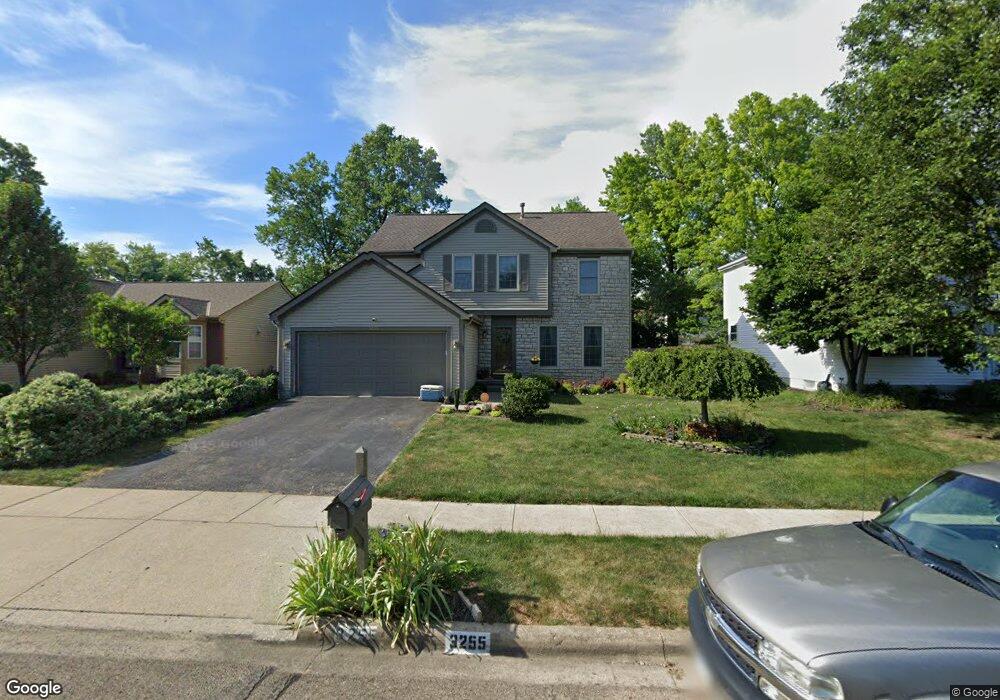

3255 Berkley Pointe Dr Columbus, OH 43230

Wexmoor NeighborhoodEstimated Value: $359,000 - $374,000

4

Beds

3

Baths

1,750

Sq Ft

$209/Sq Ft

Est. Value

About This Home

This home is located at 3255 Berkley Pointe Dr, Columbus, OH 43230 and is currently estimated at $365,692, approximately $208 per square foot. 3255 Berkley Pointe Dr is a home located in Franklin County with nearby schools including Royal Manor Elementary School, Gahanna West Middle School, and Lincoln High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 13, 2013

Sold by

Grady Michael L and Grady Sandra K

Bought by

Grady Sandra K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$169,083

Interest Rate

4.33%

Mortgage Type

FHA

Purchase Details

Closed on

May 14, 1999

Sold by

M/I Schottenstein Homes Inc

Bought by

Grady Michael L and Grady Sandra K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$154,950

Interest Rate

7.04%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Grady Sandra K | -- | None Available | |

| Grady Michael L | $165,900 | Transohio Residential Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Grady Sandra K | $169,083 | |

| Closed | Grady Michael L | $154,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,972 | $98,420 | $24,010 | $74,410 |

| 2023 | $4,901 | $98,420 | $24,010 | $74,410 |

| 2022 | $4,438 | $70,560 | $17,990 | $52,570 |

| 2021 | $4,445 | $70,560 | $17,990 | $52,570 |

| 2020 | $4,401 | $70,560 | $17,990 | $52,570 |

| 2019 | $3,601 | $58,700 | $14,980 | $43,720 |

| 2018 | $3,548 | $58,700 | $14,980 | $43,720 |

| 2017 | $3,389 | $58,700 | $14,980 | $43,720 |

| 2016 | $3,523 | $58,100 | $11,270 | $46,830 |

| 2015 | $3,526 | $58,100 | $11,270 | $46,830 |

| 2014 | $3,493 | $58,100 | $11,270 | $46,830 |

| 2013 | $1,733 | $58,100 | $11,270 | $46,830 |

Source: Public Records

Map

Nearby Homes

- 3150 Berkley Pointe Dr

- 638 Thistle Ave

- 3118 Berkley Pointe Dr

- 3877 Hines Rd

- 3555 Tami Place

- 536 Springwood Lake Dr

- 3544 Halpern St

- 459 Bluestem Ave

- 0 Wendler Blvd

- 3715 Montclair Dr

- 402 Bluestem Ave

- 3707 Montclair Dr

- 4125 Emerius Dr

- 2741 Acarie Dr

- 642 Ridenour Rd

- 388 Elkwood Place

- 422 Dovewood Dr

- 343 Amesbury Dr

- 2694 Kantian Dr

- 2520 Mccutcheon Rd

- 3263 Berkley Pointe Dr

- 3247 Berkley Pointe Dr

- 3271 Berkley Pointe Dr

- 4365 Biscayne Ct

- 4369 Biscayne Ct

- 4373 Biscayne Ct

- 4357 Biscayne Ct

- 4377 Biscayne Ct

- 3239 Berkley Pointe Dr

- 4381 Biscayne Ct

- 4355 Biscayne Ct

- 3238 Berkley Pointe Dr

- 4353 Biscayne Ct

- 3221 Hines Rd

- 4385 Biscayne Ct

- 4349 Biscayne Ct

- 4345 Biscayne Ct

- 4341 Biscayne Ct

- 3213 Hines Rd

- 3206 Berkley Pointe Dr