330 Oak St Nelsonville, OH 45764

Estimated Value: $121,000 - $171,000

7

Beds

2

Baths

1,381

Sq Ft

$106/Sq Ft

Est. Value

About This Home

This home is located at 330 Oak St, Nelsonville, OH 45764 and is currently estimated at $145,866, approximately $105 per square foot. 330 Oak St is a home located in Athens County with nearby schools including Nelsonville-York Elementary School, Nelsonville-York Junior High School, and Nelsonville-York High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 1, 2021

Sold by

Graf Byron and Graf Byron

Bought by

North Fairlawn Property Group Inc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$15,775

Outstanding Balance

$12,000

Interest Rate

3%

Mortgage Type

Commercial

Estimated Equity

$133,866

Purchase Details

Closed on

Mar 31, 2019

Sold by

Mcmichael Jon A

Bought by

Graf Bryon and Brooks William E

Purchase Details

Closed on

Mar 27, 2019

Sold by

Brooks William E

Bought by

Graf Bryon

Purchase Details

Closed on

Mar 9, 2001

Sold by

Christman Luther

Bought by

Mcmichael Jon A

Purchase Details

Closed on

Nov 25, 1992

Sold by

Patton David Marlene

Bought by

Christman Luther

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| North Fairlawn Property Group Inc | $457,500 | None Available | |

| Graf Bryon | $43,000 | Secure Title Services | |

| Graf Bryon | -- | Secure Title Services | |

| Mcmichael Jon A | $12,000 | -- | |

| Christman Luther | $18,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | North Fairlawn Property Group Inc | $15,775 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $637 | $13,070 | $2,480 | $10,590 |

| 2023 | $627 | $13,070 | $2,480 | $10,590 |

| 2022 | $559 | $11,080 | $2,250 | $8,830 |

| 2021 | $610 | $12,070 | $2,250 | $9,820 |

| 2020 | $631 | $12,070 | $2,250 | $9,820 |

| 2019 | $664 | $13,140 | $2,250 | $10,890 |

| 2018 | $666 | $13,140 | $2,250 | $10,890 |

| 2017 | $668 | $13,140 | $2,250 | $10,890 |

| 2016 | $654 | $12,330 | $2,250 | $10,080 |

| 2015 | $859 | $12,330 | $2,250 | $10,080 |

| 2014 | $859 | $12,330 | $2,250 | $10,080 |

| 2013 | $787 | $11,860 | $2,250 | $9,610 |

Source: Public Records

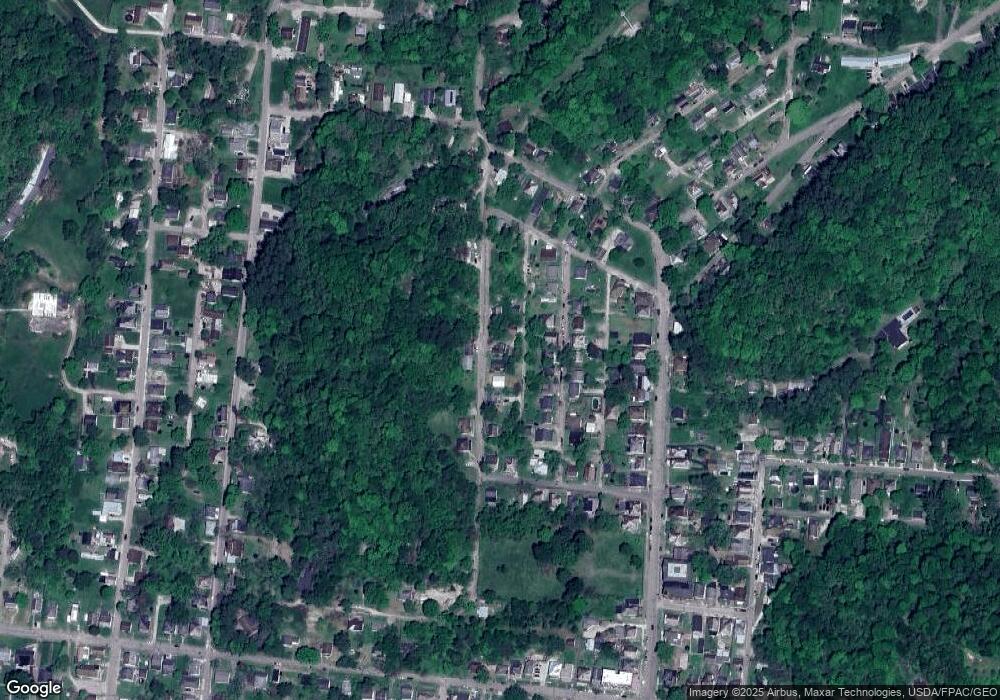

Map

Nearby Homes

- 345 Fort St

- 218 W Franklin St

- 357 Adams St

- 0 Ohio 278

- 518 W Franklin St

- 0 St Charles Unit 2433628

- 240 Jefferson St

- 190 Myers St

- 443 Chestnut St

- 480 High St

- 474 Chestnut St

- 15347 Ohio 278

- 0 Dorr Run

- 874 Chestnut St

- 20 4th St

- 1137 Poplar St

- 1200 Poplar St

- 1310 E Canal St

- 1110 Burr Oak Blvd

- 14946 Ohio 691