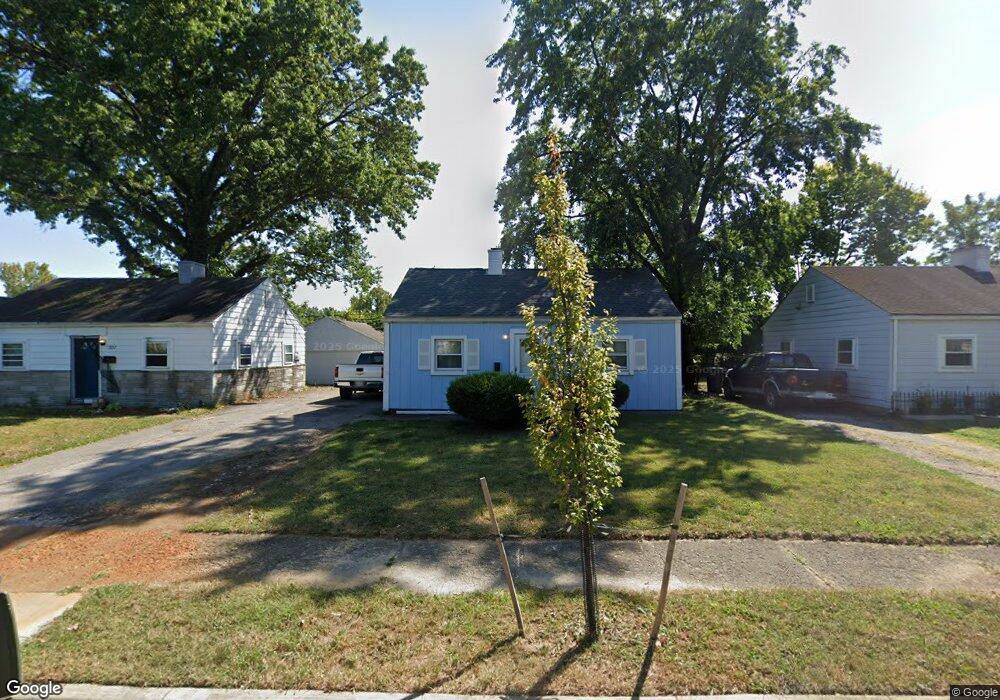

3151 E 12th Ave Columbus, OH 43219

Estimated Value: $134,000 - $163,000

3

Beds

1

Bath

960

Sq Ft

$155/Sq Ft

Est. Value

About This Home

This home is located at 3151 E 12th Ave, Columbus, OH 43219 and is currently estimated at $148,658, approximately $154 per square foot. 3151 E 12th Ave is a home located in Franklin County with nearby schools including East Columbus Elementary School, Champion Middle School, and East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 3, 2011

Sold by

Carnahan Scott R

Bought by

Mohican Properties Llc

Current Estimated Value

Purchase Details

Closed on

May 13, 2009

Sold by

Seg Commercial Llc

Bought by

Carhahan Scott R

Purchase Details

Closed on

Feb 3, 2009

Sold by

Heartwood 88 Llc

Bought by

Seg Commercial Llc

Purchase Details

Closed on

Mar 3, 2007

Sold by

Smith Geraldine M and Leonard Edward

Bought by

Heartwood 88 Llc

Purchase Details

Closed on

Feb 22, 1974

Bought by

Smith Geraldine M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mohican Properties Llc | $150,000 | Attorney | |

| Carhahan Scott R | $23,900 | None Available | |

| Seg Commercial Llc | $1,400 | None Available | |

| Heartwood 88 Llc | $11,100 | Attorney | |

| Smith Geraldine M | $15,000 | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,779 | $38,820 | $10,150 | $28,670 |

| 2024 | $1,779 | $38,820 | $10,150 | $28,670 |

| 2023 | $1,757 | $38,820 | $10,150 | $28,670 |

| 2022 | $1,030 | $12,500 | $1,820 | $10,680 |

| 2021 | $831 | $12,500 | $1,820 | $10,680 |

| 2020 | $809 | $12,500 | $1,820 | $10,680 |

| 2019 | $699 | $11,240 | $1,680 | $9,560 |

| 2018 | $678 | $11,240 | $1,680 | $9,560 |

| 2017 | $711 | $11,240 | $1,680 | $9,560 |

| 2016 | $724 | $10,650 | $2,420 | $8,230 |

| 2015 | $659 | $10,650 | $2,420 | $8,230 |

| 2014 | $660 | $10,650 | $2,420 | $8,230 |

| 2013 | $383 | $12,530 | $2,835 | $9,695 |

Source: Public Records

Map

Nearby Homes

- 3123 E 13th Ave

- 2969 E 11th Ave

- 00 E 7th Ave

- 0 E 7th Ave Unit Lot 79 225013171

- 0 E 7th Ave Unit Lot 77 225013170

- 0 E 7th Ave Unit Lot 78 225013168

- 2974 E 7th Ave

- 2996 E 6th Ave

- 3116 E 5th Ave

- 2841 E 10th Ave

- 2814 E 9th Ave

- 2822 Bellwood Ave

- 696 Northview Ave

- 2599 E 5th Ave

- 256 N Kellner Rd

- 238 Edgevale Rd

- 243 N James Rd

- 253 N James Rd

- 177 N James Rd

- 205 N Gould Rd

- 3145 E 12th Ave

- 3157 E 12th Ave

- 3139 E 12th Ave

- 3163 E 12th Ave

- 3133 E 12th Ave

- 3154 E 12th Ave

- 3148 E 12th Ave

- 3160 E 12th Ave

- 3142 E 12th Ave

- 3166 E 12th Ave

- 3125 E 12th Ave

- 3177 E 12th Ave

- 3119 E 12th Ave

- 3183 E 12th Ave

- 3180 E 12th Ave

- 3130 E 12th Ave

- 3113 E 12th Ave

- 3189 E 12th Ave

- 3124 E 12th Ave

- 3161 E 13th Ave