Estimated Value: $290,000 - $301,000

3

Beds

2

Baths

1,896

Sq Ft

$156/Sq Ft

Est. Value

About This Home

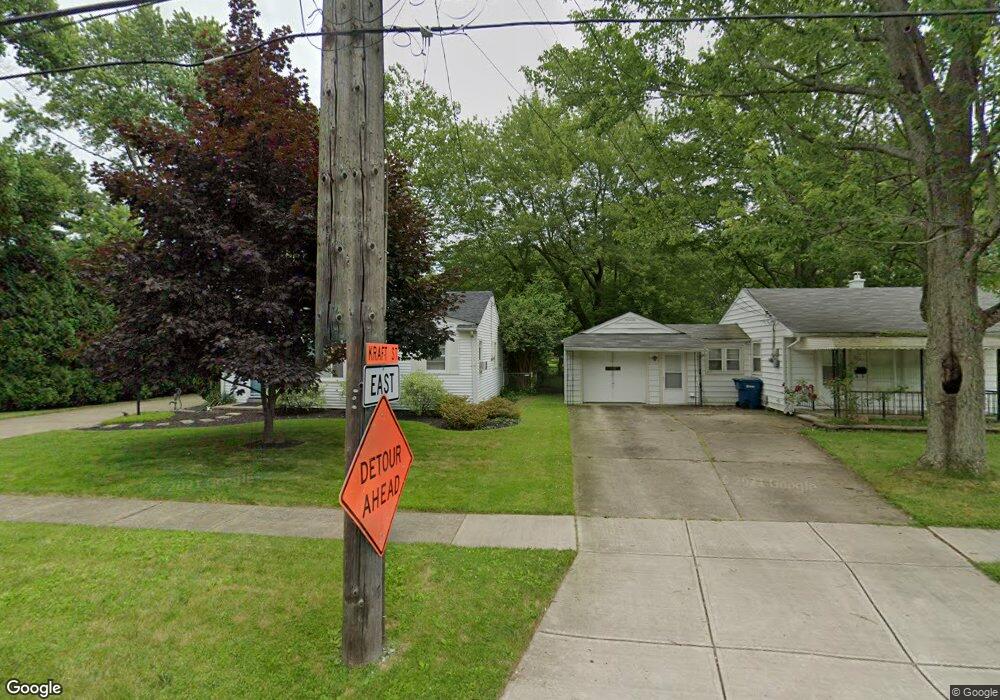

This home is located at 317 Edgewood Dr, Berea, OH 44017 and is currently estimated at $296,219, approximately $156 per square foot. 317 Edgewood Dr is a home located in Cuyahoga County with nearby schools including Grindstone Elementary School, Berea-Midpark Middle School, and Berea-Midpark High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 7, 2025

Sold by

Rex Kevin

Bought by

Kantartzis Constantine and Porter Leah

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$279,837

Outstanding Balance

$277,894

Interest Rate

6.81%

Mortgage Type

FHA

Estimated Equity

$18,325

Purchase Details

Closed on

May 11, 2016

Sold by

Peterson Kenneth D and Peterson Juanita M

Bought by

Rex Kevin

Purchase Details

Closed on

May 6, 2011

Sold by

Fannie Mae

Bought by

Peterson Kenneth D and Peterson Juanila M

Purchase Details

Closed on

Nov 9, 2010

Sold by

Myers Michael H

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Jun 24, 1999

Sold by

Mieyal Jeanette L

Bought by

Myers Michael H

Purchase Details

Closed on

May 20, 1996

Sold by

Baldwin-Wallace College

Bought by

Myers Michael H and Mieyal Jeanette L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,300

Interest Rate

7.2%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kantartzis Constantine | $286,500 | Infinity Title | |

| Rex Kevin | $165,000 | Revere Title | |

| Peterson Kenneth D | $94,900 | Ohio Title Corp | |

| Federal National Mortgage Association | $93,334 | Attorney | |

| Myers Michael H | -- | Guardian Title | |

| Myers Michael H | -- | Guardian Title | |

| Myers Michael H | $116,128 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kantartzis Constantine | $279,837 | |

| Previous Owner | Myers Michael H | $110,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,065 | $87,500 | $19,355 | $68,145 |

| 2023 | $4,684 | $67,830 | $17,360 | $50,470 |

| 2022 | $4,655 | $67,830 | $17,360 | $50,470 |

| 2021 | $4,616 | $67,830 | $17,360 | $50,470 |

| 2020 | $4,408 | $57,470 | $14,700 | $42,770 |

| 2019 | $4,291 | $164,200 | $42,000 | $122,200 |

| 2018 | $2,132 | $57,470 | $14,700 | $42,770 |

| 2017 | $4,004 | $50,050 | $12,180 | $37,870 |

| 2016 | $3,975 | $50,050 | $12,180 | $37,870 |

| 2015 | $3,730 | $50,050 | $12,180 | $37,870 |

| 2014 | $3,756 | $50,050 | $12,180 | $37,870 |

Source: Public Records

Map

Nearby Homes

- 255 Fairpark Dr

- 214 Race St

- 412 Wyleswood Dr

- 585 Woodmere Dr

- 217 Kraft St

- 517 Wyleswood Dr

- 28 Crocker St

- 154 Best St

- 8797 Westlawn Blvd

- 626 Ensenada Ct Unit 5

- 648 Tampico Ct Unit 37

- 537 Wyleswood Dr

- 543 Wyleswood Dr

- 74 Aaron St

- 549 Wyleswood Dr

- 617 Lindberg Blvd

- Daffodil II Plan at Aspire at Longbrooke

- Passionflower II Plan at Aspire at Longbrooke

- 23 Hamilton St

- 396 Crossbrook Dr

- 415 Adrian Dr

- 423 Adrian Dr

- 432 Edgewood Dr

- 400 Edgewood Dr

- 429 Adrian Dr

- 303 Race St

- 425 Edgewood Cir

- 438 Edgewood Dr

- 438 Edgewood Cir

- 395 Adrian Dr

- 431 Edgewood Cir

- 439 Adrian Dr

- 394 Edgewood Dr

- 399 Edgewood Dr

- 295 Race St

- 437 Edgewood Cir

- 446 Edgewood Dr

- 410 Adrian Dr

- 446 Edgewood Cir

- 428 Adrian Dr