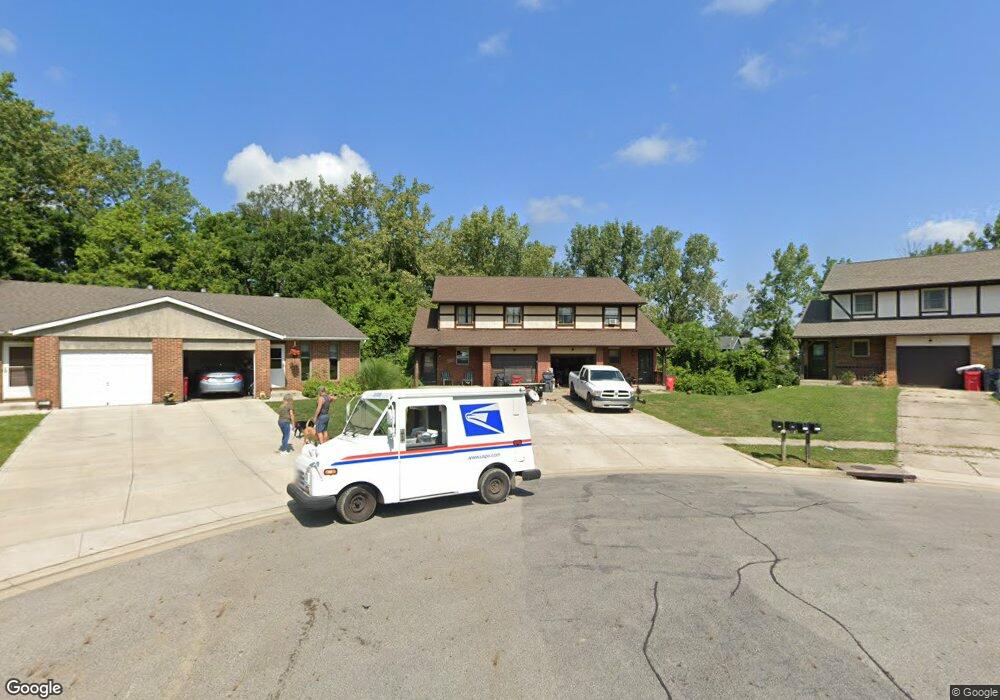

3209 Independence St Unit 211 Grove City, OH 43123

Estimated Value: $303,000 - $375,000

6

Beds

4

Baths

2,512

Sq Ft

$134/Sq Ft

Est. Value

About This Home

This home is located at 3209 Independence St Unit 211, Grove City, OH 43123 and is currently estimated at $336,371, approximately $133 per square foot. 3209 Independence St Unit 211 is a home located in Franklin County with nearby schools including Highland Park Elementary School, Park Street Intermediate School, and Grove City High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 28, 2025

Sold by

Roach Nicholas B and Roach Olivia N

Bought by

Gba Usa Llc

Current Estimated Value

Purchase Details

Closed on

Dec 13, 2024

Sold by

Berkley J Roach Revocable Trust and Roach Berkley J

Bought by

Roach Nicholas B and Roach Olivia N

Purchase Details

Closed on

Dec 15, 2017

Sold by

Indep Llc and Rauck James G

Bought by

Rauch Berkley J and The Berkley J Rauch Revocabel Trust

Purchase Details

Closed on

Jan 15, 2010

Sold by

Rauck James G and Rauck Allyson B

Bought by

Indeep Llc

Purchase Details

Closed on

Jan 19, 2005

Sold by

Rauck James O and Rauck Patrice A

Bought by

Rauck James G

Purchase Details

Closed on

Nov 19, 2001

Sold by

Rauck Amanda M and Termuhlen Amanda M

Bought by

Rauck James O and Rauck Patrice A

Purchase Details

Closed on

Dec 2, 1993

Bought by

Rauck Amanda M

Purchase Details

Closed on

Aug 1, 1986

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gba Usa Llc | -- | None Listed On Document | |

| Roach Nicholas B | $300,600 | None Listed On Document | |

| Roach Nicholas B | $300,600 | None Listed On Document | |

| Rauch Berkley J | $135,000 | Valmer Land Title Agency | |

| Indeep Llc | -- | Attorney | |

| Rauck James G | -- | -- | |

| Rauck James O | $115,000 | Chicago Title | |

| Rauck Amanda M | $122,300 | -- | |

| -- | $95,000 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,312 | $105,210 | $22,960 | $82,250 |

| 2023 | $4,830 | $105,210 | $22,960 | $82,250 |

| 2022 | $3,540 | $56,700 | $14,700 | $42,000 |

| 2021 | $3,608 | $56,700 | $14,700 | $42,000 |

| 2020 | $3,598 | $56,700 | $14,700 | $42,000 |

| 2019 | $3,237 | $47,250 | $12,250 | $35,000 |

| 2018 | $3,438 | $47,250 | $12,250 | $35,000 |

| 2017 | $4,459 | $65,490 | $12,250 | $53,240 |

| 2016 | $3,648 | $49,000 | $8,330 | $40,670 |

| 2015 | $3,649 | $49,000 | $8,330 | $40,670 |

| 2014 | $3,652 | $49,000 | $8,330 | $40,670 |

| 2013 | $1,726 | $49,000 | $8,330 | $40,670 |

Source: Public Records

Map

Nearby Homes

- 3267 Castleton St

- 2711-2713 Charles Dr

- 3120-3122 Walden Place

- 3172 Pine Manor Blvd Unit 3172

- 3429 Devin Rd

- 3449 Liberty St

- 2541 Swan Dr

- 2539 Swan Dr Unit 2539

- 3454 Independence St

- 3156 Hoover Rd

- 3474 Highland St

- 3153 Scenic Way

- 3333 Tareyton Dr

- 2571 Scott Ct

- 2545 Scott Ct

- 3466 Central Ave

- 2421 Yates Ave

- 3542 Hoover Rd

- 3201 Parkview Cir

- 3187 Parkview Cir Unit 3187

- 3217 Independence St

- 3204 Independence St Unit 206

- 3215 Independence St

- 3210 Independence St Unit 212

- 2712 Independence Way Unit 716

- 2722 Independence Way Unit 726

- 3218 Independence St

- 3216 Independence St Unit 218

- 3216 3218 Independence

- 2730 Independence Way Unit 734

- 2730 Independence Way Unit 2

- 3226 Independence St Unit 228

- 2717 Walden Bluff Ct Unit 4

- 2697 Walden Bluff Ct Unit 703

- 2697 Walden Bluff Ct

- 3752 Miltonsburg Dr

- 2689 Walden Bluff Ct Unit 691

- 3236 Independence St

- 2739 Walden Bluff Ct

- 2738 Independence Way Unit 742