328 Teal Ct Unit 328 Roswell, GA 30076

Martin's Landing NeighborhoodEstimated Value: $178,000 - $215,000

1

Bed

1

Bath

738

Sq Ft

$257/Sq Ft

Est. Value

About This Home

This home is located at 328 Teal Ct Unit 328, Roswell, GA 30076 and is currently estimated at $189,958, approximately $257 per square foot. 328 Teal Ct Unit 328 is a home located in Fulton County with nearby schools including Jackson Elementary School, Holcomb Bridge Middle School, and Centennial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 19, 2014

Sold by

Gozman Leonid

Bought by

Gozman Irian Y and Aksenova Telena

Current Estimated Value

Purchase Details

Closed on

Nov 12, 1999

Sold by

Coburn Michael S

Bought by

Gozman Leonid and Gozman Irina Y

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$20,000

Interest Rate

7.94%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 23, 1994

Sold by

Cook Donald K

Bought by

Staff Jack L Betty L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$47,050

Interest Rate

9.5%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gozman Irian Y | -- | -- | |

| Gozman Leonid | $65,000 | -- | |

| Staff Jack L Betty L | $4,100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gozman Leonid | $20,000 | |

| Previous Owner | Staff Jack L Betty L | $47,050 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $88 | $80,480 | $10,520 | $69,960 |

| 2023 | $1,633 | $57,840 | $6,680 | $51,160 |

| 2022 | $1,523 | $53,960 | $6,080 | $47,880 |

| 2021 | $23 | $47,560 | $6,960 | $40,600 |

| 2020 | $29 | $45,680 | $5,760 | $39,920 |

| 2019 | $25 | $42,080 | $4,760 | $37,320 |

| 2018 | $72 | $35,520 | $4,360 | $31,160 |

| 2017 | $4 | $24,160 | $2,280 | $21,880 |

| 2016 | $21 | $24,160 | $2,280 | $21,880 |

| 2015 | $21 | $24,160 | $2,280 | $21,880 |

| 2014 | $2 | $17,080 | $2,320 | $14,760 |

Source: Public Records

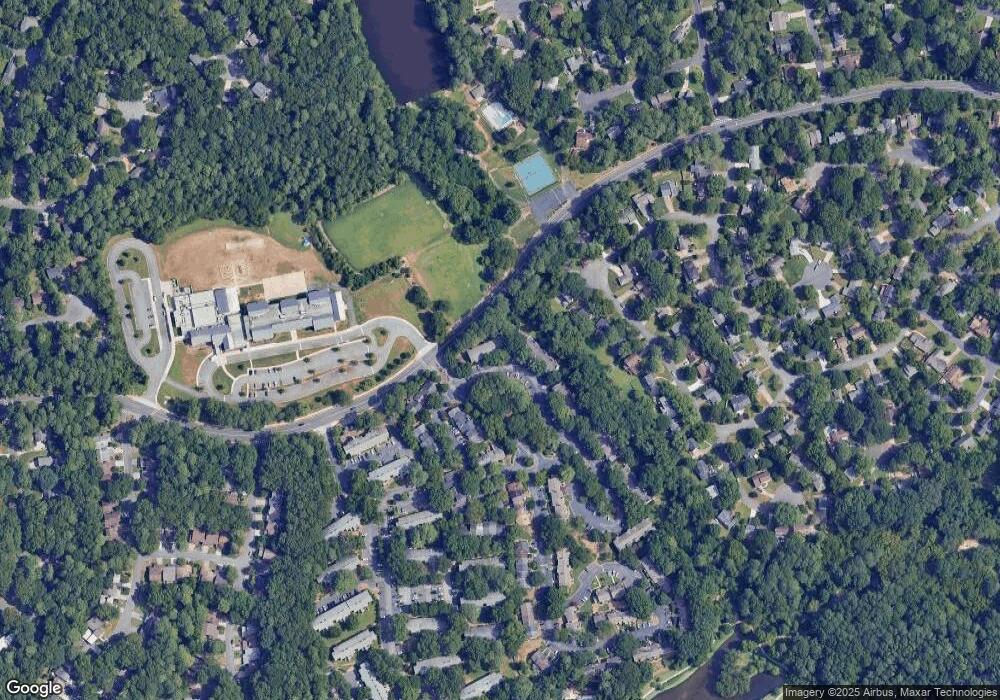

Map

Nearby Homes

- 324 Teal Ct

- 406 Teal Ct

- 227 Quail Run

- 150 N Pond Ct Unit 1

- 309 Quail Run

- 311 Quail Run

- 263 Quail Run

- 230 Lakeview Ridge E

- 130 Lakeview Ridge W

- 225 Winterberry Ct

- 230 Winterberry Ct

- 125 N Pond Way

- 9470 Hillside Dr

- 315 Sea Holly Cir

- 645 Trailmore Place

- 1265 Northshore Dr

- 2240 Six Branches Dr

- 420 Little Pines Ct

- 1045 Martin Ridge Rd

- 1050 Terramont Dr