32 Campbell Ave Highland Mills, NY 10930

Estimated Value: $456,000 - $642,000

4

Beds

2

Baths

2,495

Sq Ft

$236/Sq Ft

Est. Value

About This Home

This home is located at 32 Campbell Ave, Highland Mills, NY 10930 and is currently estimated at $589,894, approximately $236 per square foot. 32 Campbell Ave is a home located in Orange County with nearby schools including Monroe-Woodbury Middle School, Monroe-Woodbury High School, and Sheri Torah - V'Yoel Moshe.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 23, 2022

Sold by

32 Campbell Llc

Bought by

Friedman Joel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$310,000

Interest Rate

5.55%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Purchase Details

Closed on

Dec 28, 2020

Sold by

Calamari John

Bought by

32 Campbell Llc

Purchase Details

Closed on

Apr 22, 2002

Sold by

Dieudonne Angela

Bought by

Roberts Ronald Alfonso

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,000

Interest Rate

9.95%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Friedman Joel | -- | None Available | |

| 32 Campbell Llc | $625,000 | None Available | |

| Roberts Ronald Alfonso | $190,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Friedman Joel | $310,000 | |

| Previous Owner | Roberts Ronald Alfonso | $152,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $11,702 | $124,900 | $21,900 | $103,000 |

| 2023 | $11,702 | $124,900 | $21,900 | $103,000 |

| 2022 | $12,066 | $124,900 | $21,900 | $103,000 |

| 2021 | $11,834 | $124,900 | $21,900 | $103,000 |

| 2020 | $12,927 | $124,900 | $21,900 | $103,000 |

| 2019 | $11,898 | $124,900 | $21,900 | $103,000 |

| 2018 | $11,898 | $124,900 | $21,900 | $103,000 |

| 2017 | $11,561 | $124,900 | $21,900 | $103,000 |

| 2016 | $11,364 | $124,900 | $21,900 | $103,000 |

| 2015 | -- | $124,900 | $21,900 | $103,000 |

| 2014 | -- | $124,900 | $21,900 | $103,000 |

Source: Public Records

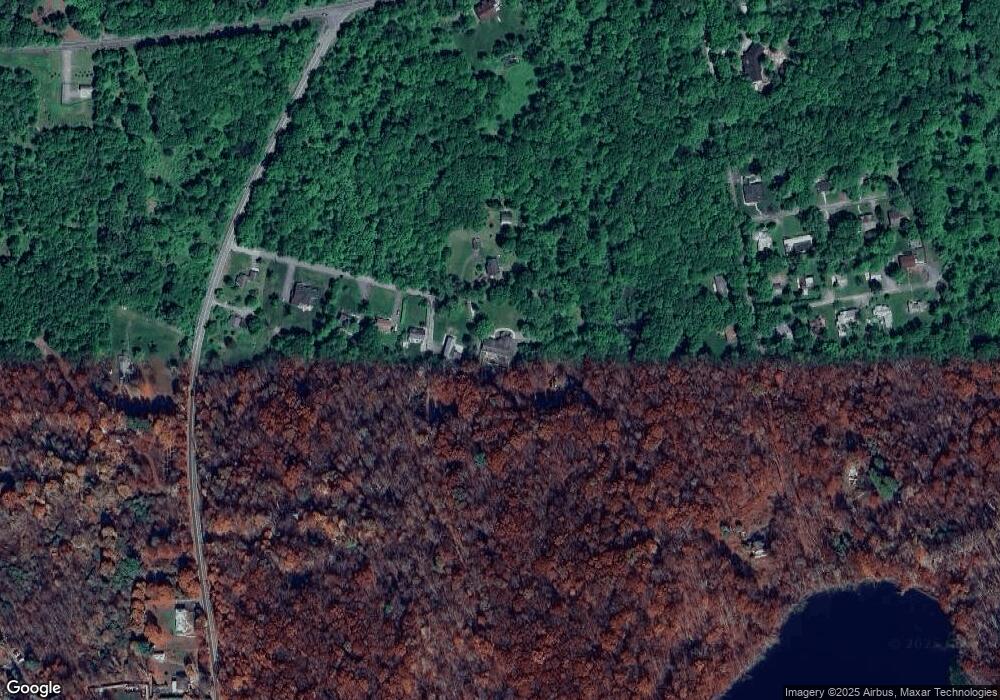

Map

Nearby Homes

- 8 Lemberg Ct Unit 105

- 18 Fordham Ln

- 172 County Route 105

- 2 Berkeley Ct

- 10 Leone Ct

- 8 First Ave

- 29 Westend Dr

- 27 Westend Dr

- 27 Jefferson St

- 19 Sunset Terrace

- 35 Depalma Dr

- 6 Hamburg Way Unit 2

- 93 Weygant Hill

- 1 Grant Ct

- 14 Hamburg Way Unit 303

- 20 Jones Dr

- 5 Lizensk Blvd

- 8 Ledger View Ct

- 2 Riverstone Ct

- 13 Butternut Ct