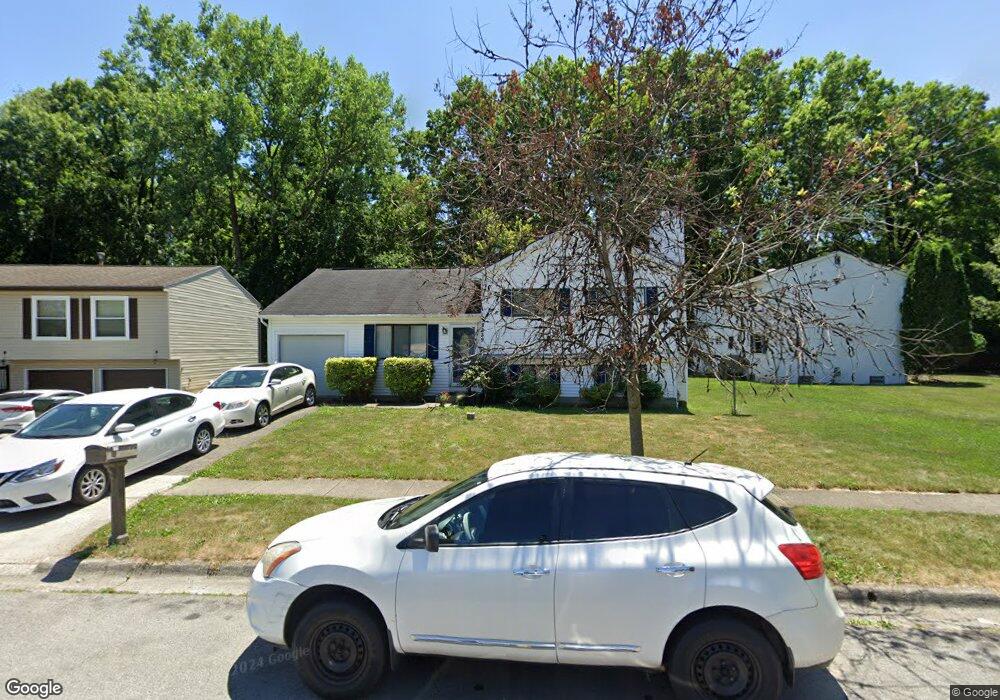

3239 Lone Spruce Rd Columbus, OH 43219

Cumberland Ridge NeighborhoodEstimated Value: $184,000 - $286,000

3

Beds

2

Baths

1,301

Sq Ft

$185/Sq Ft

Est. Value

About This Home

This home is located at 3239 Lone Spruce Rd, Columbus, OH 43219 and is currently estimated at $240,397, approximately $184 per square foot. 3239 Lone Spruce Rd is a home located in Franklin County with nearby schools including Cassady Elementary School, Mifflin Middle School, and Mifflin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 28, 2010

Sold by

Wells Fargo Financial I Inc

Bought by

Smith Garrett and Smith Garrett K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$61,610

Interest Rate

4.78%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 8, 2010

Sold by

Miller Harry L and Miller Cheryl A

Bought by

Wells Fargo Financial Ohio 1 Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$61,610

Interest Rate

4.78%

Mortgage Type

FHA

Purchase Details

Closed on

May 12, 1992

Purchase Details

Closed on

Dec 26, 1991

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smith Garrett | $65,000 | Attorney | |

| Wells Fargo Financial Ohio 1 Inc | $76,000 | None Available | |

| -- | $83,300 | -- | |

| -- | $9,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Smith Garrett | $61,610 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,867 | $63,880 | $18,900 | $44,980 |

| 2023 | $2,830 | $63,875 | $18,900 | $44,975 |

| 2022 | $2,218 | $42,770 | $10,500 | $32,270 |

| 2021 | $2,222 | $42,770 | $10,500 | $32,270 |

| 2020 | $2,225 | $42,770 | $10,500 | $32,270 |

| 2019 | $2,304 | $37,980 | $10,500 | $27,480 |

| 2018 | $2,268 | $37,980 | $10,500 | $27,480 |

| 2017 | $2,384 | $37,980 | $10,500 | $27,480 |

| 2016 | $2,465 | $37,210 | $5,880 | $31,330 |

| 2015 | $2,238 | $37,210 | $5,880 | $31,330 |

| 2014 | $2,243 | $37,210 | $5,880 | $31,330 |

| 2013 | $1,165 | $39,165 | $6,195 | $32,970 |

Source: Public Records

Map

Nearby Homes

- 1929 Holly Ridge Rd

- 3096 Leon Ave

- 1822 Stelzer Rd

- 2876 Johnstown Rd

- 2736 Bellero Way Unit 94

- 2193 Rustic Ledge Dr

- 3601 Agler Rd

- 0 E Emmons Ave

- 2275 Stelzer Rd

- 3832 Emmons Ave

- 0 E Minnesota Ave Unit 224018641

- 0 Agler Rd Unit 224000625

- 3784 Armuth Ave

- 3221 Caralee Dr

- 2457 Ashpoint St

- 2423 Stelzer Rd

- 2483 Vendome Dr

- 3888 Agler Rd

- 2398 Dunkirk Dr

- 2424 Holt Ave

- 3247 Lone Spruce Rd

- 1790 Mountain Oak Rd

- 3255 Lone Spruce Rd

- 3244 Lone Spruce Rd

- 3263 Lone Spruce Rd

- 3254 Lone Spruce Rd

- 1803 Mountain Oak Rd

- 1795 Mountain Oak Rd

- 1818 Mountain Oak Rd

- 3262 Lone Spruce Rd

- 3271 Lone Spruce Rd

- 1809 Mountain Oak Rd

- 0 Drake Rd

- 3270 Lone Spruce Rd

- 1828 Mountain Oak Rd

- 1824 Passage Ln

- 3279 Lone Spruce Rd

- 3223 Larch Ln

- 3278 Lone Spruce Rd

- 1833 Ferntree Rd