3150 NE 48th Ct Unit 305 Lighthouse Point, FL 33064

Estimated Value: $275,276 - $319,000

2

Beds

2

Baths

900

Sq Ft

$334/Sq Ft

Est. Value

About This Home

This home is located at 3150 NE 48th Ct Unit 305, Lighthouse Point, FL 33064 and is currently estimated at $300,569, approximately $333 per square foot. 3150 NE 48th Ct Unit 305 is a home located in Broward County with nearby schools including Norcrest Elementary School, Deerfield Beach Middle School, and Deerfield Beach High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 23, 2025

Sold by

Kendsersky George and Young Barbara J

Bought by

Bygk Living Trust and Young

Current Estimated Value

Purchase Details

Closed on

May 5, 2018

Sold by

Kelemen William

Bought by

Puleo Marie E

Purchase Details

Closed on

Dec 30, 2004

Sold by

Dicostanzo Martin N

Bought by

Kendersky George and Young Barbara J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Interest Rate

5.63%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 30, 2002

Sold by

Connolly David J

Bought by

Dicostanzo Martin N

Purchase Details

Closed on

Oct 12, 2000

Sold by

Sundstrom Thelma

Bought by

Connolly David J

Purchase Details

Closed on

Jan 6, 1999

Sold by

Sylvia Dan and Sylvia Barsky

Bought by

Sundstrom Thelma

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,000

Interest Rate

6.77%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bygk Living Trust | -- | None Listed On Document | |

| Puleo Marie E | $257,000 | Integrity Title Inc | |

| Kendersky George | $175,000 | The John Galt Title Company | |

| Dicostanzo Martin N | $130,000 | First American Title Ins Co | |

| Connolly David J | $86,500 | -- | |

| Sundstrom Thelma | $80,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kendersky George | $140,000 | |

| Previous Owner | Sundstrom Thelma | $40,000 | |

| Closed | Kendersky George | $17,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,717 | $286,240 | $28,620 | $257,620 |

| 2024 | $5,397 | $286,240 | $28,620 | $257,620 |

| 2023 | $5,397 | $265,370 | $0 | $0 |

| 2022 | $4,606 | $241,250 | $0 | $0 |

| 2021 | $4,183 | $219,320 | $21,930 | $197,390 |

| 2020 | $4,289 | $225,400 | $22,540 | $202,860 |

| 2019 | $4,131 | $226,240 | $22,620 | $203,620 |

| 2018 | $3,531 | $189,770 | $18,980 | $170,790 |

| 2017 | $3,470 | $183,710 | $0 | $0 |

| 2016 | $3,409 | $175,450 | $0 | $0 |

| 2015 | $3,168 | $159,500 | $0 | $0 |

| 2014 | $2,993 | $146,740 | $0 | $0 |

| 2013 | -- | $133,400 | $13,340 | $120,060 |

Source: Public Records

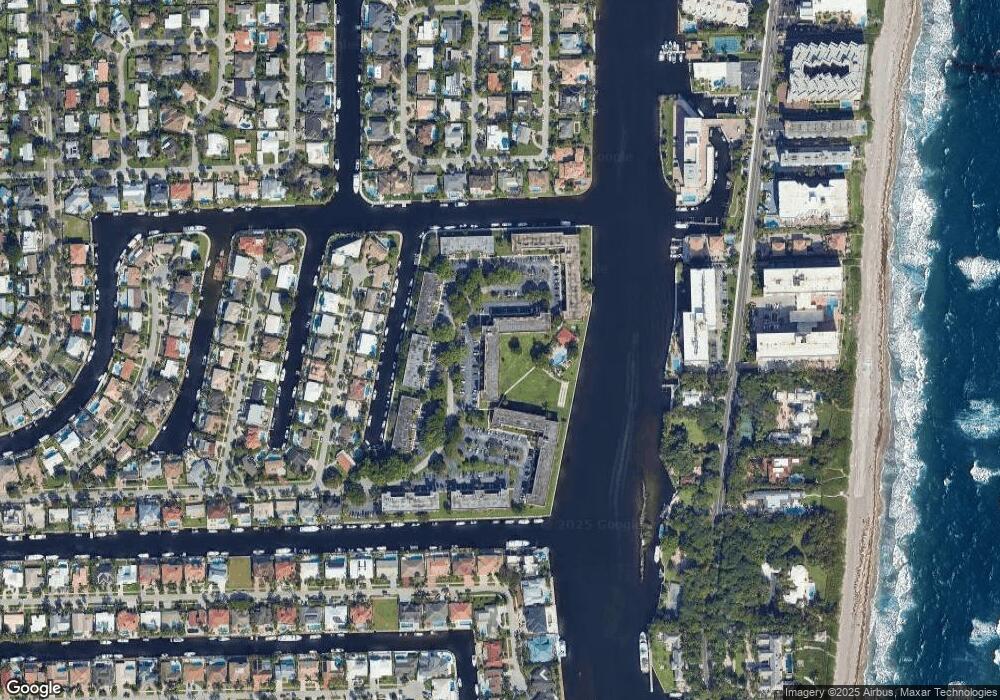

Map

Nearby Homes

- 3150 NE 48th Ct Unit 107

- 3000 NE 48th Ct Unit 302

- 3050 NE 48th Ct Unit 401

- 3050 NE 48th Ct Unit 402

- 3050 NE 48th Ct Unit 303

- 3020 NE 47th St

- 3100 NE 48th Ct Unit 415

- 2901 NE 47th St

- 2810 NE 48th Ct

- 3100 NE 46th St

- 4850 NE 29th Ave

- 2901 NE 46th St

- 2800 NE 48th St

- 4821 NE 28th Ave

- 4460 NE 31st Ave

- 4930 NE 28th Ave

- 3180 NE 48th Ct Unit 210

- 1150 Hillsboro Mile Unit 714

- 1150 Hillsboro Mile Unit 905

- 1150 Hillsboro Mile Unit 212

- 3150 NE 48th St Unit 402

- 3150 NE 48th Ct

- 3150 NE 48th Ct Unit 101

- 3150 NE 48th Ct Unit 109

- 3150 NE 48th Ct Unit 207

- 3150 NE 48th Ct Unit 410

- 3150 NE 48th Ct Unit 306

- 3150 NE 48th Ct Unit 211

- 3150 NE 48th Ct Unit 214

- 3150 NE 48th Ct Unit 409

- 3150 NE 48th Ct Unit 405

- 3150 NE 48th Ct Unit 407

- 3150 NE 48th Ct Unit 111

- 3150 NE 48th Ct Unit 202

- 3150 NE 48th Ct Unit 414

- 3150 NE 48th Ct Unit 204

- 3150 NE 48th Ct Unit 213

- 3150 NE 48th Ct Unit 102