330 Private Road 281 Bonham, TX 75418

Estimated Value: $337,401 - $452,000

3

Beds

2

Baths

1,548

Sq Ft

$249/Sq Ft

Est. Value

About This Home

This home is located at 330 Private Road 281, Bonham, TX 75418 and is currently estimated at $384,800, approximately $248 per square foot. 330 Private Road 281 is a home located in Fannin County with nearby schools including Finley-Oates Elementary School and LH Rather Jr High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 12, 2021

Sold by

Nichols James Harold and Nichols Jeanette Rance

Bought by

Martinez Matthew and Martinez Hannah

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$265,010

Outstanding Balance

$240,613

Interest Rate

2.8%

Mortgage Type

FHA

Estimated Equity

$144,187

Purchase Details

Closed on

Jan 23, 2019

Sold by

Cruz Victor Manuel and Cruz Yesenia

Bought by

Nichols James Harold and Nichols Jeanette Rance

Purchase Details

Closed on

Apr 25, 2013

Sold by

Patton Debra

Bought by

Cruz Victor Manuel and Cruz Yesenia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$94,489

Interest Rate

3.67%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 14, 2005

Sold by

Schockey Arthur and Schockey Gayle

Bought by

Patton Jeff and Patton Debra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,743

Interest Rate

5.71%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Martinez Matthew | -- | Fannin County Title | |

| Nichols James Harold | -- | Cole Title Co | |

| Cruz Victor Manuel | -- | None Available | |

| Patton Jeff | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Martinez Matthew | $265,010 | |

| Previous Owner | Cruz Victor Manuel | $94,489 | |

| Previous Owner | Patton Jeff | $75,743 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,984 | $271,080 | $60,000 | $211,080 |

| 2024 | $2,984 | $287,320 | $60,000 | $227,320 |

| 2023 | $3,858 | $290,900 | $63,000 | $227,900 |

| 2022 | $4,054 | $248,450 | $38,000 | $210,450 |

| 2021 | $3,166 | $169,080 | $19,000 | $150,080 |

| 2020 | $2,737 | $143,990 | $11,000 | $132,990 |

| 2019 | $2,505 | $134,250 | $11,000 | $123,250 |

| 2018 | $2,273 | $115,520 | $8,900 | $106,620 |

| 2017 | $2,140 | $113,490 | $8,900 | $104,590 |

| 2016 | $2,036 | $107,940 | $8,900 | $99,040 |

| 2015 | -- | $101,870 | $8,900 | $92,970 |

| 2014 | -- | $104,040 | $8,900 | $95,140 |

Source: Public Records

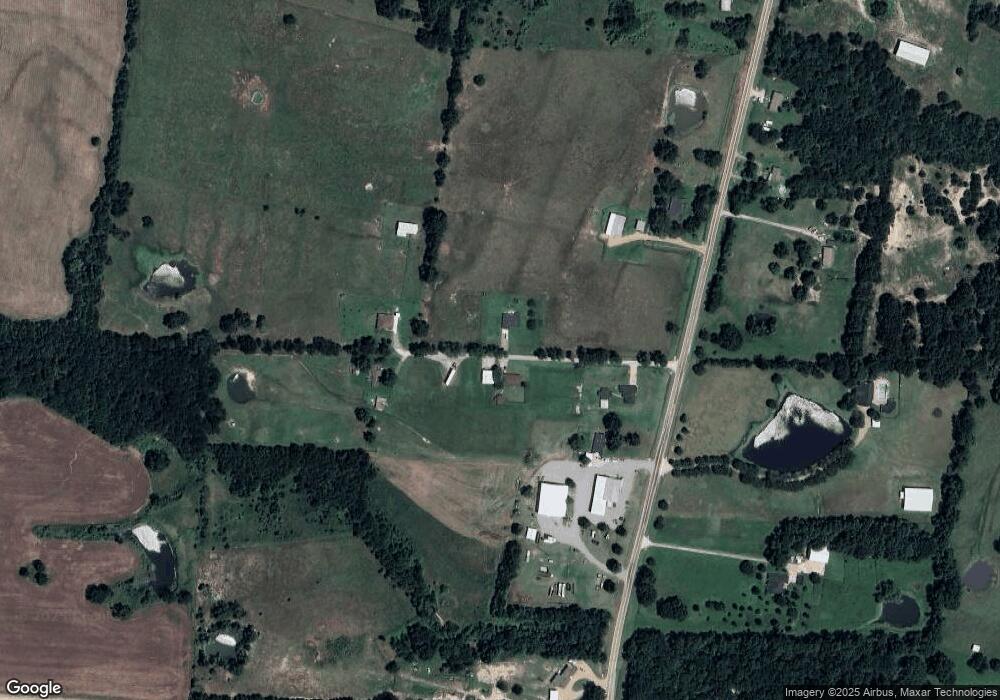

Map

Nearby Homes

- 956 County Road 4231

- 300 County Road 4233

- TBD #1 County Road 4145

- 0000 County Road 4145

- 2473 County Road 4215

- 2306 County Road 4145

- 000 County Road 4764

- 2701 Co Rd 4145

- 645 County Road 4160

- 462 County Road 4165

- 313 N Main

- 101 E Reed

- 470 Fm 896

- 308 N Helton St

- 200 E South St

- TBD 15+/- N S State Highway 121 St

- 1501 Business Highway 121

- 3876 NW State Highway 11

- 2628 S State Highway 121

- 1250 County Road 4120

- 330 Pr 281

- 329 Prairie 281

- 205 Prairie 281

- 380 Prairie 281

- 375 Prairie 281 Dr

- 2600 Fm 2815 S

- 2468 Fm 2815 S

- 2377 Fm 2815 S

- 2601 Fm 2815 S

- 2607 Fm 2815 S

- 2270 Farm To Market 2815

- TBD Farm To Market 2815

- 2229 Farm To Market 2815

- TBD 15.3 Acres Farm To Market 2815

- 1 Farm To Market 2815

- 0 2815 Hwy Unit 10066944

- 2773 Fm 2815 S

- 2227 Fm 2815 S

- 400 County Road 4235

- 2222 Fm 2815 S