3309 Teeside Dr Unit 6404 New Port Richey, FL 34655

Estimated Value: $158,000 - $189,000

2

Beds

2

Baths

1,148

Sq Ft

$151/Sq Ft

Est. Value

About This Home

This home is located at 3309 Teeside Dr Unit 6404, New Port Richey, FL 34655 and is currently estimated at $173,858, approximately $151 per square foot. 3309 Teeside Dr Unit 6404 is a home located in Pasco County with nearby schools including Longleaf Elementary School, Seven Springs Middle School, and James W. Mitchell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 27, 2020

Sold by

Pedone Janie and Pedone Monte

Bought by

Sevigny Ivy M

Current Estimated Value

Purchase Details

Closed on

Mar 23, 2010

Sold by

Melton Judith and Pedone Janie

Bought by

Melton Judith

Purchase Details

Closed on

Mar 17, 2010

Sold by

Melton Judith A

Bought by

Melton Judith and Pedone Janie

Purchase Details

Closed on

Sep 12, 2008

Sold by

Plummer Gary

Bought by

Collins Genevieve

Purchase Details

Closed on

Dec 12, 2001

Sold by

Plummer Claude D and Plummer Gladys

Bought by

Plummer Claude D and Claude D Plummer

Purchase Details

Closed on

Oct 5, 1998

Sold by

K Joyce Szklarz Tr

Bought by

Plummertr Claude D and Plummer Gladys N

Purchase Details

Closed on

Mar 7, 1997

Sold by

Szklarz Walter E and Joyce Szklarz K

Bought by

Szklarz K Joyce

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sevigny Ivy M | $90,000 | Ark Title Services Llc | |

| Sevigny Ivy M | $90,000 | Ark Title Services Llc | |

| Sevigny Ivy M | $90,000 | Ark Title Services Llc | |

| Sevigny Ivy M | $90,000 | Ark Title Services Llc | |

| Melton Judith | -- | Attorney | |

| Melton Judith | -- | Attorney | |

| Melton Judith | -- | None Available | |

| Melton Judith | -- | None Available | |

| Collins Genevieve | $108,000 | Star Title Partners Of Palm | |

| Collins Genevieve | $108,000 | Star Title Partners Of Palm | |

| Plummer Claude D | -- | -- | |

| Plummer Claude D | -- | -- | |

| Plummertr Claude D | $51,285 | -- | |

| Plummertr Claude D | $51,285 | -- | |

| Szklarz K Joyce | $100 | -- | |

| Szklarz K Joyce | $100 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,716 | $171,176 | $6,435 | $164,741 |

| 2024 | $2,716 | $161,613 | $6,435 | $155,178 |

| 2023 | $2,485 | $129,810 | $0 | $0 |

| 2022 | $2,018 | $118,015 | $6,435 | $111,580 |

| 2021 | $1,911 | $109,763 | $6,435 | $103,328 |

| 2020 | $613 | $59,760 | $6,435 | $53,325 |

| 2019 | $605 | $58,420 | $0 | $0 |

| 2018 | $596 | $57,340 | $0 | $0 |

| 2017 | $598 | $57,328 | $0 | $0 |

| 2016 | $557 | $55,006 | $0 | $0 |

| 2015 | $565 | $54,624 | $0 | $0 |

| 2014 | $545 | $54,190 | $6,435 | $47,755 |

Source: Public Records

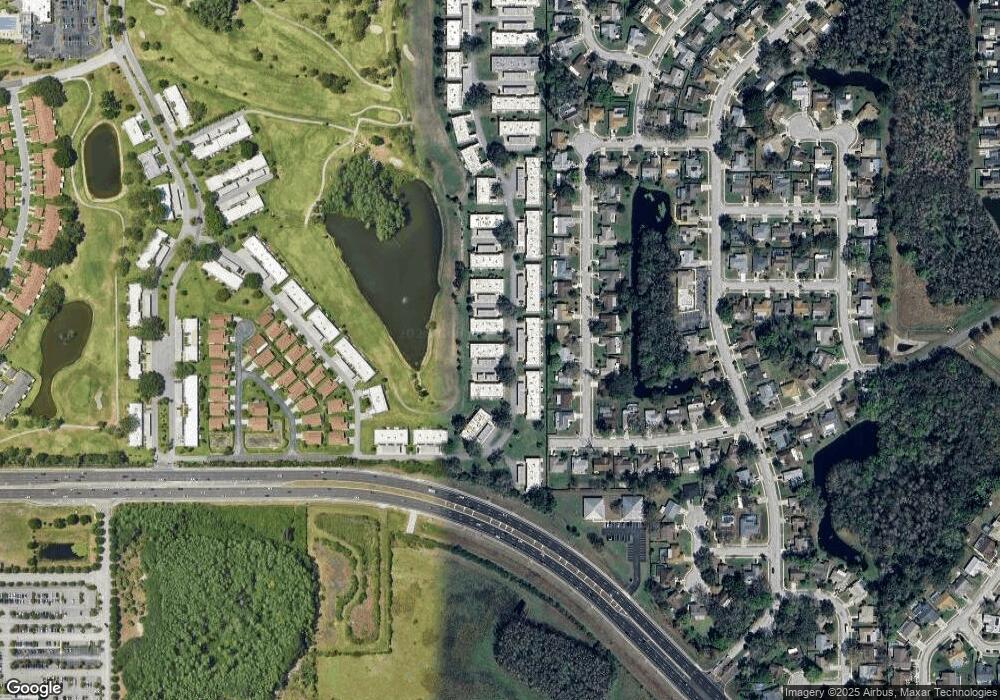

Map

Nearby Homes

- 3411 Teeside Dr

- 9827 Lema Ct

- 3402 Rankin Dr

- 3248 Trophy Blvd

- 3422 Trophy Blvd

- 3503 Teeside Dr

- 3521 Teeside Dr Unit 3521

- 3516 Player Dr

- 9344 Links Ln Unit 3905

- 3103 Ellington Way

- 3310 Lori Ln

- 3602 Player Dr

- 3716 Trophy Blvd

- 3712 Trophy Blvd Unit 3712

- 9312 Golf View Dr Unit 3

- 3683 Trophy Blvd Unit 7

- 3274 Lori Ln Unit 2

- 10106 Basin St

- 10127 Ringling St

- 9622 Brassie Ct Unit 9

- 3309 Teeside Dr Unit 4

- 3311 Teeside Dr Unit 3311

- 3311 Teeside Dr

- 3311 Teeside Dr Unit 6403

- 3311 Teeside Dr Unit 3

- 3313 Teeside Dr

- 3313 Teeside Dr Unit 6402

- 3315 Teeside Dr Unit 3315

- 3315 Teeside Dr Unit 6401

- 3323 Teeside Dr

- 3323 Teeside Dr Unit 10

- 3325 Teeside Dr

- 3327 Teeside Dr Unit 6303

- 3316 Teeside Dr

- 3316 Teeside Dr Unit 3316

- 3314 Teeside Dr

- 3329 Teeside Dr

- 3318 Teeside Dr Unit 2210

- 3320 Teeside Dr Unit 9

- 3320 Teeside Dr Unit 2209