3124 Windchase Blvd Unit 422 Houston, TX 77082

Briar Village NeighborhoodEstimated Value: $167,372 - $181,000

2

Beds

2

Baths

1,111

Sq Ft

$158/Sq Ft

Est. Value

About This Home

This home is located at 3124 Windchase Blvd Unit 422, Houston, TX 77082 and is currently estimated at $175,093, approximately $157 per square foot. 3124 Windchase Blvd Unit 422 is a home located in Harris County with nearby schools including Heflin Elementary School, Budewig Intermediate School, and O'Donnell Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 2, 2023

Sold by

King Wc3

Bought by

Allison Leslie

Current Estimated Value

Purchase Details

Closed on

Oct 5, 2022

Sold by

Allison Leslie

Bought by

Wc3 King A Texas Company Llc

Purchase Details

Closed on

Oct 31, 2019

Sold by

Rodriguez Evelyn

Bought by

Allison Leslie

Purchase Details

Closed on

Aug 31, 2016

Sold by

Hedges Marta M

Bought by

Rodriguez Evelyn

Purchase Details

Closed on

May 7, 2003

Sold by

Ellis Edward C

Bought by

Hedges Marta M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$65,840

Interest Rate

5.77%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 13, 1999

Sold by

Paye William C

Bought by

Ellis Edward C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,100

Interest Rate

7.06%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Allison Leslie | -- | None Listed On Document | |

| Wc3 King A Texas Company Llc | -- | -- | |

| Allison Leslie | -- | First American Title | |

| Rodriguez Evelyn | -- | First American Title | |

| Hedges Marta M | -- | Chicago Title Insurance Co | |

| Ellis Edward C | -- | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hedges Marta M | $65,840 | |

| Previous Owner | Ellis Edward C | $50,100 | |

| Closed | Hedges Marta M | $12,345 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,096 | $161,396 | $31,128 | $130,268 |

| 2024 | $3,096 | $152,234 | $31,128 | $121,106 |

| 2023 | $3,096 | $176,455 | $31,128 | $145,327 |

| 2022 | $3,201 | $152,909 | $21,271 | $131,638 |

| 2021 | $2,447 | $110,872 | $21,271 | $89,601 |

| 2020 | $2,602 | $112,595 | $21,271 | $91,324 |

| 2019 | $2,417 | $101,400 | $17,120 | $84,280 |

| 2018 | $2,407 | $100,868 | $15,979 | $84,889 |

| 2017 | $2,435 | $100,868 | $15,979 | $84,889 |

| 2016 | $1,777 | $94,970 | $15,979 | $78,991 |

| 2015 | $1,265 | $79,435 | $15,979 | $63,456 |

| 2014 | $1,265 | $68,034 | $15,979 | $52,055 |

Source: Public Records

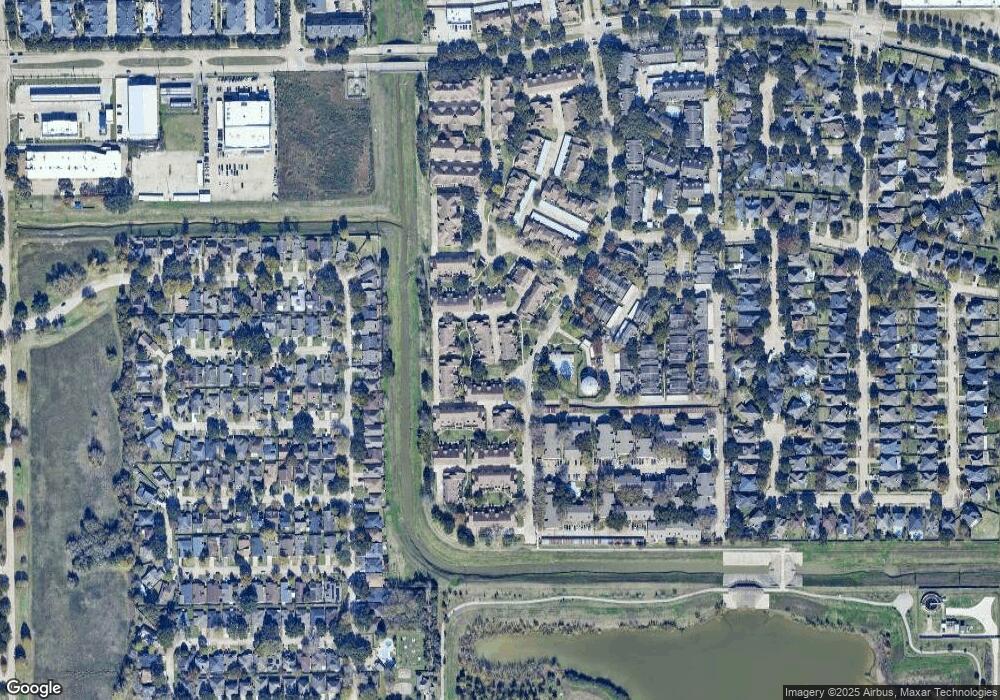

Map

Nearby Homes

- 3206 Windchase Blvd Unit 471

- 3162 Windchase Blvd Unit 451

- 3224 Windchase Blvd Unit 495

- 3148 Windchase Blvd Unit 442

- 3143 Windchase Blvd Unit 785

- 13807 Beech Hollow Ln

- 13461 Garden Grove Unit 761

- 3065 Windchase Blvd Unit 719

- 13483 Garden Grove Unit 723

- 13806 Sheri Hollow Ln

- 13351 Arlon Trail

- 3143 W Hampton Dr

- 2948 Meadowgrass Ln Unit 175

- 2895 Panagard Dr Unit 4209

- 2889 Panagard Dr Unit 42

- 2865 Westhollow Dr Unit 83

- 2865 Westhollow Dr Unit 61

- 2831 Panagard Dr Unit 39

- 13833 Hollowgreen Dr

- 13835 Hollowgreen Dr

- 3130 Windchase Blvd Unit 436

- 3120 Windchase Blvd Unit 424

- 3136 Windchase Blvd Unit 433

- 3122 Windchase Blvd Unit 423

- 3126 Windchase Blvd Unit 421

- 3124 Windchase Blvd

- 3132 Windchase Blvd Unit 435

- 3128 Windchase Blvd Unit 437

- 3134 Windchase Blvd Unit 434

- 3138 Windchase Blvd Unit 432

- 3152 Windchase Blvd Unit 456

- 3168 Windchase Blvd Unit 464

- 3170 Windchase Blvd Unit 463

- 3118 Windchase Blvd Unit 425

- 3154 Windchase Blvd Unit 455

- 3166 Windchase Blvd Unit 465

- 3172 Windchase Blvd Unit 462

- 3172 Windchase Blvd

- 3146 Windchase Blvd Unit 443

- 3174 Windchase Blvd Unit 461