3297 Eagles Loft Unit C Cortland, OH 44410

Estimated Value: $127,192 - $144,000

2

Beds

1

Bath

1,024

Sq Ft

$130/Sq Ft

Est. Value

About This Home

This home is located at 3297 Eagles Loft Unit C, Cortland, OH 44410 and is currently estimated at $132,798, approximately $129 per square foot. 3297 Eagles Loft Unit C is a home located in Trumbull County with nearby schools including Lakeview Elementary School, Lakeview Middle School, and Lakeview High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 11, 2016

Sold by

Kuszmaul Ronald E and Kuszmaul Phyllis E

Bought by

Hughes James L and Hughes Joyce J

Current Estimated Value

Purchase Details

Closed on

Mar 22, 2015

Sold by

Kuszmaul Ronald E

Bought by

Kuszmaul Phyllis E and Kuszmaul Ronald E

Purchase Details

Closed on

Mar 16, 2015

Sold by

Hutchins Charles E and Hutchins Debra

Bought by

Kuszmaul Phyllis E

Purchase Details

Closed on

Mar 11, 2015

Sold by

Clement Naomi J

Bought by

Kuszmaul Phyllis E

Purchase Details

Closed on

Jun 19, 2008

Sold by

Hutchins Grace E and Clement Naomi J

Bought by

Hutchins Charles E and Clement Naomi J

Purchase Details

Closed on

Jul 28, 2004

Sold by

Masluk Mark J and Masluk Erin L

Bought by

Hutchins Grace E

Purchase Details

Closed on

Feb 16, 1996

Sold by

Woodland Trails Inc

Bought by

Masluk Mark J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,183

Interest Rate

7.07%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hughes James L | $67,000 | None Available | |

| Kuszmaul Phyllis E | -- | None Available | |

| Kuszmaul Phyllis E | -- | None Available | |

| Kuszmaul Phyllis E | -- | None Available | |

| Hutchins Charles E | -- | None Available | |

| Hutchins Grace E | $85,500 | -- | |

| Masluk Mark J | $73,778 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Masluk Mark J | $75,183 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,221 | $34,590 | $3,680 | $30,910 |

| 2023 | $1,221 | $34,590 | $3,680 | $30,910 |

| 2022 | $915 | $25,030 | $2,980 | $22,050 |

| 2021 | $919 | $25,030 | $2,980 | $22,050 |

| 2020 | $924 | $25,030 | $2,980 | $22,050 |

| 2019 | $842 | $23,040 | $2,980 | $20,060 |

| 2018 | $846 | $23,040 | $2,980 | $20,060 |

| 2017 | $844 | $23,040 | $2,980 | $20,060 |

| 2016 | $1,424 | $22,720 | $2,700 | $20,020 |

| 2015 | $1,428 | $22,720 | $2,700 | $20,020 |

| 2014 | $1,314 | $22,720 | $2,700 | $20,020 |

| 2013 | $1,486 | $25,210 | $2,980 | $22,230 |

Source: Public Records

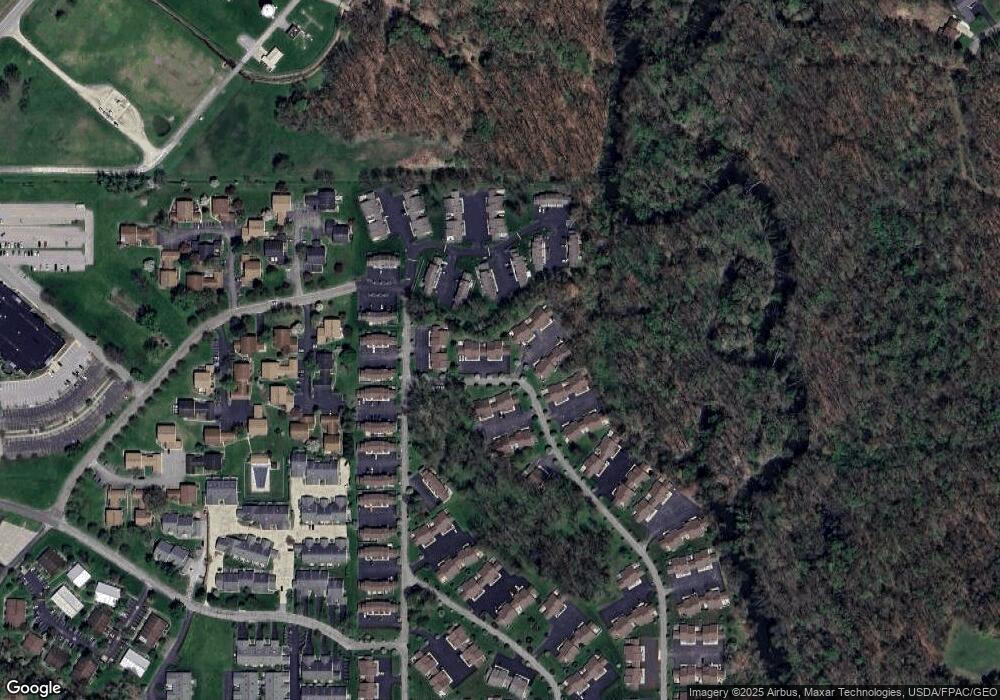

Map

Nearby Homes

- 3339 Eagles Loft

- 3224 Woodland Trail Unit B

- 3394 Ivy Hill Cir Unit E

- 3012 Ivy Hill Cir

- 3093 Ivy Hill Cir Unit D

- 3477 Ivy Hill Cir Unit B

- 2609 Warren Meadville Rd

- 2047 Quail Run Dr

- 2698 McCleary Jacoby Rd

- 92 Larry Ln

- 2342 McCleary Jacoby Rd

- 2261 Saddlebrook Ln

- 0 Niles Ashtabula Rd Unit 5147189

- 0 Black Duck Ct Unit 5133669

- 0 Durst Dr

- 2540 Cadwallader Sonk Rd

- 4167 N River Rd NE

- 255 S Linden Ct Unit 3

- 4260 N River Rd NE

- 106 N Aspen Ct Unit 4

- 3297 Eagles Loft Unit D

- 3297 Eagles Loft Unit B

- 3297 Eagles Loft Unit A

- 3329 Eagles Loft Unit D

- 3329 Eagles Loft Unit C

- 3329 Eagles Loft Unit B

- 3329 Eagles Loft Unit A

- 3281 Eagles Loft Unit D

- 3281 Eagles Loft Unit C

- 3281 Eagles Loft Unit B

- 3281 Eagles Loft Unit A

- 3328 Eagles Loft Unit D

- 3328 Eagles Loft Unit C

- 3328 Eagles Loft Unit B

- 3328 Eagles Loft Unit A

- 3339 Eagles Loft Unit D

- 3339 Eagles Loft Unit C

- 3339 Eagles Loft Unit B

- 3339 Eagles Loft Unit A

- 3253 Eagles Loft Unit D