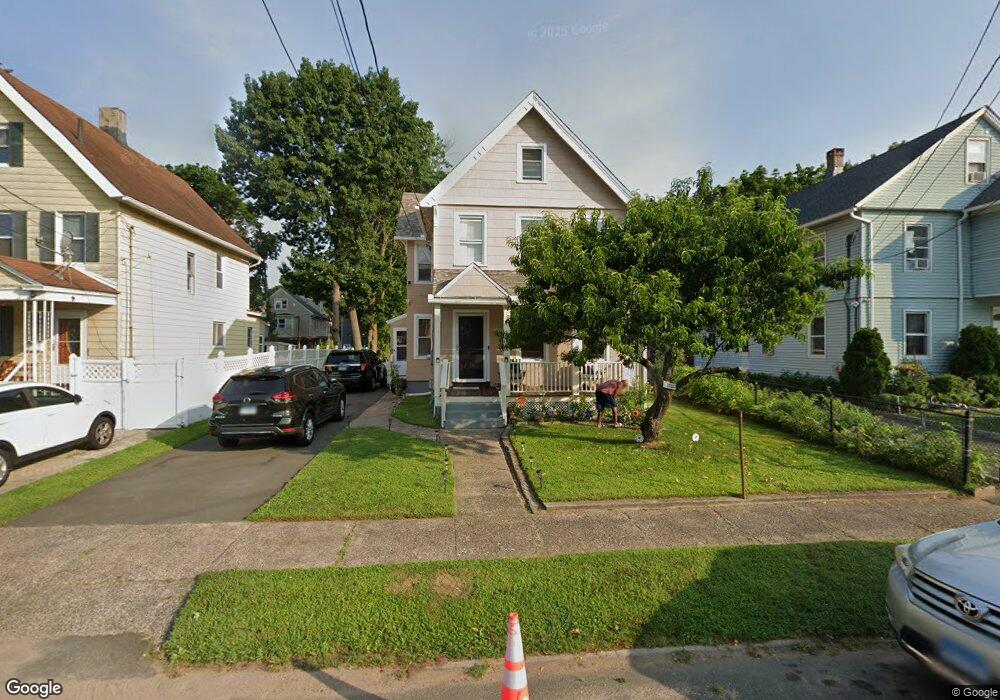

33 Wallace St West Haven, CT 06516

West Haven Center NeighborhoodEstimated Value: $305,359 - $339,000

3

Beds

2

Baths

1,344

Sq Ft

$242/Sq Ft

Est. Value

About This Home

This home is located at 33 Wallace St, West Haven, CT 06516 and is currently estimated at $324,840, approximately $241 per square foot. 33 Wallace St is a home located in New Haven County with nearby schools including Carrigan 5/6 Intermediate School, Harry M. Bailey Middle School, and West Haven High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 18, 2013

Sold by

Byfield Shaunett

Bought by

Byfield Shaunette and Doyle Donahugh

Current Estimated Value

Purchase Details

Closed on

Jun 27, 2003

Sold by

Rose Matthew S and Rose Nicole M

Bought by

Byfield Shaunett

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Interest Rate

5.53%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 19, 1999

Sold by

Lillis Mary F

Bought by

Rose Matthew S and Rose Nicole M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Byfield Shaunette | -- | -- | |

| Byfield Shaunett | $120,000 | -- | |

| Rose Matthew S | $70,000 | -- | |

| Byfield Shaunette | -- | -- | |

| Byfield Shaunett | $120,000 | -- | |

| Rose Matthew S | $70,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rose Matthew S | $211,500 | |

| Previous Owner | Rose Matthew S | $12,187 | |

| Previous Owner | Rose Matthew S | $120,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,028 | $174,580 | $61,880 | $112,700 |

| 2024 | $5,105 | $105,210 | $42,840 | $62,370 |

| 2023 | $4,893 | $105,210 | $42,840 | $62,370 |

| 2022 | $4,798 | $105,210 | $42,840 | $62,370 |

| 2021 | $4,984 | $105,210 | $42,840 | $62,370 |

| 2020 | $4,910 | $89,880 | $34,650 | $55,230 |

| 2019 | $4,910 | $89,880 | $34,650 | $55,230 |

| 2018 | $4,337 | $89,880 | $34,650 | $55,230 |

| 2017 | $4,104 | $89,880 | $34,650 | $55,230 |

| 2016 | $4,095 | $89,880 | $34,650 | $55,230 |

| 2015 | $4,423 | $109,620 | $37,870 | $71,750 |

| 2014 | $4,396 | $109,620 | $37,870 | $71,750 |

Source: Public Records

Map

Nearby Homes

- 484 1st Ave Unit 6

- 524 1st Ave

- 682 2nd Ave

- 548 Second Ave

- 126 Richards Place

- 141 Center St

- 88 Main St

- 21 Richards St

- 203 Main St

- 677 Washington Ave

- 22 Thill St

- 202 Main St Unit 3H

- 285 Main St

- 211 Kimberly Ave

- 300 Harbour Close Unit R

- 117 Harbour Close Unit 117

- 111 Harbour Close

- 2 Treadwell St

- 93 Spring St

- 28 Brown St