32 Village Ct Wilton, CT 06897

Estimated Value: $966,000 - $1,091,000

4

Beds

3

Baths

1,861

Sq Ft

$547/Sq Ft

Est. Value

About This Home

This home is located at 32 Village Ct, Wilton, CT 06897 and is currently estimated at $1,017,560, approximately $546 per square foot. 32 Village Ct is a home located in Fairfield County with nearby schools including Miller-Driscoll School, Cider Mill School, and Middlebrook School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 24, 2023

Sold by

Callahan Elizabeth B

Bought by

Federico Kathleen B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$500,000

Outstanding Balance

$488,921

Interest Rate

6.96%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$528,639

Purchase Details

Closed on

Apr 23, 2013

Sold by

Seymour Marie P

Bought by

Callahan Elizabeth B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$570,000

Interest Rate

3.52%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Federico Kathleen B | $800,000 | None Available | |

| Callahan Elizabeth B | $559,100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Federico Kathleen B | $500,000 | |

| Previous Owner | Callahan Elizabeth B | $570,000 | |

| Previous Owner | Callahan Elizabeth B | $291,000 | |

| Previous Owner | Callahan Elizabeth B | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,181 | $539,980 | $0 | $539,980 |

| 2024 | $12,927 | $539,980 | $0 | $539,980 |

| 2023 | $12,043 | $411,600 | $0 | $411,600 |

| 2022 | $11,619 | $411,600 | $0 | $411,600 |

| 2021 | $11,471 | $411,600 | $0 | $411,600 |

| 2020 | $11,303 | $411,600 | $0 | $411,600 |

| 2019 | $11,747 | $411,600 | $0 | $411,600 |

| 2018 | $10,089 | $357,910 | $0 | $357,910 |

| 2017 | $9,939 | $357,910 | $0 | $357,910 |

| 2016 | $9,785 | $357,910 | $0 | $357,910 |

| 2015 | $9,603 | $357,910 | $0 | $357,910 |

| 2014 | $9,488 | $357,910 | $0 | $357,910 |

Source: Public Records

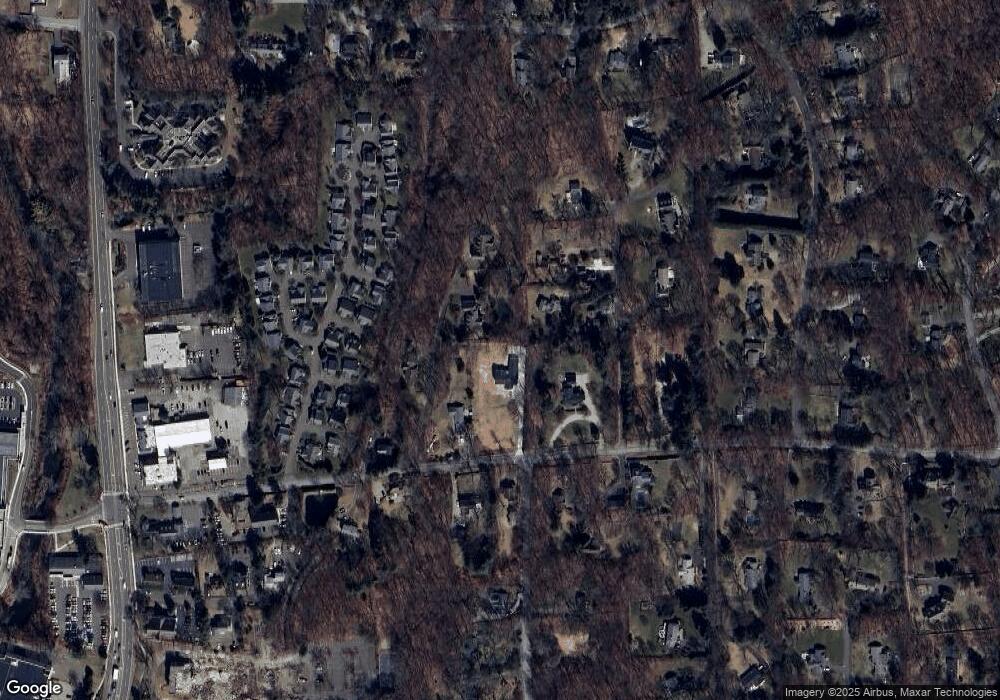

Map

Nearby Homes

- 28 Village Ct

- 105 Danbury Rd

- 10 Wilton Hills

- 45 Lambert Common Unit 45

- 29 Grumman Ave

- 65 Valeview Rd

- 10 Wilton Hunt Rd

- 510 Foxboro Dr

- 316 Foxboro Dr Unit 316

- 20 Newsome Ln

- 8 Live Oak Rd

- 84 Wilton Crest Rd Unit 84

- 123 Old Belden Hill Rd Unit 40

- 110 Dudley Rd

- 36 Wilton Crest Unit 36

- 515 Belden Hill Rd

- 11 Eastwood Rd

- 54 Glen View Unit 54

- 35 Mohawk Dr

- 41 Mohawk Dr