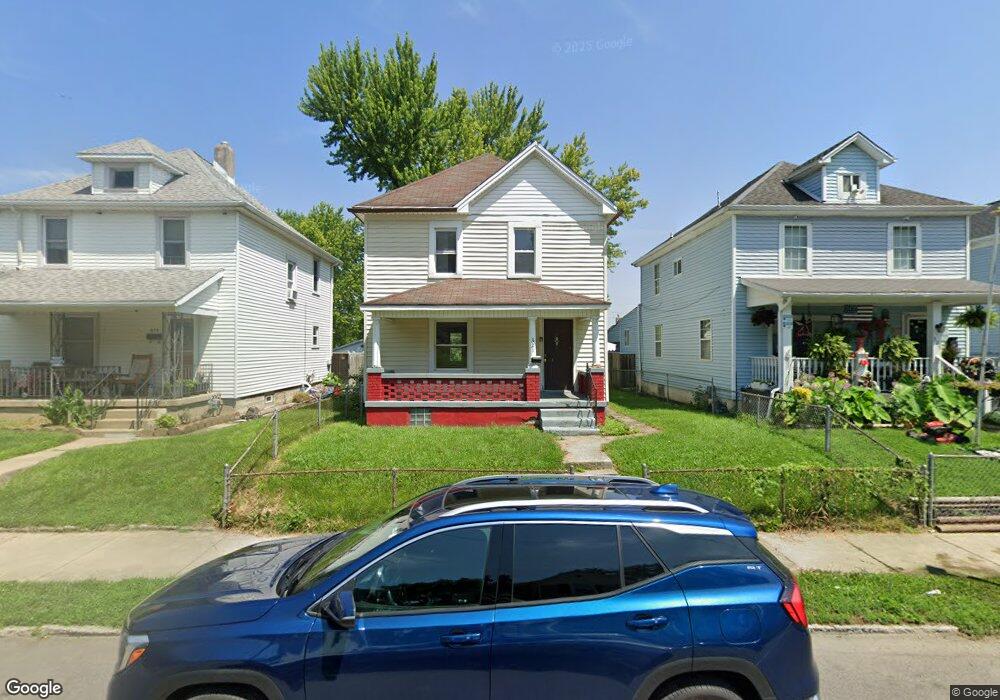

321 Pleasant Ave Dayton, OH 45403

Wright View NeighborhoodEstimated Value: $102,000 - $120,000

3

Beds

1

Bath

1,328

Sq Ft

$84/Sq Ft

Est. Value

About This Home

This home is located at 321 Pleasant Ave, Dayton, OH 45403 and is currently estimated at $111,000, approximately $83 per square foot. 321 Pleasant Ave is a home located in Montgomery County with nearby schools including Ruskin Elementary School, Kiser Elementary, and Horizon Science Academy Dayton Downtown.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 22, 2022

Sold by

Guy Gm Limited Llc

Bought by

Prop Resolution Services Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,000

Interest Rate

6.95%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 10, 2017

Sold by

N R Management Llc

Bought by

Guy Gm Limited Llc

Purchase Details

Closed on

Mar 28, 2012

Sold by

Usa Rental Fund Llc

Bought by

N & R Management Llc

Purchase Details

Closed on

May 28, 2010

Sold by

Fannie Mae

Bought by

Usa Rental Fund Llc

Purchase Details

Closed on

Dec 28, 2009

Sold by

Lyons Aaron D

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

May 24, 2006

Sold by

Beal Bank Ssb

Bought by

Lyons Aaron

Purchase Details

Closed on

Dec 23, 2004

Sold by

Caldwell Ted R

Bought by

Beal Bank Ssb

Purchase Details

Closed on

Mar 18, 2001

Sold by

Tipton Drucilla and Mclin Thomas

Bought by

Loudin Kimberly A and Loudin Christopher Vaughn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$69,600

Interest Rate

10.75%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 25, 1997

Sold by

Loudin Kimberly A and Loudin Christopher Vaughn

Bought by

Caldwell Dorie L and Caldwell Ted R

Purchase Details

Closed on

Aug 31, 1994

Sold by

Mclin Drucilla Rose

Bought by

Loudin Kimberly A and Loudin Christopher Vaughn

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Prop Resolution Services Llc | $27,000 | None Listed On Document | |

| Guy Gm Limited Llc | $16,000 | Chicago Title Company Llc | |

| N & R Management Llc | $14,100 | None Available | |

| Usa Rental Fund Llc | $5,000 | Attorney | |

| Federal National Mortgage Association | $24,000 | None Available | |

| Lyons Aaron | $23,000 | None Available | |

| Beal Bank Ssb | $30,000 | None Available | |

| Loudin Kimberly A | -- | -- | |

| Caldwell Dorie L | $55,000 | -- | |

| Loudin Kimberly A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Prop Resolution Services Llc | $30,000 | |

| Previous Owner | Loudin Kimberly A | $69,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,505 | $26,000 | $3,610 | $22,390 |

| 2023 | $1,505 | $26,000 | $3,610 | $22,390 |

| 2022 | $1,296 | $17,270 | $2,390 | $14,880 |

| 2021 | $1,289 | $17,270 | $2,390 | $14,880 |

| 2020 | $1,286 | $17,270 | $2,390 | $14,880 |

| 2019 | $1,365 | $16,410 | $3,190 | $13,220 |

| 2018 | $1,367 | $16,410 | $3,190 | $13,220 |

| 2017 | $1,357 | $16,410 | $3,190 | $13,220 |

| 2016 | $1,304 | $15,380 | $3,190 | $12,190 |

| 2015 | $1,234 | $15,380 | $3,190 | $12,190 |

| 2014 | $1,234 | $15,380 | $3,190 | $12,190 |

| 2012 | -- | $23,180 | $3,170 | $20,010 |

Source: Public Records

Map

Nearby Homes

- 223 Pleasant Ave

- 1323 Huffman Ave

- 40 Klee Ave

- 161 S Harbine Ave

- 153 S Hedges St

- 227 Livingston Ave Unit 225

- 631 Greenlawn Ave

- 111 S Hedges St

- 2929 E 5th St

- 515 Heiss Ave Unit 515-517

- 101 S Delmar Ave

- 755 Huffman Ave

- 240 Bierce Ave

- 3007 E 4th St

- 2821 E 5th St Unit 2819

- 115 Oaklawn Ave

- 715 Gondert Ave

- 800 Linden Ave

- 639 Huffman Ave

- 133 Linsan Ct

- 325 Pleasant Ave

- 319 Pleasant Ave

- 315 Pleasant Ave

- 311 Pleasant Ave

- 333 Pleasant Ave

- 337 Pleasant Ave

- 307 Pleasant Ave

- 520 Sheridan Ave

- 524 Sheridan Ave

- 516 Sheridan Ave

- 501 S Garland Ave

- 350 Pleasant Ave

- 528 Sheridan Ave

- 512 Sheridan Ave

- 316 Pleasant Ave

- 301 Pleasant Ave

- 324 Pleasant Ave

- 328 Pleasant Ave

- 316 Pleasant Ave

- 330 Pleasant Ave