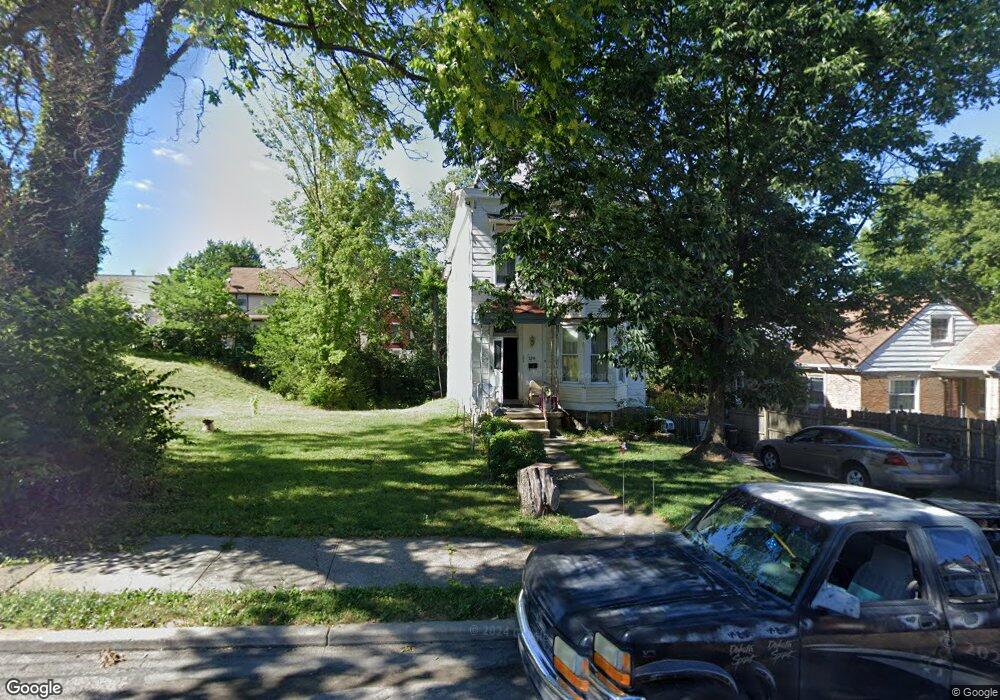

3218 W 8th St Cincinnati, OH 45205

East Price Hill NeighborhoodEstimated Value: $32,029 - $183,000

3

Beds

1

Bath

1,736

Sq Ft

$50/Sq Ft

Est. Value

About This Home

This home is located at 3218 W 8th St, Cincinnati, OH 45205 and is currently estimated at $86,507, approximately $49 per square foot. 3218 W 8th St is a home located in Hamilton County with nearby schools including Gilbert A. Dater High School, Robert A. Taft Information Technology High School, and Western Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 22, 2021

Sold by

Jones Sean

Bought by

M&M Property Contractors Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Interest Rate

2.97%

Purchase Details

Closed on

Apr 15, 2021

Sold by

Jones Sean

Bought by

M & M Property Contractors Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Interest Rate

2.97%

Purchase Details

Closed on

Jul 26, 2019

Sold by

Hamilton County

Bought by

Jones Sean

Purchase Details

Closed on

Jul 11, 1995

Sold by

Mulholland Anne M

Bought by

Yanke Orville H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$36,750

Interest Rate

8.87%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| M&M Property Contractors Llc | $100 | -- | |

| M & M Property Contractors Llc | $1,000 | None Available | |

| Jones Sean | -- | None Available | |

| Yanke Orville H | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | M&M Property Contractors Llc | -- | |

| Previous Owner | Yanke Orville H | $36,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $115 | $1,705 | $1,705 | -- |

| 2023 | $115 | $1,705 | $1,705 | $0 |

| 2022 | $114 | $1,509 | $1,509 | $0 |

| 2021 | $110 | $1,509 | $1,509 | $0 |

| 2020 | $5,627 | $1,509 | $1,509 | $0 |

| 2019 | $6,017 | $1,372 | $1,372 | $0 |

| 2018 | $6,621 | $10,843 | $1,372 | $9,471 |

| 2017 | $2,049 | $10,843 | $1,372 | $9,471 |

| 2016 | $1,446 | $11,824 | $1,530 | $10,294 |

| 2015 | $762 | $11,824 | $1,530 | $10,294 |

| 2014 | $1,998 | $11,824 | $1,530 | $10,294 |

| 2013 | $804 | $12,191 | $1,579 | $10,612 |

Source: Public Records

Map

Nearby Homes

- 817 Considine Ave

- 817 Hawthorne Ave

- 723 Considine Ave

- 725 Purcell Ave

- 3425 Eighth St W

- 3424 Price Ave

- 3427 Eighth St W

- 720 Grand Ave

- 2810 Eighth St W

- 658 Hawthorne Ave

- 812 Fairbanks Ave

- 810 Summit Ave

- 2711 Price Ave

- 924 Fairbanks Ave

- 922 Summit Ave

- 716 Fairbanks Ave

- 543 Considine Ave

- 541 Considine Ave

- 942 Summit Ave

- 1013 Del Monte Place

- 3218 W 8th St Unit 3220

- 3216 W 8th St

- 3220 W 8 Th St

- 3220 W 8th St

- 3220 Eighth St W

- 3214 W 8th St

- 812 Purcell Ave

- 814 Purcell Ave

- 816 Purcell Ave

- 803 Purcell Ave

- 811 Purcell Ave

- 3219 W 8th St

- 3217 W 8th St

- 818 Purcell Ave

- 3215 Eighth St W

- 801 Considine Ave

- 3215 W 8th St

- 811 Considine Ave

- 757 Purcell Ave

- 3209 Eighth St W