- 309 E 7th St SW

- 311 E 7th St SW

- 705 Lee Ave SW

- 305 E 7th St SW

- 703 Lee Ave SW Unit F

- 312 E 7th St SW Unit 15

- 312 E 7th St SW Unit 12

- 312 E 7th St SW Unit 13

- 312 E 7th St SW Unit 14

- 312 E 7th St SW Unit 16

- 312 E 7th St SW Unit 17

- 312 E 7th St SW Unit 18

- 312 E 7th St SW Unit 19

- 312 E 7th St SW Unit 11

- 312 E 7th St SW Unit 10

- 312 E 7th St SW Unit 9

Your Personal Tour Guide

Ask me questions while you tour the home.