3175 NE 48th Ct Unit 101 Lighthouse Point, FL 33064

Eastway Park NeighborhoodEstimated Value: $469,000 - $539,000

4

Beds

2

Baths

1,450

Sq Ft

$340/Sq Ft

Est. Value

About This Home

This home is located at 3175 NE 48th Ct Unit 101, Lighthouse Point, FL 33064 and is currently estimated at $492,700, approximately $339 per square foot. 3175 NE 48th Ct Unit 101 is a home located in Broward County with nearby schools including Norcrest Elementary School, Deerfield Beach Middle School, and Deerfield Beach High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 12, 2001

Sold by

Sheldon M Freistat M and Katherine D Freistat M

Bought by

Puleo Marie R Trust

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

6.98%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Sep 4, 2001

Sold by

Freistat Sheldon M and Freistat Katherine D

Bought by

Puleo Marie R and Revocable Living Tr Agreement Marie R Pu

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

6.98%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Sep 8, 1998

Sold by

Richard R Moore Tr and Mary M Gourley Tr

Bought by

Freistat Sheldon M and Freistat Katherine D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,500

Interest Rate

6.96%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 1, 1986

Sold by

Available Not

Bought by

Available Not

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Puleo Marie R Trust | $225,000 | -- | |

| Puleo Marie R | $225,000 | -- | |

| Freistat Sheldon M | $135,000 | -- | |

| Available Not | $7,142 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Puleo Marie R | $80,000 | |

| Previous Owner | Freistat Sheldon M | $121,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $3,060 | $189,190 | -- | -- |

| 2025 | $2,940 | $189,190 | -- | -- |

| 2024 | $2,768 | $183,860 | -- | -- |

| 2023 | $2,768 | $178,510 | $0 | $0 |

| 2022 | $2,554 | $173,320 | $0 | $0 |

| 2021 | $2,479 | $168,280 | $0 | $0 |

| 2020 | $2,434 | $165,960 | $0 | $0 |

| 2019 | $2,386 | $162,230 | $0 | $0 |

| 2018 | $2,246 | $159,210 | $0 | $0 |

| 2017 | $2,212 | $155,940 | $0 | $0 |

| 2016 | $2,184 | $152,740 | $0 | $0 |

| 2015 | $2,230 | $151,680 | $0 | $0 |

| 2014 | $2,247 | $150,480 | $0 | $0 |

| 2013 | -- | $178,220 | $17,820 | $160,400 |

Source: Public Records

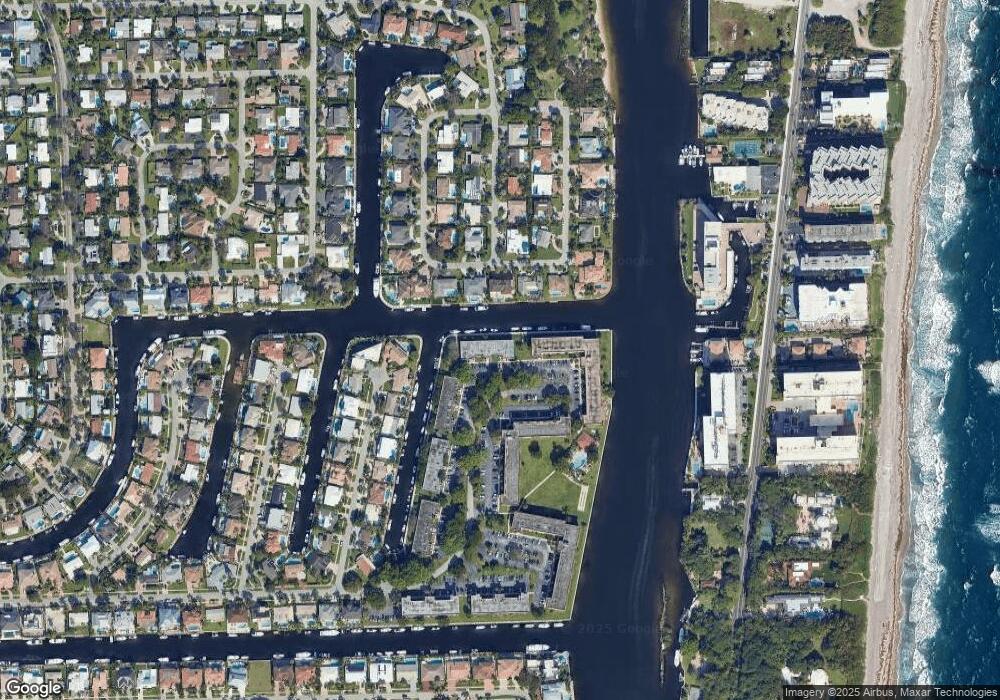

Map

Nearby Homes

- 3180 NE 48th Ct Unit 215

- 3180 NE 48th Ct Unit 404

- 4850 NE 29th Ave

- 4930 NE 28th Ave

- 4841 NE 29th Ave

- 3100 NE 48th Ct Unit 307

- 5121 NE 30th Terrace

- 3000 NE 48th Ct Unit 302

- 5120 NE 31st Ave

- 4930 NE 27th Terrace

- 2801 NE 48th Ct

- 1150 Hillsboro Mile Unit 1016

- 1150 Hillsboro Mile Unit 408

- 1150 Hillsboro Mile Unit 905

- 1150 Hillsboro Mile Unit 708

- 1150 Hillsboro Mile Unit 212

- 4821 NE 28th Ave

- 1160 Hillsboro Mile Unit 903

- 1160 Hillsboro Mile Unit 901

- 1160 Hillsboro Mile Unit 701

- 3175 NE 48th Ct Unit 105

- 3175 NE 48th Ct Unit 104

- 3175 NE 48th Ct Unit 202

- 3175 NE 48th Ct Unit 102

- 3175 NE 48th Ct Unit 205

- 3175 NE 48th Ct Unit 204

- 3175 NE 48th Ct Unit 103

- 3175 NE 48th Ct Unit 106

- 3175 NE 48th Ct Unit 206

- 3175 NE 48th Ct Unit 201

- 3175 NE 48th Ct Unit 203

- 3165 NE 48th Ct

- 3165 NE 48th Ct Unit 212

- 3165 NE 48th Ct Unit 208

- 3165 NE 48th Ct Unit 111

- 3165 NE 48th Ct Unit 107

- 3165 NE 48th Ct Unit 210

- 3165 NE 48th Ct Unit 112

- 3165 NE 48th Ct Unit 109

- 3165 NE 48th Ct Unit 105

Your Personal Tour Guide

Ask me questions while you tour the home.