323 Sweetshrub Dr Unit 4 Austell, GA 30168

Estimated Value: $269,000 - $296,000

3

Beds

3

Baths

1,838

Sq Ft

$153/Sq Ft

Est. Value

About This Home

This home is located at 323 Sweetshrub Dr Unit 4, Austell, GA 30168 and is currently estimated at $280,916, approximately $152 per square foot. 323 Sweetshrub Dr Unit 4 is a home located in Cobb County with nearby schools including Riverside Primary School, Lindley Middle School, and Pebblebrook High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 8, 2025

Sold by

Fannie Mae and Federal National Mortgage Association

Bought by

Johnson Chalan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$274,928

Interest Rate

6.89%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 12, 2024

Sold by

Lakeview Loan Servicing Llc

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Aug 30, 2024

Sold by

Oshinowo Oluwaseyi

Bought by

Lakeview Loan Servicing Llc

Purchase Details

Closed on

Apr 20, 2022

Sold by

Danita Boseman-Thomas

Bought by

Oshinowo Oluwaseyi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$266,750

Interest Rate

3.85%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 11, 2019

Sold by

Indutop Realty Llc

Bought by

Boseman-Thomas Danita

Purchase Details

Closed on

Aug 7, 2012

Sold by

Gfi Atlanta Wc Llc

Bought by

Kabr Aahf West Chase Llc

Purchase Details

Closed on

Feb 5, 2008

Sold by

Kings Lake Dev Llc

Bought by

Haven Trust Bk

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnson Chalan | $280,000 | None Listed On Document | |

| Johnson Chalan | $280,000 | None Listed On Document | |

| Federal National Mortgage Association | -- | None Listed On Document | |

| Federal National Mortgage Association | -- | None Listed On Document | |

| Lakeview Loan Servicing Llc | -- | None Listed On Document | |

| Lakeview Loan Servicing Llc | -- | None Listed On Document | |

| Oshinowo Oluwaseyi | $283,000 | Okelley & Sorohan Attorneys At | |

| Boseman-Thomas Danita | $162,500 | -- | |

| Kabr Aahf West Chase Llc | $1,682,000 | -- | |

| Haven Trust Bk | $137,126 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Johnson Chalan | $274,928 | |

| Previous Owner | Oshinowo Oluwaseyi | $266,750 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,410 | $113,172 | $26,000 | $87,172 |

| 2024 | $3,245 | $107,640 | $26,000 | $81,640 |

| 2023 | $3,334 | $110,572 | $20,000 | $90,572 |

| 2022 | $2,387 | $78,652 | $20,000 | $58,652 |

| 2021 | $2,020 | $66,568 | $14,000 | $52,568 |

| 2020 | $1,955 | $64,428 | $14,000 | $50,428 |

| 2019 | $1,518 | $50,012 | $4,800 | $45,212 |

| 2018 | $1,518 | $50,012 | $4,800 | $45,212 |

| 2017 | $1,438 | $50,012 | $4,800 | $45,212 |

| 2016 | $561 | $19,516 | $4,800 | $14,716 |

| 2015 | $575 | $19,516 | $4,800 | $14,716 |

| 2014 | $580 | $19,516 | $0 | $0 |

Source: Public Records

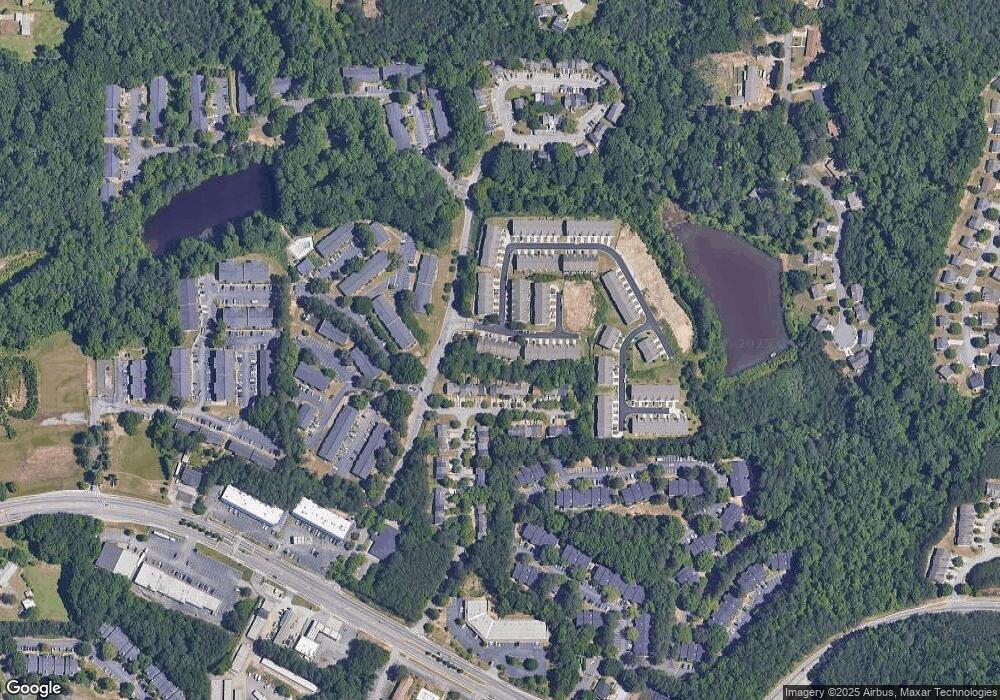

Map

Nearby Homes

- 7080 Fringe Flower Dr Unit 18

- 7074 Oakhill Cir

- 6938 Oakhill Cir

- 7066 Oakhill Cir

- 7010 Oakhill Cir

- 201 Wilhelmina Dr

- 0 Cityview Dr SW Unit 10597603

- 6904 Silver Bend Place Unit 4

- 6914 Fairway Trail

- 7160 Silver Mine Crossing SE

- 6874 Bridgewood Dr

- 7249 Factory Shoals Rd

- 6854 Bridgewood Dr

- 7151 Springchase Way

- 218 Copperbend Dr

- 776 Crestside Ct

- 204 Becket V L 949 Rd

- 6947 Gallant Cir SE Unit 10

- 6927 Gallant Cir SE

- 6964 Chasewater Ln

- 323 Sweetshrub Dr Unit 1

- 319 Sweetshrub Dr Unit 1

- 319 Sweetshrub Dr

- 319 Sweetshrub Dr Unit 5

- 327 Sweetshrub Dr Unit 1

- 327 Sweetshrub Dr Unit 3

- 315 Sweetshrub Dr Unit 1

- 315 Sweetshrub Dr

- 315 Sweetshrub Dr Unit 6

- 331 Sweetshrub Dr Unit 1

- 331 Sweetshrub Dr

- 331 Sweetshrub Dr Unit 2

- 1400 Sweetshrub Dr Unit 33

- 1398 Sweetshrub Dr Unit 32

- 1392 Sweetshrub Dr

- 329 Sweetshrub Dr Unit 7

- 335 Sweetshrub Dr Unit 1

- 335 Sweetshrub Dr

- 303 Sweetshrub Dr Unit 7

- 299 Sweetshrub Dr Unit 8