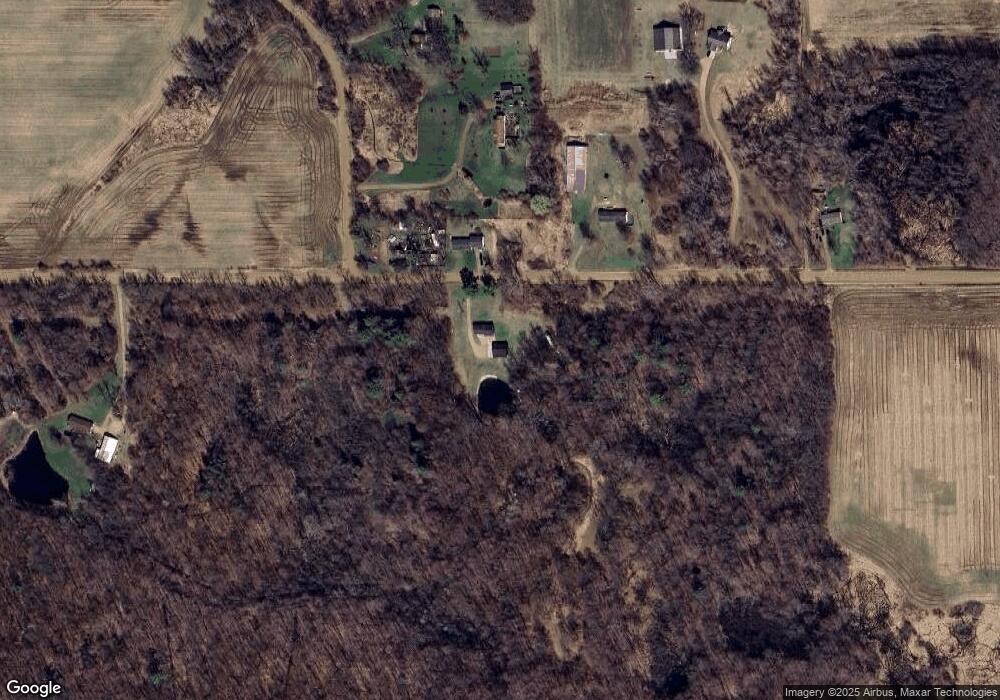

3282 110th Ave Allegan, MI 49010

Estimated Value: $277,000 - $449,617

2

Beds

1

Bath

1,296

Sq Ft

$261/Sq Ft

Est. Value

About This Home

This home is located at 3282 110th Ave, Allegan, MI 49010 and is currently estimated at $337,904, approximately $260 per square foot. 3282 110th Ave is a home located in Allegan County with nearby schools including Pine Trails Elementary School, L.E. White Middle School, and Allegan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 19, 2019

Sold by

T & T Smith Development Llc

Bought by

Thompson Ryan A and Thomson Ryan A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Outstanding Balance

$91,155

Interest Rate

3.7%

Mortgage Type

New Conventional

Estimated Equity

$246,749

Purchase Details

Closed on

Nov 14, 2019

Sold by

Thompson Ryan A and Thomson Ryan A

Bought by

Thompson Ryan A and Thompson Betty

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Outstanding Balance

$91,155

Interest Rate

3.7%

Mortgage Type

New Conventional

Estimated Equity

$246,749

Purchase Details

Closed on

Nov 26, 2014

Sold by

Milbocker Barbara A

Bought by

T&T Smith Development Llc

Purchase Details

Closed on

Mar 10, 1999

Sold by

Milbocker Edward and Milbocker Barbara

Bought by

Milbocker Edward and Milbocker Barb

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Thompson Ryan A | $180,000 | None Available | |

| Thompson Ryan A | -- | None Available | |

| T&T Smith Development Llc | -- | Chicago Title | |

| Milbocker Edward | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Thompson Ryan A | $135,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,634 | $196,800 | $109,000 | $87,800 |

| 2024 | $4,459 | $167,000 | $90,000 | $77,000 |

| 2023 | $4,459 | $150,300 | $83,000 | $67,300 |

| 2022 | $4,459 | $139,200 | $75,000 | $64,200 |

| 2021 | $3,313 | $132,600 | $75,000 | $57,600 |

| 2020 | $3,313 | $102,500 | $75,000 | $27,500 |

| 2019 | $0 | $90,700 | $76,200 | $14,500 |

| 2018 | $0 | $89,500 | $76,000 | $13,500 |

| 2017 | $0 | $79,900 | $66,500 | $13,400 |

| 2016 | $0 | $69,800 | $57,200 | $12,600 |

| 2015 | -- | $69,800 | $57,200 | $12,600 |

| 2014 | -- | $66,200 | $55,000 | $11,200 |

| 2013 | -- | $58,400 | $47,500 | $10,900 |

Source: Public Records

Map

Nearby Homes

- V/L Springhill Dr

- V/L 109th Ave

- 1077 Sun Valley Ln

- 3138 Valley Vista Ln

- VL 34th

- VL 61acres 34th

- 45 acres 108th Ave

- Lot 18 Conley Dr

- 1269 Highland Ct

- 3570 109th Ave

- 3036 Primrose Place

- 616 Beechwood Dr

- 3537 Lake Ridge Ln

- 369 Thomas St

- 335 Thomas St

- 322 Thomas St

- 171 Thomas St

- VL 108th Ave

- 628 32nd St

- 716 30th St