3269 Berkeley Glen Way Unit 46 Norcross, GA 30092

Estimated Value: $415,000 - $439,412

3

Beds

3

Baths

1,970

Sq Ft

$215/Sq Ft

Est. Value

About This Home

This home is located at 3269 Berkeley Glen Way Unit 46, Norcross, GA 30092 and is currently estimated at $423,853, approximately $215 per square foot. 3269 Berkeley Glen Way Unit 46 is a home located in Gwinnett County with nearby schools including Berkeley Lake Elementary School, Duluth Middle School, and Duluth High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 13, 2025

Sold by

Restrepo Nicole

Bought by

Restrepo Nicole and Stone Timothy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$14,525

Outstanding Balance

$13,753

Interest Rate

7.04%

Mortgage Type

New Conventional

Estimated Equity

$410,100

Purchase Details

Closed on

May 15, 2015

Sold by

Suh Clara Hyewon

Bought by

Lee Yong M

Purchase Details

Closed on

May 6, 2015

Sold by

Kim Hyewon

Bought by

Shu Clara Hyewon

Purchase Details

Closed on

Mar 1, 2010

Sold by

Kim Hyewon

Bought by

Kim Hyewon and Suh Clara

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Restrepo Nicole | -- | -- | |

| Restrepo Nicole | $415,000 | -- | |

| Restrepo Nicole | -- | -- | |

| Restrepo Nicole | $415,000 | -- | |

| Lee Yong M | $218,000 | -- | |

| Lee Yong M | $218,000 | -- | |

| Shu Clara Hyewon | -- | -- | |

| Shu Clara Hyewon | -- | -- | |

| Kim Hyewon | -- | -- | |

| Kim Hyewon | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Restrepo Nicole | $14,525 | |

| Open | Restrepo Nicole | $407,483 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,189 | $184,080 | $22,000 | $162,080 |

| 2024 | $6,156 | $168,440 | $24,840 | $143,600 |

| 2023 | $6,156 | $168,440 | $24,840 | $143,600 |

| 2022 | $5,442 | $147,920 | $24,000 | $123,920 |

| 2021 | $4,623 | $122,240 | $24,000 | $98,240 |

| 2020 | $4,422 | $115,960 | $16,680 | $99,280 |

| 2019 | $3,859 | $104,480 | $14,800 | $89,680 |

| 2018 | $3,869 | $104,480 | $14,800 | $89,680 |

| 2016 | $3,225 | $87,200 | $14,800 | $72,400 |

| 2015 | $3,117 | $83,000 | $14,800 | $68,200 |

| 2014 | $2,995 | $83,000 | $14,800 | $68,200 |

Source: Public Records

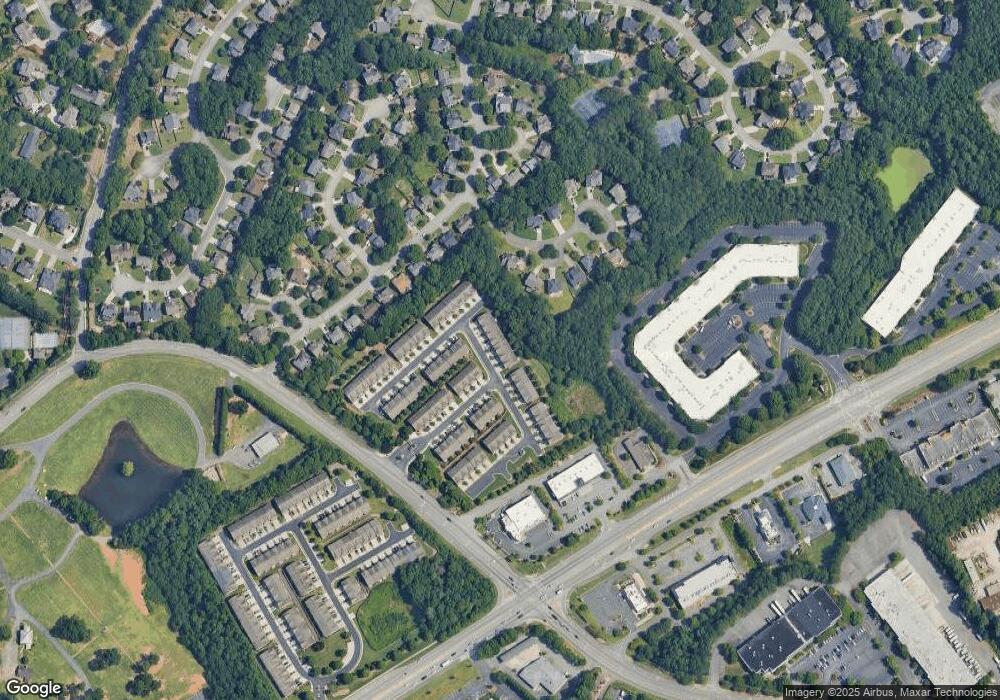

Map

Nearby Homes

- 4900 Berkeley Glen Dr

- 4854 Allston Ln

- 3330 Avocet Ct

- 4913 Berkeley Oak Cir

- 4906 Berkeley Oak Cir

- 4785 Pomarine Cir

- 4897 Lou Ivy Rd

- 3725 Highcroft Cir

- 3680 Highcroft Cir

- 4924 Waterport Way

- 4820 Coppedge Trail

- 4775 Berkeley Walk Point

- 4682 Bentley Place

- 3204 Claudia Place

- 3425 Kingsland Cir

- 3225 Claudia Place

- 3269 Berkeley Glen Way

- 3279 Berkeley Glen Way

- 3259 Berkeley Glen Way Unit 47

- 3259 Berkeley Glen Way

- 3249 Berkeley Glen Way

- 3289 Berkeley Glen Way Unit 44

- 3289 Berkeley Glen Way

- 3299 Berkeley Glen Way

- 3309 Berkeley Glen Way

- 3239 Berkeley Glen Way

- 3239 Berkeley Glen Way Unit 49

- 4841 Berkeley Glen Dr Unit 10

- 0 Berkeley Glen Way Unit 7538742

- 0 Berkeley Glen Way Unit 8646615

- 0 Berkeley Glen Way Unit 8254472

- 0 Berkeley Glen Way Unit 8131608

- 0 Berkeley Glen Way

- 4804 Allston Ln

- 4804 Allston Ln Unit 11

- 3229 Berkeley Glen Way