Estimated Value: $83,000 - $154,000

3

Beds

1

Bath

1,092

Sq Ft

$115/Sq Ft

Est. Value

About This Home

This home is located at 315 Carlos Rd, Odum, GA 31555 and is currently estimated at $125,110, approximately $114 per square foot. 315 Carlos Rd is a home located in Wayne County with nearby schools including Odum Elementary School, Martha Puckett Middle School, and Wayne County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 9, 2023

Sold by

Spivey John N

Bought by

Spivey John N

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Outstanding Balance

$78,151

Interest Rate

6.96%

Mortgage Type

New Conventional

Estimated Equity

$46,959

Purchase Details

Closed on

Jul 19, 2007

Sold by

Thornton Roy

Bought by

Spivey John N and Spivey Krista A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$66,950

Interest Rate

6.65%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 1, 2004

Bought by

Thornton Roy and Thornton Cynthia K

Purchase Details

Closed on

Sep 1, 2004

Purchase Details

Closed on

Apr 1, 1984

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Spivey John N | -- | -- | |

| Spivey John N | $65,000 | -- | |

| Thornton Roy | -- | -- | |

| -- | -- | -- | |

| -- | $1,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Spivey John N | $80,000 | |

| Previous Owner | Spivey John N | $66,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $918 | $39,640 | $1,298 | $38,342 |

| 2023 | $1,050 | $34,994 | $1,298 | $33,696 |

| 2022 | $740 | $28,491 | $1,298 | $27,193 |

| 2021 | $671 | $24,890 | $1,298 | $23,592 |

| 2020 | $762 | $26,832 | $3,240 | $23,592 |

| 2019 | $784 | $26,832 | $3,240 | $23,592 |

| 2018 | $784 | $26,832 | $3,240 | $23,592 |

| 2017 | $83 | $26,832 | $3,240 | $23,592 |

| 2016 | $653 | $26,832 | $3,240 | $23,592 |

| 2014 | $655 | $26,832 | $3,240 | $23,592 |

| 2013 | -- | $26,832 | $3,240 | $23,592 |

Source: Public Records

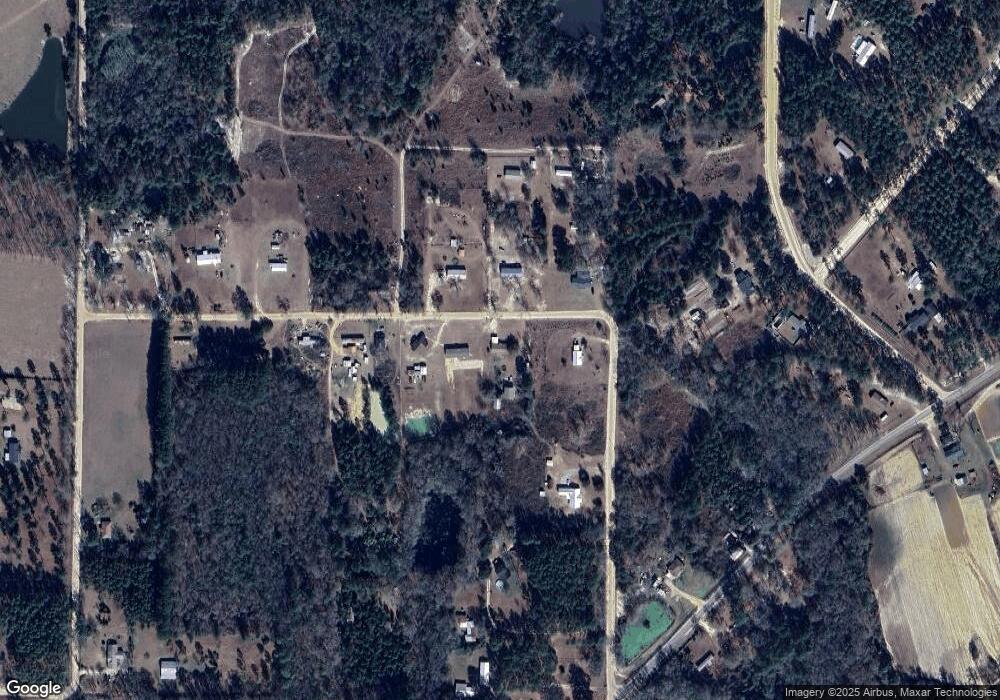

Map

Nearby Homes

- 468 Lake Lanell Rd

- 468 Lake Lannell Rd

- 10 Beards Bluff Rd

- 0 Beards Bluff Rd

- 0 N Church St

- 21 AC Hwy 341

- 10.00 AC Hwy 341 Odum Hwy

- 796 Lud Oquinn Rd

- 858 Hoke Ogden Rd

- Lot 00 Moss Landing

- Lots 26+ Moss Landing

- Lot 21 Moss Landing

- 0 Tract 3 Hwy 341 & Bennett Mill Pond Rd Unit 1656129

- 0 Tract 6 Hwy 341 & Bennett Mill Rd Unit 1656128

- 720 Kaitlyn Ave

- 818 Kaitlyn Ave

- 0 Bennett Mill Pond Rd

- 2936 Madray Springs Rd

- 6555 Lanes Bridge Rd

- 192 Hummingbird Ln

- 435 Carlos Rd

- 0 Carlos Rd Unit 7515234

- 0 Carlos Rd

- 310 Carlos Rd

- 131 Carlos Rd

- 500 Carlos Rd

- 233 Druid Hills Rd

- 49 Carlos Rd

- 2239 Walter Griffis Rd

- 51 Carlos Rd

- 365 Carlos Rd

- 97 Druid Hills Rd

- 2234 Walter Griffis Rd

- 29 Druid Hills Rd

- 2115 Walter Griffis Rd

- 2467 Walter Griffis Rd

- 788 Lake Lannell Rd

- 979 Druid Hills Rd

- 333 Druid Hills Rd

- 700 Lake Lannell Rd