3314 Soaring Bird Cir Colorado Springs, CO 80920

Briargate NeighborhoodEstimated Value: $436,664 - $476,000

4

Beds

3

Baths

1,492

Sq Ft

$306/Sq Ft

Est. Value

About This Home

This home is located at 3314 Soaring Bird Cir, Colorado Springs, CO 80920 and is currently estimated at $456,916, approximately $306 per square foot. 3314 Soaring Bird Cir is a home located in El Paso County with nearby schools including High Plains Elementary School, Mountain Ridge Middle School, and Rampart High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 2, 2012

Sold by

Griffith Glenn A

Bought by

Griffith Glenn A and Griffith Linda Sue

Current Estimated Value

Purchase Details

Closed on

Mar 8, 1999

Sold by

Hildebrandt Elaine R

Bought by

Griffith Glenn A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

6.8%

Mortgage Type

Balloon

Purchase Details

Closed on

Sep 13, 1993

Bought by

Griffith Linda Sue

Purchase Details

Closed on

Oct 15, 1992

Bought by

Griffith Linda Sue

Purchase Details

Closed on

Sep 21, 1992

Bought by

Griffith Linda Sue

Purchase Details

Closed on

May 5, 1992

Bought by

Griffith Linda Sue

Purchase Details

Closed on

Jan 1, 1989

Bought by

Griffith Glenn A

Purchase Details

Closed on

Sep 1, 1987

Bought by

Griffith Glenn A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Griffith Glenn A | -- | None Available | |

| Griffith Glenn A | $178,000 | -- | |

| Griffith Linda Sue | $143,200 | -- | |

| Griffith Linda Sue | -- | -- | |

| Griffith Linda Sue | -- | -- | |

| Griffith Linda Sue | -- | -- | |

| Griffith Glenn A | -- | -- | |

| Griffith Glenn A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Griffith Glenn A | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,867 | $32,930 | -- | -- |

| 2024 | $1,374 | $32,890 | $5,930 | $26,960 |

| 2022 | $1,189 | $23,800 | $3,820 | $19,980 |

| 2021 | $1,315 | $24,480 | $3,930 | $20,550 |

| 2020 | $1,261 | $22,640 | $3,070 | $19,570 |

| 2019 | $1,248 | $22,640 | $3,070 | $19,570 |

| 2018 | $1,021 | $19,660 | $2,810 | $16,850 |

| 2017 | $1,017 | $19,660 | $2,810 | $16,850 |

| 2016 | $995 | $20,130 | $2,390 | $17,740 |

| 2015 | $993 | $20,130 | $2,390 | $17,740 |

| 2014 | $1,069 | $21,060 | $2,390 | $18,670 |

Source: Public Records

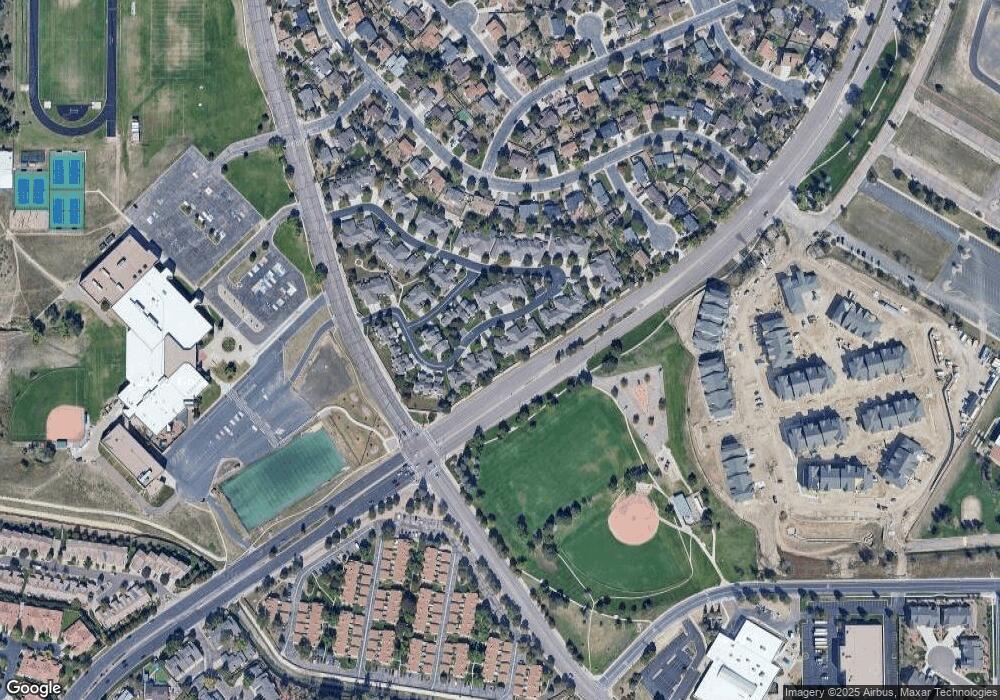

Map

Nearby Homes

- 3326 Soaring Bird Cir

- 3142 Soaring Bird Cir

- 8213 Caravel Dr

- 2768 Thrush Grove

- 3339 Union Jack Way

- 7849 Flicker Grove

- 2615 Thrush Grove

- 8112 Old Exchange Dr

- 8020 Cooper River Dr

- 8146 Horizon Dr

- 7640 Gibralter Dr

- 7530 Madrid Ct

- 3690 Amelia Island St

- 3329 Misty Meadows Dr

- 7644 Lexington Manor Dr

- 8118 Ravenel Dr

- 2656 Marston Heights

- 7636 Lexington Manor Dr

- 7870 Chimney Terrace

- 8335 Saint Helena Dr

- 3310 Soaring Bird Cir

- 3318 Soaring Bird Cir

- 3306 Soaring Bird Cir

- 3322 Soaring Bird Cir

- 3270 Soaring Bird Cir

- 3319 Soaring Bird Cir

- 3315 Soaring Bird Cir

- 3305 Soaring Bird Cir

- 8125 Celestial Ln

- 8135 Celestial Ln

- 3266 Soaring Bird Cir

- 3271 Soaring Bird Cir

- 3330 Soaring Bird Cir

- 8115 Celestial Ln

- 3335 Soaring Bird Cir

- 3262 Soaring Bird Cir

- 3345 Soaring Bird Cir

- 3334 Soaring Bird Cir

- 8105 Celestial Ln

- 3258 Soaring Bird Cir