321 Chesapeake Cove Unit 321 Painesville, OH 44077

Estimated Value: $251,789 - $258,000

3

Beds

2

Baths

1,624

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 321 Chesapeake Cove Unit 321, Painesville, OH 44077 and is currently estimated at $254,447, approximately $156 per square foot. 321 Chesapeake Cove Unit 321 is a home located in Lake County with nearby schools including Henry F. Lamuth Middle School, Riverside Junior/Senior High School, and St Gabriel School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 28, 2025

Sold by

Claxton Robert and Henricks-Claxton Pamela

Bought by

Tighe Michael and Tighe Carol

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$242,250

Outstanding Balance

$242,044

Interest Rate

6.81%

Mortgage Type

New Conventional

Estimated Equity

$12,403

Purchase Details

Closed on

Oct 24, 2013

Sold by

Shea John C and Shea Phyllis J

Bought by

Claxton Robert and Henricks Claxton Pamela

Purchase Details

Closed on

Mar 8, 2007

Sold by

Gerard Rebecca L

Bought by

Shea John C and Shea Phyllis J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Interest Rate

6.28%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 20, 1990

Bought by

Hudak Joan A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tighe Michael | $255,000 | None Listed On Document | |

| Claxton Robert | -- | None Available | |

| Shea John C | $160,000 | Guardian Title | |

| Hudak Joan A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tighe Michael | $242,250 | |

| Previous Owner | Shea John C | $140,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | -- | $68,020 | $10,840 | $57,180 |

| 2023 | $5,282 | $48,470 | $8,430 | $40,040 |

| 2022 | $2,906 | $48,470 | $8,430 | $40,040 |

| 2021 | $2,916 | $48,470 | $8,430 | $40,040 |

| 2020 | $2,948 | $43,280 | $7,530 | $35,750 |

| 2019 | $2,971 | $43,280 | $7,530 | $35,750 |

| 2018 | $2,980 | $37,420 | $7,000 | $30,420 |

| 2017 | $2,660 | $37,420 | $7,000 | $30,420 |

| 2016 | $2,350 | $37,420 | $7,000 | $30,420 |

| 2015 | $2,198 | $37,420 | $7,000 | $30,420 |

| 2014 | $2,235 | $37,420 | $7,000 | $30,420 |

| 2013 | $1,630 | $37,420 | $7,000 | $30,420 |

Source: Public Records

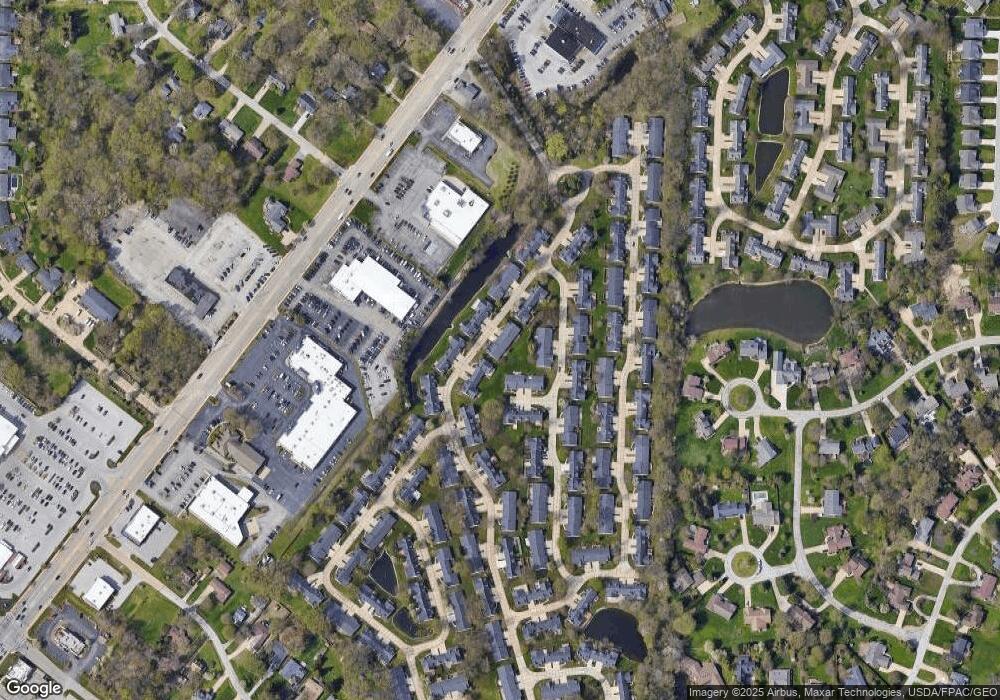

Map

Nearby Homes

- 317 Chesapeake Cove Unit 317

- 110 Hampshire Cove Unit 110

- 135 Nantucket Cir

- 2155 Ridgebury Dr

- 1936 Mentor Ave

- 2051 Kingsborough Dr

- 6931 Chairmans Ct

- 139 Mill Morr Dr

- 81 Fairfield Rd

- 6509 Hudson Ave

- 31 Fairfield Rd

- 9820 Old Johnnycake Ridge Rd Unit 5

- 9681 Abbeyshire Way

- 41 Warrington Ln

- 9846 Old Johnnycake Ridge Rd

- 146 Garfield Dr

- 339 Barrington Ridge Rd

- 7065 Brightwood Dr

- 7069 Brightwood Dr

- 8 Johnnycake Ridge Rd

- 319 Chesapeake Cove

- 323 Chesapeake Cove Unit 323

- 322 Chesapeake Cove

- 222 Gulls Cove Unit 222

- 222 Gulls Cove Unit 54

- 324 Chesapeake Cove

- 324 Chesapeake Cove Unit U-324

- 320 Chesapeake Cove Unit 320

- 325 Chesapeake Cove

- 325 Chesapeake Cove Unit U-325

- 218 Gulls Cove

- 216 Gulls Cove Unit 216

- 220 Gulls Cove Unit 220

- 326 Chesapeake Cove

- 318 Chesapeake Cove

- 315 Chesapeake Cove Unit 315

- 226 Gulls Cove

- 327 Chesapeake Cove Unit 327

- 316 Chesapeake Cove

- 224 Gulls Cove