31252 Wrencrest Dr Unit 1A Wesley Chapel, FL 33543

Estimated Value: $401,013 - $446,000

3

Beds

2

Baths

2,685

Sq Ft

$158/Sq Ft

Est. Value

About This Home

This home is located at 31252 Wrencrest Dr Unit 1A, Wesley Chapel, FL 33543 and is currently estimated at $425,253, approximately $158 per square foot. 31252 Wrencrest Dr Unit 1A is a home located in Pasco County with nearby schools including Wiregrass Elementary School, Dr. John Long Middle School, and Wiregrass Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 1, 2017

Bought by

2017-1 Ih Borrower Lp

Current Estimated Value

Purchase Details

Closed on

May 30, 2014

Sold by

Thr Florida Lp

Bought by

2014 & 1 Ih Borrower Lp

Purchase Details

Closed on

Jan 7, 2013

Sold by

Land Trust Service Corporation

Bought by

Thr Florida Lp

Purchase Details

Closed on

Oct 20, 2011

Sold by

Sharples Alwyn

Bought by

L T S C Llc and Trust #31252

Purchase Details

Closed on

Oct 12, 2011

Sold by

L T S C Llc

Bought by

Trust #31252 and Land Trust Service Corporation

Purchase Details

Closed on

Oct 15, 2004

Sold by

Hanna Bobby and Hanna Willi

Bought by

Sharples Alwyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,400

Interest Rate

5.71%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| 2017-1 Ih Borrower Lp | $100 | -- | |

| 2014 & 1 Ih Borrower Lp | -- | None Available | |

| Thr Florida Lp | $160,000 | None Available | |

| L T S C Llc | $121,200 | Attorney | |

| Trust #31252 | -- | None Available | |

| Sharples Alwyn | $238,000 | North American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sharples Alwyn | $190,400 | |

| Closed | Sharples Alwyn | $35,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,248 | $384,334 | $85,004 | $299,330 |

| 2024 | $8,248 | $406,142 | $85,004 | $321,138 |

| 2023 | $7,777 | $296,320 | $0 | $0 |

| 2022 | $6,572 | $338,786 | $64,424 | $274,362 |

| 2021 | $5,766 | $247,608 | $57,772 | $189,836 |

| 2020 | $5,462 | $222,638 | $35,008 | $187,630 |

| 2019 | $5,463 | $220,782 | $35,008 | $185,774 |

| 2018 | $5,344 | $212,958 | $35,008 | $177,950 |

| 2017 | $5,208 | $203,104 | $35,008 | $168,096 |

| 2016 | $4,569 | $186,198 | $35,008 | $151,190 |

| 2015 | $4,327 | $172,170 | $35,008 | $137,162 |

| 2014 | $3,945 | $146,319 | $28,428 | $117,891 |

Source: Public Records

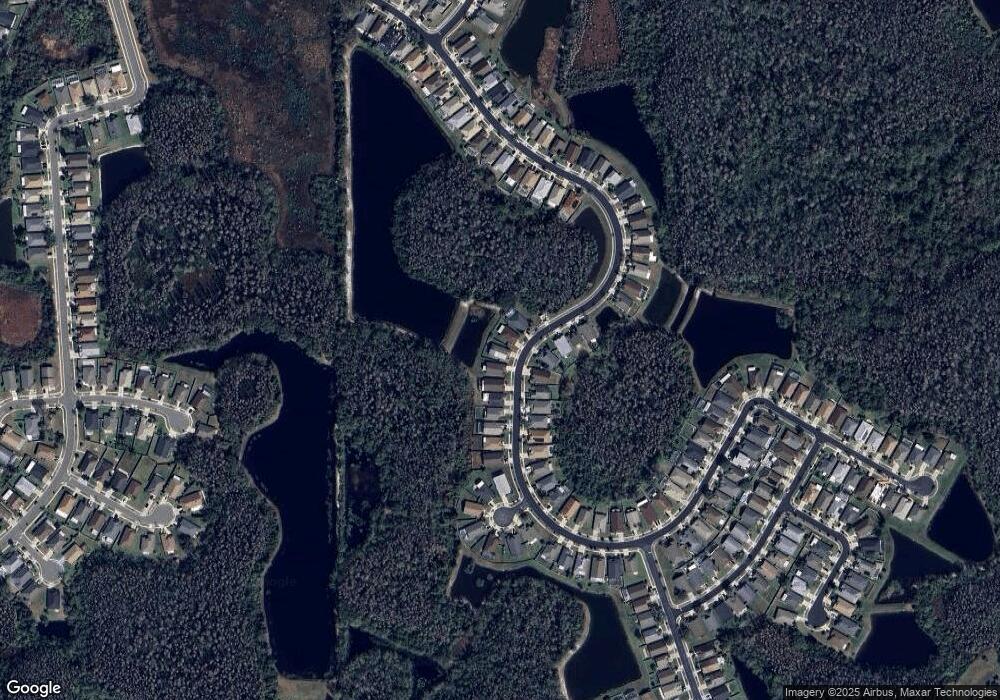

Map

Nearby Homes

- 31308 Wrencrest Dr

- 31215 Wrencrest Dr

- 31203 Wrencrest Dr

- 31052 Wrencrest Dr

- 1433 Greely Ct

- 31141 Harthorn Ct

- 30912 Burleigh Dr

- 30946 Burleigh Dr

- 1227 Atticus Ct Unit 1B

- 30829 Iverson Dr

- 31307 Chatterly Dr Unit 1D/1E

- 30930 Whitlock Dr

- 31306 Heatherstone Dr

- 31434 Shaker Cir

- 31241 Kirkshire Ct

- 31451 Shaker Cir

- 1948 Blanchard Ct

- 30642 Nickerson Loop

- 1436 Baythorn Dr

- 30638 Nickerson Loop

- 31256 Wrencrest Dr

- 31248 Wrencrest Dr

- 31300 Wrencrest Dr

- 31244 Wrencrest Dr

- 31304 Wrencrest Dr

- 31251 Wrencrest Dr Unit 1A

- 31255 Wrencrest Dr

- 31301 Wrencrest Dr

- 31305 Wrencrest Dr

- 31247 Wrencrest Dr

- 31312 Wrencrest Dr

- 31309 Wrencrest Dr

- 31316 Wrencrest Dr Unit 1A

- 31313 Wrencrest Dr

- 31239 Wrencrest Dr

- 31320 Wrencrest Dr

- 31317 Wrencrest Dr

- 31321 Wrencrest Dr

- 31111 Wolfert Place

- 31229 Wrencrest Dr