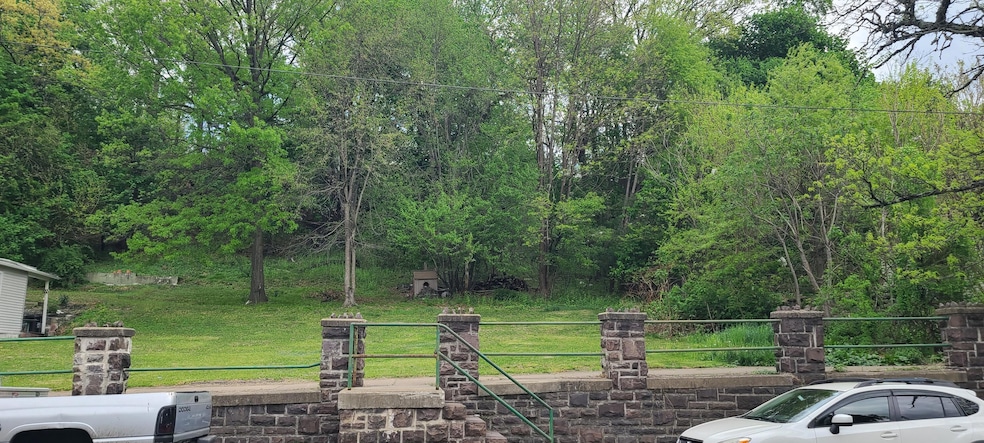

320 N Main St Wilkes Barre, PA 18702

Estimated payment $703/month

Total Views

7,571

0.43

Acre

$302,326

Price per Acre

18,731

Sq Ft Lot

Highlights

- City Lights View

- Property is near public transit

- No HOA

- 0.43 Acre Lot

About This Lot

This is a great opportunity to build your in- town multi-unit dream home. This sale includes multiple lots. Formally the sight of a 5-unit apartment building. close to the university and public transportation.

Property Details

Property Type

- Land

Est. Annual Taxes

- $223

Lot Details

- 0.43 Acre Lot

- 4 Lots in the community

- 73-H10NW4-026-10C, 73-H10NW4-026-10A, 73-H10NW4-026-010,

- Zoning described as Multi-Family

Additional Features

- City Lights Views

- Property is near public transit

- No Utilities

Community Details

- No Home Owners Association

Listing and Financial Details

- Assessor Parcel Number 73-H10NW4-026-10B-000

- Tax Block 26

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,326 | $14,000 | $14,000 | $0 |

| 2024 | $2,326 | $14,000 | $14,000 | $0 |

| 2023 | $2,326 | $14,000 | $14,000 | $0 |

| 2022 | $2,323 | $14,000 | $14,000 | $0 |

| 2021 | $2,323 | $14,000 | $14,000 | $0 |

| 2020 | $2,323 | $14,000 | $14,000 | $0 |

| 2019 | $2,315 | $14,000 | $14,000 | $0 |

| 2018 | $2,306 | $14,000 | $14,000 | $0 |

| 2017 | $2,298 | $14,000 | $14,000 | $0 |

| 2016 | -- | $31,200 | $14,000 | $17,200 |

| 2015 | -- | $31,200 | $14,000 | $17,200 |

| 2014 | -- | $31,200 | $14,000 | $17,200 |

Source: Public Records

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 05/06/2025 05/06/25 | For Sale | $130,000 | -- | -- |

Source: Pocono Mountains Association of REALTORS®

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Deed | $3,000 | None Available |

Source: Public Records

Source: Pocono Mountains Association of REALTORS®

MLS Number: PM-131909

APN: 73-H10NW4-026-10B-000

Nearby Homes

- 150 Court St

- 354 N Main St

- 137 Madison St

- 247 N Main St

- 50 Butler St

- 235 Madison St

- 34 Darling St

- 282 N Pennsylvania Ave

- 395 N Pennsylvania Ave

- 472 N Washington St

- 81 Courtright Ave

- 20 Wyoming St

- 522 N Washington St

- 59 Bowman St

- 557 N Main St

- 640 N Pennsylvania Ave

- 171 Scott St

- 1 N River St

- 174 Kidder St

- 649 N Franklin St

- 251 N Main St Unit 1

- 0 N Pennsylvania Ave

- 159 N Washington St

- 98 N Franklin St Unit 2

- 235 Scott St

- 100 Parkway Blvd

- 19 N River St Unit 308

- 19 N River St Unit 307

- 19 N River St Unit 203

- 19 N River St Unit 403

- 11 W Market St Unit 802

- 15 Public Square

- 395 Scott St

- 124 2nd Ave Unit E

- 34 S Main St

- 480 Scott St

- 113 N Fulton St

- 34 2nd Ave Unit 34

- 92 S Main St Unit 304

- 272 Coal St