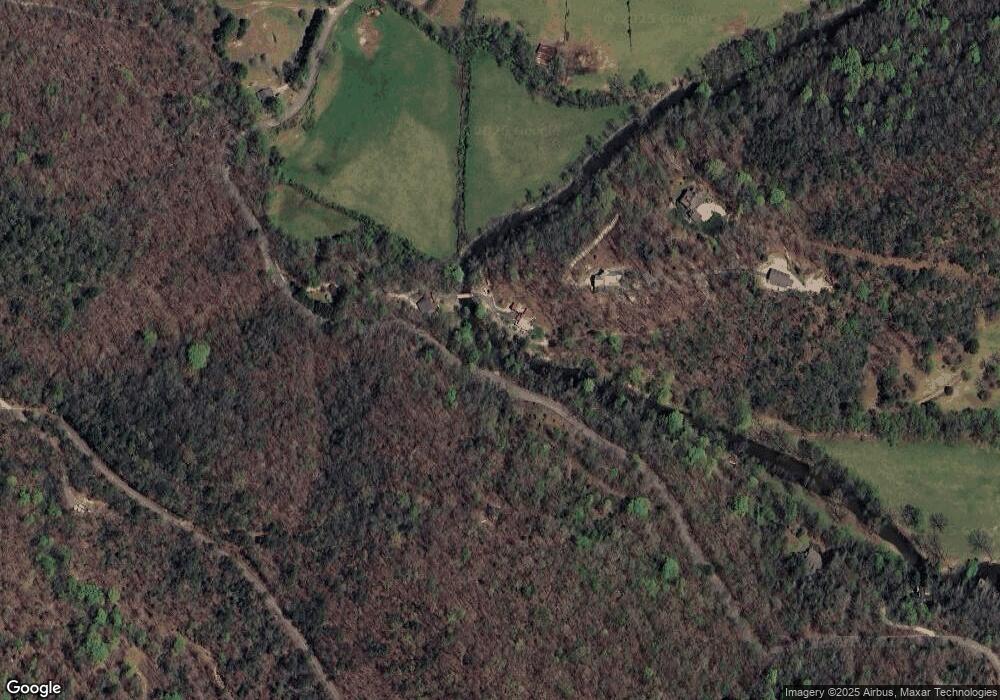

32 Buzzards Bend Trail Clayton, GA 30525

Estimated Value: $367,858 - $583,000

3

Beds

2

Baths

1,048

Sq Ft

$491/Sq Ft

Est. Value

About This Home

This home is located at 32 Buzzards Bend Trail, Clayton, GA 30525 and is currently estimated at $514,965, approximately $491 per square foot. 32 Buzzards Bend Trail is a home located in Rabun County with nearby schools including Rabun County Primary School and Rabun County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 21, 2019

Sold by

Hunt Richard E

Bought by

Meissen Theodore Frederick and Meissen Cynthia Roxanne

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,000

Outstanding Balance

$153,782

Interest Rate

4.3%

Mortgage Type

New Conventional

Estimated Equity

$361,183

Purchase Details

Closed on

Sep 1, 2007

Sold by

Not Provided

Bought by

Hunt Richard E

Purchase Details

Closed on

Aug 1, 1981

Purchase Details

Closed on

Feb 1, 1981

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Meissen Theodore Frederick | $220,000 | -- | |

| Meissen Theodore Frederick | $220,000 | -- | |

| Hunt Richard E | -- | -- | |

| Hunt Richard E | $305,500 | -- | |

| Hunt Richard E | -- | -- | |

| Hunt Richard E | $305,500 | -- | |

| -- | $24,000 | -- | |

| -- | $24,000 | -- | |

| -- | -- | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Meissen Theodore Frederick | $176,000 | |

| Closed | Meissen Theodore Frederick | $176,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,447 | $90,174 | $39,724 | $50,450 |

| 2024 | $1,397 | $87,063 | $39,724 | $47,339 |

| 2023 | $1,459 | $79,702 | $36,781 | $42,921 |

| 2022 | $1,431 | $78,199 | $36,781 | $41,418 |

| 2021 | $1,355 | $72,271 | $36,781 | $35,490 |

| 2020 | $1,321 | $68,094 | $36,781 | $31,313 |

| 2019 | $1,048 | $53,661 | $27,586 | $26,075 |

| 2018 | $1,022 | $52,107 | $27,586 | $24,521 |

| 2017 | $980 | $52,107 | $27,586 | $24,521 |

| 2016 | $982 | $52,107 | $27,586 | $24,521 |

| 2015 | $965 | $50,102 | $27,586 | $22,516 |

| 2014 | -- | $50,102 | $27,586 | $22,516 |

Source: Public Records

Map

Nearby Homes

- 2479 Plum Orchard Rd

- 728 Oscar Rock Rd

- 22 Cajun Loop

- J35 Bent Grass Way

- J-27 & J-28 Bent Grass Way Unit J-27 & J-28

- 608 Winterberry Trail

- 177 Whitetail Trail

- LOT44 Bent Grass Way

- 655 Bent Grass Way

- LOT 12A Winterberry Trail

- A 7 Winterberry Trail

- LOT C2 Grey Fox Trail

- LOT C1 Grey Fox Trail

- 876 Whitetail Trail

- 689 Waterfall Dr

- 235 Grey Fox Trail

- A19 Winterberry Dr

- 0 Persimmon Rd Unit 20136006

- 96 Fair View Dr

- L-3 High Pointe Dr Unit L-3

- 32 Buzzard Bend

- 298 Buzzards Bend Trail

- 103 Buzzards Bend Trail

- 2348 Plum Orchard Rd

- 614 Cat Gap Rd

- 0 Cat Gap Rd Unit 7261559

- 0 Cat Gap Rd Unit 3106547

- 0 Cat Gap Rd Unit 7261550

- 256 Cat Gap Rd

- 1079 Cat Gap Rd

- 40 Garrett Ln

- 178 Cat Gap Rd

- 1168 Cat Gap Rd

- 1701 Cat Gap Rd

- 155 Cat Gap Rd

- 2479 Plum Orchard Rd Unit 1 & 2

- 153 Cat Gap Rd

- 2080 Tallualh River Rd

- 2080 Tallulah River Rd

- 2476 Plum Orchard Rd