32 Smith Ave Unit 1D Fair Lawn, NJ 07410

Estimated Value: $423,000 - $501,000

--

Bed

--

Bath

1,100

Sq Ft

$410/Sq Ft

Est. Value

About This Home

This home is located at 32 Smith Ave Unit 1D, Fair Lawn, NJ 07410 and is currently estimated at $451,446, approximately $410 per square foot. 32 Smith Ave Unit 1D is a home located in Bergen County with nearby schools including Westmoreland Elementary School, Memorial Middle School, and Fair Lawn High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 15, 2013

Sold by

Russo Kenneth R and Corby Ann Marie

Bought by

Madru Meghan E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,000

Outstanding Balance

$136,992

Interest Rate

3.97%

Mortgage Type

New Conventional

Estimated Equity

$314,454

Purchase Details

Closed on

Nov 12, 2010

Sold by

Youngberg Joseph T

Bought by

Egan Kerianne and Russo Kenneth R

Purchase Details

Closed on

Apr 6, 2006

Sold by

Vanvankruiningen James Van

Bought by

Youngberg Joseph and Egen Kerianne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$248,000

Interest Rate

6.37%

Purchase Details

Closed on

Jun 26, 2000

Sold by

Rosenberg Michael L

Bought by

Vankruiningen James and Vankruiningen Dorothy J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,700

Interest Rate

8.59%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Madru Meghan E | $235,000 | -- | |

| Egan Kerianne | $210,146 | -- | |

| Youngberg Joseph | $310,000 | -- | |

| Vankruiningen James | $110,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Madru Meghan E | $188,000 | |

| Previous Owner | Youngberg Joseph | $248,000 | |

| Previous Owner | Vankruiningen James | $106,700 | |

| Closed | Egan Kerianne | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,007 | $229,100 | $112,000 | $117,100 |

| 2024 | $8,007 | $229,100 | $112,000 | $117,100 |

| 2023 | $7,911 | $229,100 | $112,000 | $117,100 |

| 2022 | $7,911 | $229,100 | $112,000 | $117,100 |

| 2021 | $7,918 | $229,100 | $112,000 | $117,100 |

| 2020 | $7,858 | $229,100 | $112,000 | $117,100 |

| 2019 | $7,721 | $229,100 | $112,000 | $117,100 |

| 2018 | $7,579 | $229,100 | $112,000 | $117,100 |

| 2017 | $7,391 | $229,100 | $112,000 | $117,100 |

| 2016 | $7,187 | $229,100 | $112,000 | $117,100 |

| 2015 | $7,052 | $229,100 | $112,000 | $117,100 |

| 2014 | $6,933 | $229,100 | $112,000 | $117,100 |

Source: Public Records

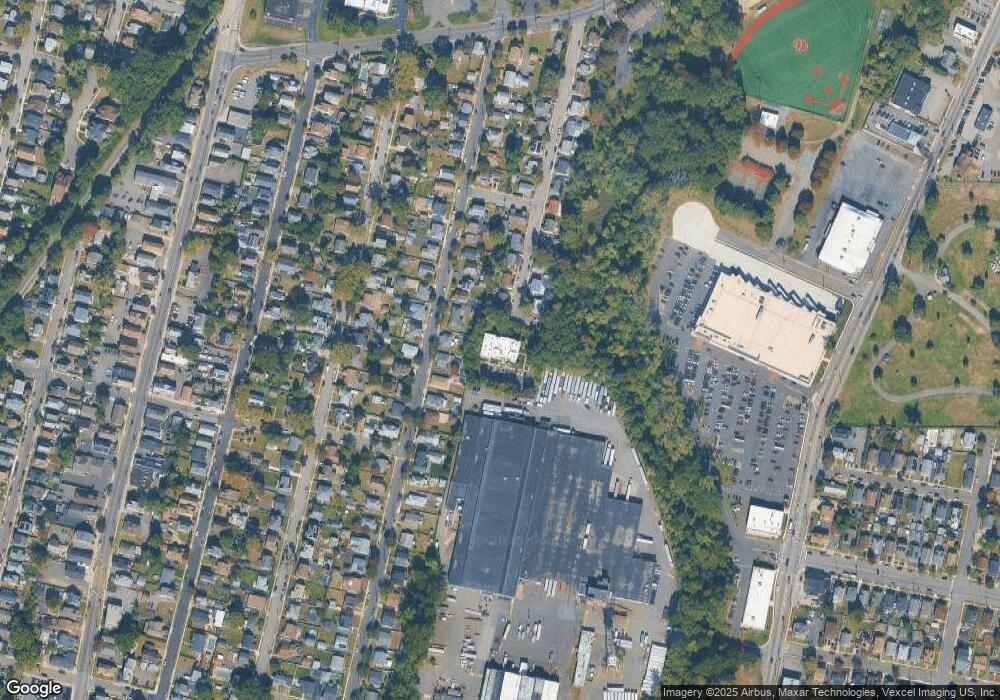

Map

Nearby Homes

- 40 Pomona Ave

- 37 Albert Ave Unit 1X

- 51 Pomona Ave

- 61 Pomona Ave Unit 1X

- 63 Pomona Ave

- 22-05 Maple Ave

- 59 Lincoln Ave

- 337 Diamond Bridge Ave

- 8-24 Fern St Unit 1X

- 7-29 Cedar St Unit 1X

- 155 Washington Ave

- 21 Hawthorne Ave

- 84 Washington Ave

- 110 Mawhinney Ave

- 47 Heathcote Rd

- 185 South Ave

- 100 3rd Ave Unit 6

- 327 Harristown Rd

- 164 Diamond Bridge Ave Unit 18

- 406 Dixie Ave

- 32 Smith Ave Unit 1E

- 32 Smith Ave Unit 2A

- 32 Smith Ave Unit 2E

- 32 Smith Ave Unit 1H

- 32 Smith Ave Unit 1B

- 32 Smith Ave Unit 2C

- 32 Smith Ave Unit 2B

- 32 Smith Ave Unit 2G

- 32 Smith Ave Unit 1G

- 32 Smith Ave Unit 2D

- 32 Smith Ave Unit 1F

- 32 Smith Ave Unit 1C

- 32 Smith Ave Unit 1A

- 32 Smith Ave

- 32 Smith Ave Apt 1h Unit 1H

- 37 Pomona Ave Unit 1X

- 39 Pomona Ave

- 39 Pomona Ave Unit 1X

- 33 Pomona Ave Unit 1X

- 28 Smith Ave Unit 2X