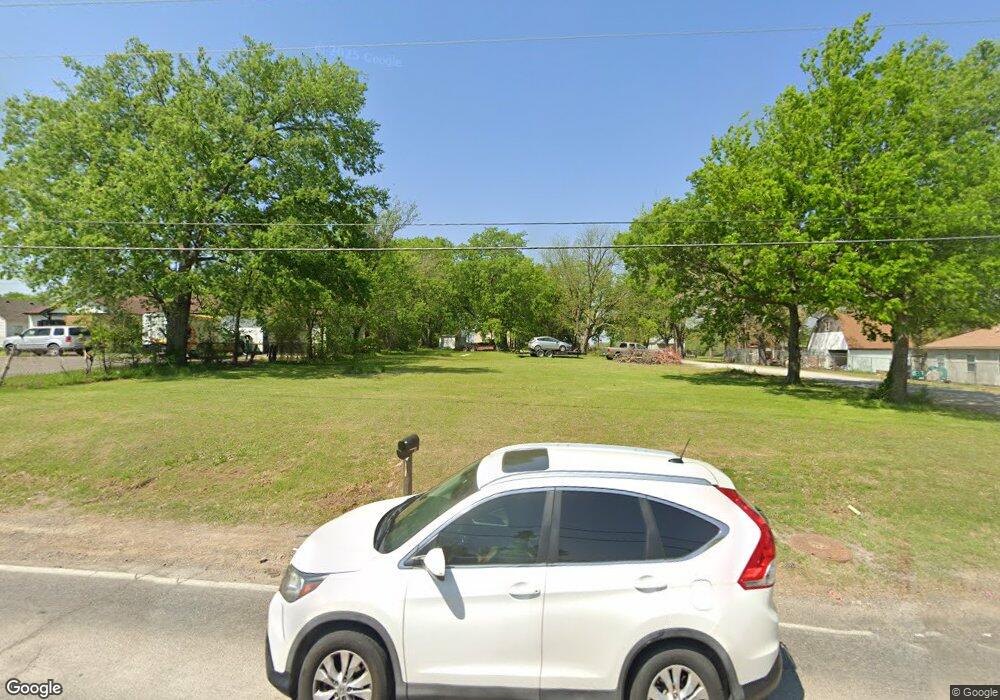

3220 S 113th West Ave Sand Springs, OK 74063

Prattville NeighborhoodEstimated Value: $51,000 - $184,000

--

Bed

1

Bath

1,152

Sq Ft

$102/Sq Ft

Est. Value

About This Home

This home is located at 3220 S 113th West Ave, Sand Springs, OK 74063 and is currently estimated at $117,500, approximately $101 per square foot. 3220 S 113th West Ave is a home located in Tulsa County with nearby schools including Pratt Elementary School, Clyde Boyd Middle School, and Charles Page High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 10, 2024

Sold by

Immel Lagena

Bought by

Ramezani Hamid R and Ramezani Annette

Current Estimated Value

Purchase Details

Closed on

Apr 5, 2022

Sold by

Luttrell Jeremy A and Luttrell Tonya

Bought by

City Of Sand Springs

Purchase Details

Closed on

Mar 28, 2022

Sold by

Lagena Immel

Bought by

City Of Sand Springs

Purchase Details

Closed on

Mar 1, 2021

Sold by

Immel Lagena

Bought by

Immel Lagena and Mclemore Krissy

Purchase Details

Closed on

Feb 3, 2000

Sold by

Immel Lagena and Immel Krissy

Bought by

Immel Lagena

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,500

Interest Rate

8.23%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 31, 1998

Sold by

Collins Conrad Doyle and Collins Ruth Ann

Bought by

Immel Lagena and Immel Krissy

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ramezani Hamid R | $50,000 | None Listed On Document | |

| City Of Sand Springs | -- | None Listed On Document | |

| City Of Sand Springs | -- | None Listed On Document | |

| Immel Lagena | -- | None Listed On Document | |

| Immel Lagena | -- | Tulsa Abstract & Title Co | |

| Immel Lagena | $45,000 | Tulsa Abstract & Title Compa |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Immel Lagena | $54,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $275 | $2,181 | $2,181 | -- |

| 2023 | $275 | $2,181 | $2,181 | $0 |

| 2022 | $287 | $2,330 | $2,330 | $0 |

| 2021 | $286 | $2,279 | $2,279 | $0 |

| 2020 | $282 | $2,171 | $2,171 | $0 |

| 2019 | $261 | $2,067 | $2,067 | $0 |

| 2018 | $242 | $1,969 | $1,969 | $0 |

| 2017 | $848 | $7,040 | $1,969 | $5,071 |

| 2016 | $866 | $7,040 | $1,969 | $5,071 |

| 2015 | $878 | $7,040 | $1,969 | $5,071 |

| 2014 | $886 | $7,040 | $1,969 | $5,071 |

Source: Public Records

Map

Nearby Homes

- 3218 S 113th West Ave

- Ashville AE Plan at Rivercrest - Prattville

- Brenda MG Plan at Rivercrest - Prattville

- Lee II Plan at Rivercrest - Prattville

- Ashville Plan at Rivercrest - Prattville

- Brenda Plan at Rivercrest - Prattville

- Walker ll Plan at Rivercrest - Prattville

- Walker FH Plan at Rivercrest - Prattville

- Oak Plan at Rivercrest - Prattville

- Dorsey IV Plan at Rivercrest - Prattville

- Washington Plan at Rivercrest - Prattville

- Dorsey Farm House Plan at Rivercrest - Prattville

- Ridgway III Plan at Rivercrest - Prattville

- Dorsey V Plan at Rivercrest - Prattville

- 0 S Linwood Dr Unit 2535831

- 10 E 31st Place

- 0 S Walnut Creek Place

- 3210 Summit Blvd

- 3306 Springtree Ln

- 302 Skylane Ct

- 3220 S 113th West Ave

- 3224 S 113th West Ave

- 3218 S 113th Ave W

- 3216 S 113th West Ave

- 3226 S 113th West Ave

- 3222 S 113th West Ave

- 704 W 53rd Place

- 3300 S 113th West Ave

- 3214 S 113th West Ave

- 3301 S 113th Ave W Unit 64

- 3301 S 113th Ave W Unit 10

- 3301 S 113th Ave W

- 3302 S 113th West Ave

- 2 E 32nd Place

- 3212 S 113th West Ave

- 4 E 32nd Place

- 3301 S 113th West Ave

- 6 E 32nd Place

- 6 E 32nd Place

- 3210 S 113th West Ave