Estimated Value: $200,000 - $249,000

3

Beds

1

Bath

1,094

Sq Ft

$207/Sq Ft

Est. Value

About This Home

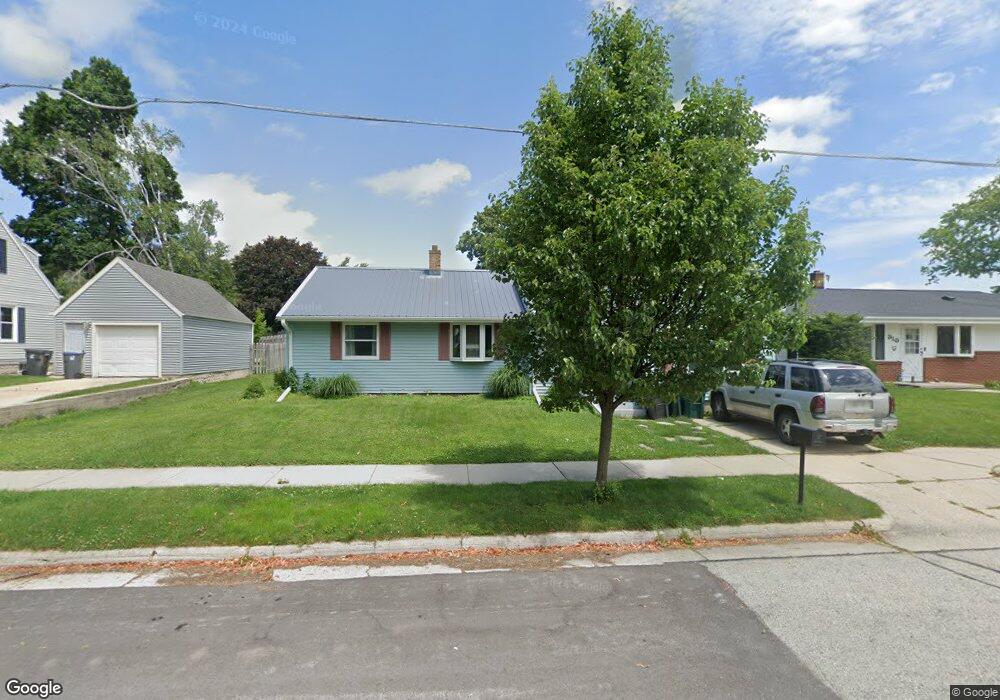

This home is located at 314 First Ave, Adell, WI 53001 and is currently estimated at $226,609, approximately $207 per square foot. 314 First Ave is a home located in Sheboygan County with nearby schools including Random Lake Elementary School, Random Lake Middle School, and Random Lake High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 20, 2023

Sold by

Stemper Michael R

Bought by

Lopez Antonio

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Outstanding Balance

$172,706

Interest Rate

5.63%

Mortgage Type

New Conventional

Estimated Equity

$53,903

Purchase Details

Closed on

Feb 17, 2023

Sold by

Stemper Michael R

Bought by

Lopez Antonio

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Outstanding Balance

$172,706

Interest Rate

5.63%

Mortgage Type

New Conventional

Estimated Equity

$53,903

Purchase Details

Closed on

Oct 24, 2018

Sold by

Matic Patricia R

Bought by

Stemper Mike R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,772

Interest Rate

5.12%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 7, 2014

Sold by

Matic Patricia R Patricia R

Bought by

Michaels Annette E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lopez Antonio | $180,000 | Burnet Title | |

| Lopez Antonio | $180,000 | Burnet Title | |

| Stemper Mike R | $123,000 | -- | |

| Michaels Annette E | $55,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lopez Antonio | $180,000 | |

| Closed | Lopez Antonio | $180,000 | |

| Previous Owner | Stemper Mike R | $120,772 | |

| Closed | Stemper Mike R | $4,305 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,493 | $148,400 | $14,000 | $134,400 |

| 2023 | $2,144 | $92,800 | $10,500 | $82,300 |

| 2022 | $2,015 | $92,800 | $10,500 | $82,300 |

| 2021 | $2,009 | $92,800 | $10,500 | $82,300 |

| 2020 | $1,903 | $92,800 | $10,500 | $82,300 |

| 2019 | $1,801 | $92,800 | $10,500 | $82,300 |

| 2018 | $1,778 | $92,800 | $10,500 | $82,300 |

| 2017 | $1,742 | $92,800 | $10,500 | $82,300 |

| 2016 | $1,748 | $92,800 | $10,500 | $82,300 |

| 2015 | $1,186 | $67,300 | $10,500 | $56,800 |

| 2014 | $1,792 | $92,800 | $10,500 | $82,300 |

Source: Public Records

Map

Nearby Homes

- N1502 County Road I

- w 4568 County Road F

- N2753 Windridge Dr

- Lt0 State Highway 144

- 348 W 1st St

- Lt3 Mowtown Dr

- W4838 County Road Rr

- 310 Madison Ave

- TBD Blueberry Ln

- 790 Wolf Rd

- 215 Maries Way

- 627 Bobolink Ln

- 101 Deppiesse Rd

- 337 Lake Dr

- 612 Bobolink Ln

- W4037 County Road Rr

- 555 Lake Breeze Ln

- 90 Mcdermott Ct

- Tbd Blueberry Ln

- Lt2 County Road A S

Your Personal Tour Guide

Ask me questions while you tour the home.