3252 E 103rd Dr Unit 710 Thornton, CO 80229

Quimby NeighborhoodEstimated Value: $304,120 - $321,000

2

Beds

2

Baths

1,148

Sq Ft

$270/Sq Ft

Est. Value

About This Home

This home is located at 3252 E 103rd Dr Unit 710, Thornton, CO 80229 and is currently estimated at $310,530, approximately $270 per square foot. 3252 E 103rd Dr Unit 710 is a home located in Adams County with nearby schools including Trailside Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 22, 2010

Sold by

Secretary Of Housing & Urban Development

Bought by

Burnett Patricia K and Hofstatter Laura

Current Estimated Value

Purchase Details

Closed on

Mar 25, 2010

Sold by

Perez Gerald I and Perez Christina A

Bought by

The Secretary Of Housing & Urban Develop

Purchase Details

Closed on

Feb 29, 2008

Sold by

Bruns Randall and Wallin Joe Don

Bought by

Perez Gerald I and Perez Christina A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,000

Interest Rate

5.47%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 4, 2004

Sold by

Heritage Condominiums Llc

Bought by

Bruns Virgil F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,920

Interest Rate

5.62%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Burnett Patricia K | $115,100 | Wtg | |

| The Secretary Of Housing & Urban Develop | -- | None Available | |

| Perez Gerald I | $139,950 | Security Title | |

| Bruns Virgil F | $149,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Perez Gerald I | $138,000 | |

| Previous Owner | Bruns Virgil F | $119,920 | |

| Closed | Bruns Virgil F | $14,990 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,152 | $22,440 | $5,440 | $17,000 |

| 2024 | $1,152 | $20,630 | $5,000 | $15,630 |

| 2023 | $1,143 | $22,730 | $3,310 | $19,420 |

| 2022 | $1,686 | $16,910 | $3,410 | $13,500 |

| 2021 | $1,590 | $16,910 | $3,410 | $13,500 |

| 2020 | $1,600 | $17,190 | $3,500 | $13,690 |

| 2019 | $1,609 | $17,190 | $3,500 | $13,690 |

| 2018 | $1,509 | $15,180 | $920 | $14,260 |

| 2017 | $1,479 | $15,180 | $920 | $14,260 |

| 2016 | $1,148 | $11,550 | $1,020 | $10,530 |

| 2015 | $1,004 | $11,550 | $1,020 | $10,530 |

| 2014 | $610 | $6,820 | $1,020 | $5,800 |

Source: Public Records

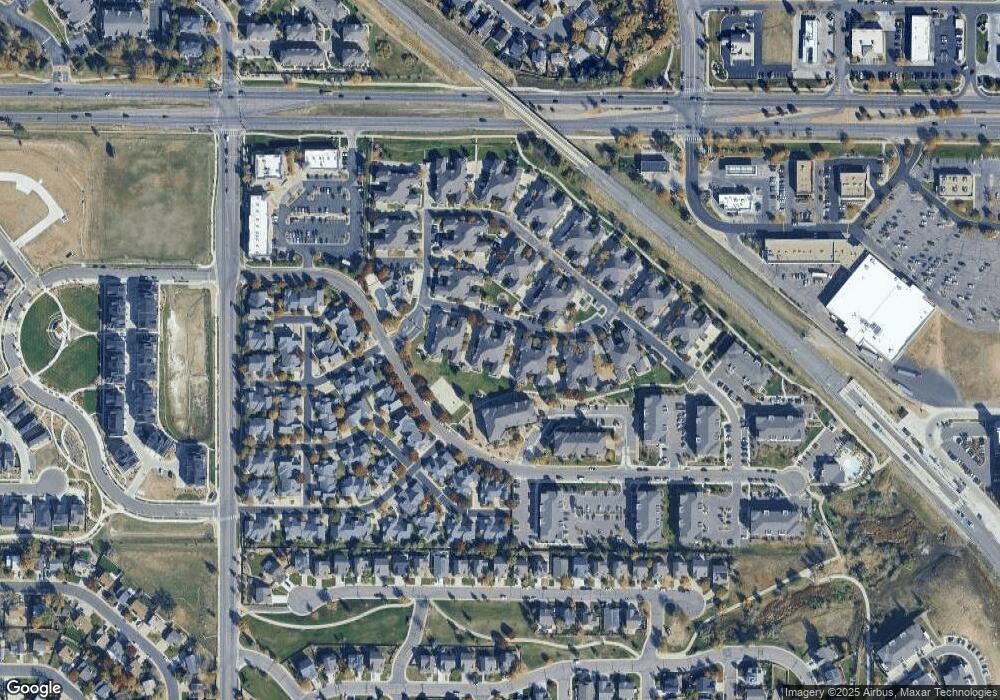

Map

Nearby Homes

- 3242 E 103rd Dr Unit 608

- 3262 E 103rd Dr Unit 1806

- 10316 Adams Place Unit 10316

- 3260 E 103rd Place Unit 908

- 10371 Cook Way Unit 107

- 3291 E 103rd Place Unit 1507

- 3155 E 104th Ave Unit 4D

- 3155 E 104th Ave Unit 8D

- 2980 E 102nd Place

- 2652 E 103rd Ave

- 2691 E 102nd Place

- Meadow Plan at Arras Park - The Copper Collection

- Cascade Plan at Arras Park - The Durango Collection

- Alpine Plan at Arras Park - The Durango Collection

- Silverleaf Plan at Arras Park - The Summit Collection

- Flatiron Plan at Arras Park - The Summit Collection

- Princeton Plan at Arras Park - The Summit Collection

- Evergreen Plan at Arras Park - The Copper Collection

- Prospect Plan at Arras Park - The Durango Collection

- Breckenridge Plan at Arras Park - The Durango Collection

- 3252 E 103rd Dr Unit 712

- 3252 E 103rd Dr Unit 711

- 3252 E 103rd Dr Unit 709

- 3252 E 103rd Dr Unit 707

- 3252 E 103rd Dr Unit 706

- 3252 E 103rd Dr Unit 705

- 3252 E 103rd Dr Unit 704

- 3252 E 103rd Dr Unit 703

- 3252 E 103rd Dr Unit 702

- 3252 E 103rd Dr Unit 701

- 3252 E 103rd Dr

- 3252 E 103rd Dr Unit 7704

- 3242 E 103rd Dr Unit 612

- 3242 E 103rd Dr Unit 611

- 3242 E 103rd Dr Unit 610

- 3242 E 103rd Dr Unit 609

- 3242 E 103rd Dr Unit 607

- 3242 E 103rd Dr Unit 606

- 3242 E 103rd Dr

- 3242 E 103rd Dr Unit 604