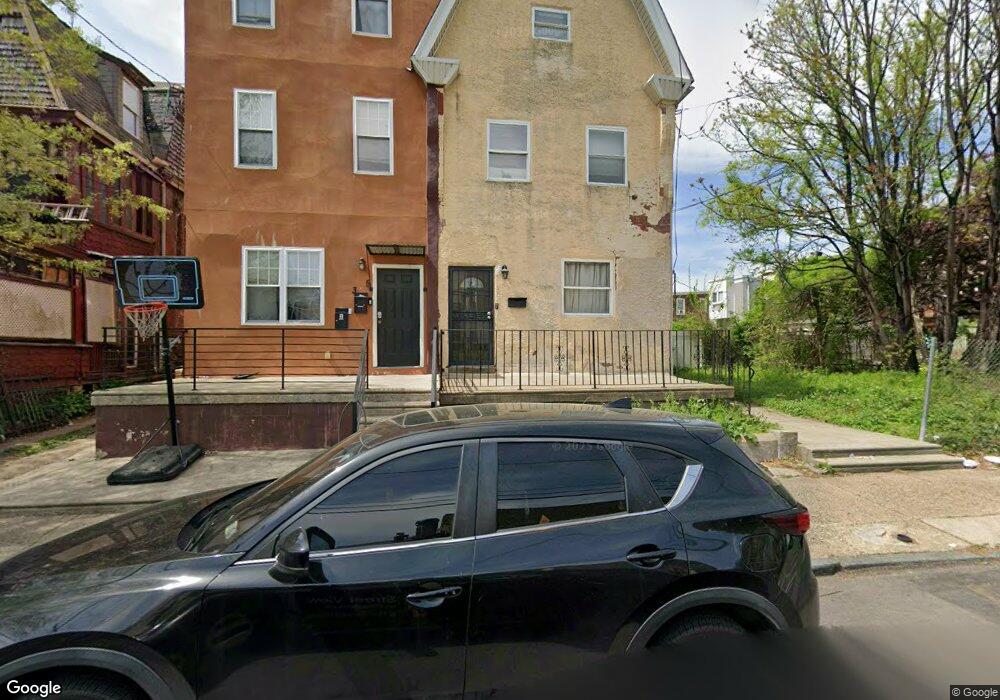

313 W Hansberry St Philadelphia, PA 19144

Germantown NeighborhoodEstimated Value: $221,000 - $348,000

6

Beds

2

Baths

2,358

Sq Ft

$115/Sq Ft

Est. Value

About This Home

This home is located at 313 W Hansberry St, Philadelphia, PA 19144 and is currently estimated at $271,017, approximately $114 per square foot. 313 W Hansberry St is a home located in Philadelphia County with nearby schools including John B. Kelly School, Martin Luther King High School, and Queen Lane Montessori School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 15, 2018

Sold by

Howard Angelica

Bought by

Howard Kennedy Lafaye Aija

Current Estimated Value

Purchase Details

Closed on

Nov 24, 2015

Sold by

Us Bank Na

Bought by

Howard Angelica

Purchase Details

Closed on

Jul 17, 2012

Sold by

Williams Jewell and Vignola Joseph C

Bought by

Us Bank National Association

Purchase Details

Closed on

Nov 27, 2007

Sold by

Polack Alexander

Bought by

Cook Aisha L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,945

Interest Rate

6.48%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 24, 2005

Sold by

Grinberg Boris and Grinberg Zisel

Bought by

Polack Alexander

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,250

Interest Rate

5.79%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Aug 18, 2003

Sold by

Walton Achelohiym and Weaver Carrie

Bought by

Grinberg Boris and Grinberg Zisel

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Howard Kennedy Lafaye Aija | $2,000 | None Available | |

| Howard Angelica | $45,000 | Diversified Settlement Servi | |

| Us Bank National Association | $5,700 | None Available | |

| Cook Aisha L | $133,000 | None Available | |

| Polack Alexander | $115,000 | Chicago Title Insurance Co | |

| Grinberg Boris | $12,100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Cook Aisha L | $130,945 | |

| Previous Owner | Polack Alexander | $86,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,254 | $201,200 | $40,240 | $160,960 |

| 2024 | $2,254 | $201,200 | $40,240 | $160,960 |

| 2023 | $2,254 | $161,000 | $32,200 | $128,800 |

| 2022 | $1,524 | $161,000 | $32,200 | $128,800 |

| 2021 | $1,524 | $0 | $0 | $0 |

| 2020 | $1,524 | $0 | $0 | $0 |

| 2019 | $1,592 | $0 | $0 | $0 |

| 2018 | $1,233 | $0 | $0 | $0 |

| 2017 | $1,233 | $0 | $0 | $0 |

| 2016 | $1,233 | $0 | $0 | $0 |

| 2015 | -- | $0 | $0 | $0 |

| 2014 | -- | $102,100 | $18,889 | $83,211 |

| 2012 | -- | $11,072 | $2,548 | $8,524 |

Source: Public Records

Map

Nearby Homes

- 260 W Queen Ln

- 332 W Queen Ln

- 5138 Newhall St

- 333 W Hansberry St

- 232 W Penn St

- 230 W Penn St

- 5128 Newhall St

- 5238 Morris St

- 5351 Newhall St

- 5204 Morris St

- 5322 Wayne Ave

- 5125 Newhall St

- 5347 Priscilla St

- 5349 Priscilla St

- 337 W Penn St

- 5225 Mckean Ave

- 300 W Coulter St

- 247 W Coulter St

- 417 W Penn St

- 302 W Earlham Terrace

- 315 W Hansberry St

- 311 W Hansberry St

- 317 W Hansberry St

- 319 W Hansberry St

- 5204 Pulaski Ave

- 5206 Pulaski Ave

- 5208 Pulaski Ave

- 5202 Pulaski Ave

- 5210 Pulaski Ave

- 321 W Hansberry St

- 5200 Pulaski Ave

- 323 W Hansberry St

- 5214 Pulaski Ave

- 325 W Hansberry St

- 5216 Pulaski Ave

- 5212 Pulaski Ave

- 327 W Hansberry St

- 5218 Pulaski Ave

- 5220 Pulaski Ave

- 329 W Hansberry St