315 74th St SW Everett, WA 98203

Evergreen NeighborhoodEstimated Value: $638,412 - $700,000

3

Beds

3

Baths

1,508

Sq Ft

$450/Sq Ft

Est. Value

About This Home

This home is located at 315 74th St SW, Everett, WA 98203 and is currently estimated at $679,353, approximately $450 per square foot. 315 74th St SW is a home located in Snohomish County with nearby schools including Horizon Elementary School, Olympic View Middle School, and Mariner High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 3, 2003

Sold by

Mangum Glorie A

Bought by

Mangum Glorie A

Current Estimated Value

Purchase Details

Closed on

Apr 22, 1999

Sold by

Samaniego Daniel D and Langan Margaret D

Bought by

Mangum Glorie A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,900

Outstanding Balance

$17,279

Interest Rate

7.1%

Estimated Equity

$662,074

Purchase Details

Closed on

Jul 31, 1995

Sold by

Oak Crest Homes Inc

Bought by

Samaniego Daniel D and Langan Margaret D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,332

Interest Rate

7.61%

Mortgage Type

Assumption

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mangum Glorie A | -- | -- | |

| Mangum Glorie A | $172,900 | Pacific Northwest Title Co | |

| Samaniego Daniel D | $152,750 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mangum Glorie A | $67,900 | |

| Previous Owner | Samaniego Daniel D | $157,332 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,296 | $574,000 | $355,000 | $219,000 |

| 2024 | $4,296 | $541,000 | $319,000 | $222,000 |

| 2023 | $4,625 | $597,400 | $344,000 | $253,400 |

| 2022 | $4,347 | $486,100 | $250,000 | $236,100 |

| 2020 | $3,624 | $406,400 | $205,000 | $201,400 |

| 2019 | $3,374 | $382,400 | $183,000 | $199,400 |

| 2018 | $3,455 | $337,900 | $160,000 | $177,900 |

| 2017 | $3,107 | $309,900 | $141,000 | $168,900 |

| 2016 | $2,897 | $285,800 | $124,000 | $161,800 |

Source: Public Records

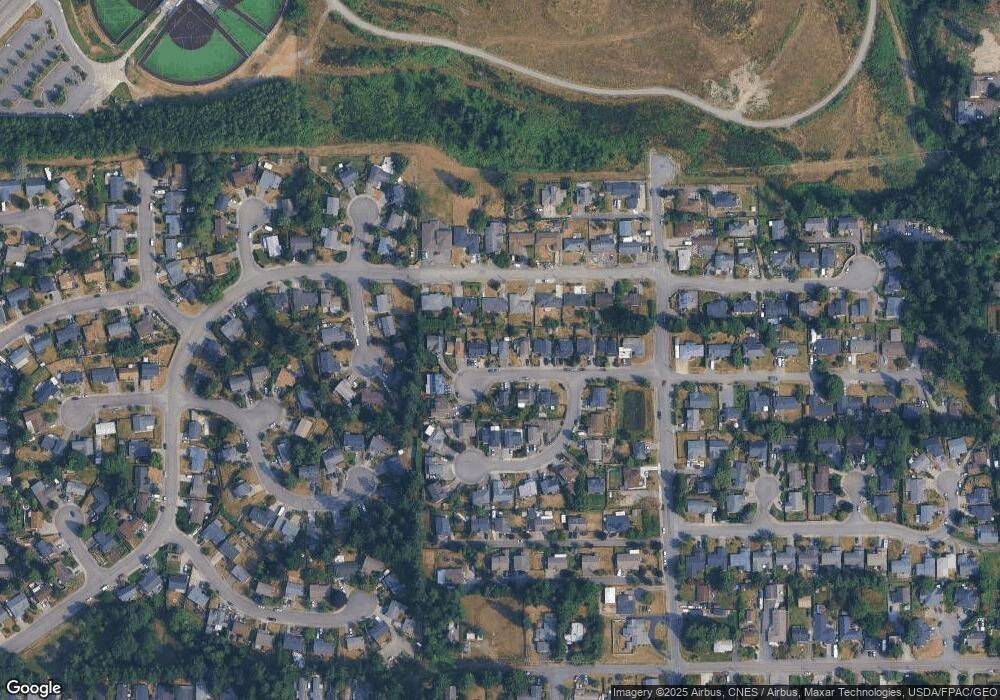

Map

Nearby Homes

- 9 76th St SE

- 7701 Hardeson Rd Unit 16

- 209 76th St SE

- 7622 Easy St

- 323 75th St SE Unit A14

- 323 75th St SE Unit B10

- 615 75th St SE Unit C44

- 615 75th St SE Unit C52

- 747 75th St SE Unit B203

- 6205 W Beech St

- 820 Cady Rd Unit J206

- 820 Cady Rd Unit E102

- 820 Cady Rd Unit H304

- 6208 Sycamore Place

- 6705 Cady Rd

- 7121 Rainier Dr

- 7027 Rainier Dr Unit C

- 7027 Rainier Dr Unit G

- 7027 Rainier Dr Unit B

- 7027 Rainier Dr Unit D