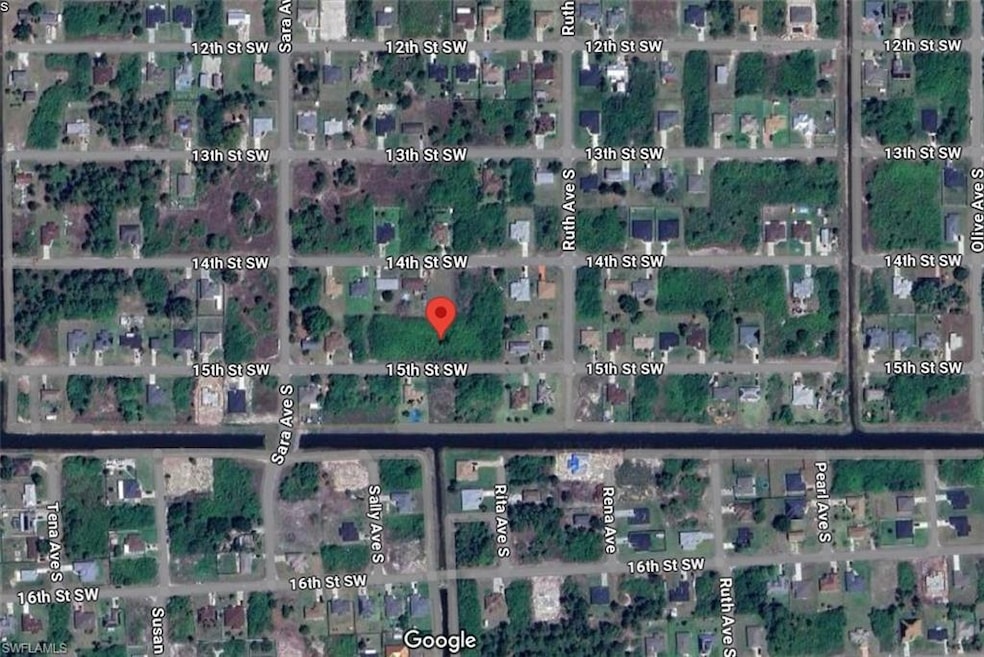

3308 15th St SW Lehigh Acres, FL 33976

Sunshine NeighborhoodEstimated payment $204/month

Total Views

245

0.25

Acre

$126,000

Price per Acre

10,890

Sq Ft Lot

About This Lot

Great Lot in Perfect Locations. Come have a look!, enjoy easy access to parks, schools, and shopping. Priced to sell. Build your beautiful dream home on this lot to enjoy the tranquility.

Property Details

Property Type

- Land

Est. Annual Taxes

- $457

Lot Details

- 0.25 Acre Lot

- Property is zoned RS-1

Community Details

- Lehigh Acres Condos

- Lehigh Acres Community

Listing and Financial Details

- Assessor Parcel Number 35-44-26-08-00070.0150

- Tax Block 70

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $354 | $19,257 | -- | -- |

| 2024 | $354 | $17,506 | $17,506 | -- |

| 2023 | $354 | $6,278 | $0 | $0 |

| 2022 | $309 | $5,707 | $0 | $0 |

| 2021 | $277 | $6,000 | $6,000 | $0 |

| 2020 | $270 | $5,000 | $5,000 | $0 |

| 2019 | $122 | $4,700 | $4,700 | $0 |

| 2018 | $110 | $4,400 | $4,400 | $0 |

| 2017 | $104 | $4,038 | $4,038 | $0 |

| 2016 | $96 | $3,800 | $3,800 | $0 |

| 2015 | $91 | $3,360 | $3,360 | $0 |

| 2014 | -- | $2,715 | $2,715 | $0 |

| 2013 | -- | $2,700 | $2,700 | $0 |

Source: Public Records

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 06/25/2025 06/25/25 | Price Changed | $31,500 | -14.6% | -- |

| 01/02/2025 01/02/25 | For Sale | $36,900 | -- | -- |

Source: Naples Area Board of REALTORS®

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Quit Claim Deed | $100 | None Listed On Document | |

| Public Action Common In Florida Clerks Tax Deed Or Tax Deeds Or Property Sold For Taxes | $12,318 | -- |

Source: Public Records

Source: Naples Area Board of REALTORS®

MLS Number: 225024000

APN: 35-44-26-08-00070.0150

Nearby Homes

- 3306 15th St SW

- 2506 15th St SW

- 2911 14th St SW

- 3605 14th St SW

- 2601 14th St SW

- 3407 14th St SW

- 3309 14th St SW

- 4112 14th St SW

- 2802 13th St SW

- 1510 Unice Ave S

- 3400 14th St SW

- 3419 16th St SW

- 1406 Vera Ave S

- 3602 17th St SW

- 1505 Sally Ave S

- 2910 11th St SW

- 2801 11th St SW

- 3705 11th St SW

- 2702 11th St SW

- 3606 17th St SW Unit 13

- 3408 15th St SW

- 1509 Sara Ave S

- 3313 14th St SW

- 3303 14th St SW

- 3418 20th St SW

- 1408 Xelda Ave S

- 3109 9th St SW

- 3107 9th St SW

- 3509 8th St SW

- 3800 11th St SW

- 3701 21st St SW

- 3806 18th St SW

- 3122 12th St SW

- 3202 8th St SW

- 3303 6th St SW

- 3811 21st St SW

- 3218 24th St SW

- 3805 22nd St SW

- 3908 18th St SW

- 3900 9th St SW