3319 Sable Creek San Antonio, TX 78259

Cavalo NeighborhoodEstimated Value: $917,000 - $941,000

5

Beds

4

Baths

4,199

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 3319 Sable Creek, San Antonio, TX 78259 and is currently estimated at $931,526, approximately $221 per square foot. 3319 Sable Creek is a home located in Bexar County with nearby schools including Roan Forest Elementary School, Tejeda Middle School, and Johnson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 3, 2010

Sold by

National Residential Nominee Services In

Bought by

Fleming Franklin G and Fleming Nancy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$309,000

Outstanding Balance

$204,278

Interest Rate

4.54%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$727,248

Purchase Details

Closed on

Mar 18, 2005

Sold by

Kelleher James M and Kelleher Patrice J

Bought by

Brandvold David B and Brandvold Michele C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$355,200

Interest Rate

4.25%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jun 30, 2003

Sold by

Arcadia Interests Inc

Bought by

Kelleher James M and Kelleher Patrice J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$322,700

Interest Rate

5.27%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fleming Franklin G | -- | Alamo Title | |

| National Residential Nominee Services In | -- | Alamo Title | |

| Brandvold David B | -- | Commerce Title Co | |

| Kelleher James M | -- | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | National Residential Nominee Services In | $309,000 | |

| Closed | Fleming Franklin G | $307,500 | |

| Previous Owner | Brandvold David B | $355,200 | |

| Previous Owner | Kelleher James M | $322,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $16,184 | $879,250 | $97,820 | $781,430 |

| 2024 | $16,184 | $839,702 | $97,820 | $790,950 |

| 2023 | $16,184 | $763,365 | $97,820 | $728,520 |

| 2022 | $17,124 | $693,968 | $85,140 | $702,480 |

| 2021 | $16,117 | $630,880 | $77,290 | $553,590 |

| 2020 | $15,191 | $585,790 | $77,290 | $508,500 |

| 2019 | $15,397 | $578,110 | $87,960 | $490,150 |

| 2018 | $15,261 | $571,570 | $87,960 | $483,610 |

| 2017 | $14,680 | $544,760 | $87,960 | $456,800 |

| 2016 | $14,366 | $533,115 | $87,360 | $460,780 |

| 2015 | $12,179 | $484,650 | $87,360 | $397,290 |

| 2014 | $12,179 | $448,560 | $0 | $0 |

Source: Public Records

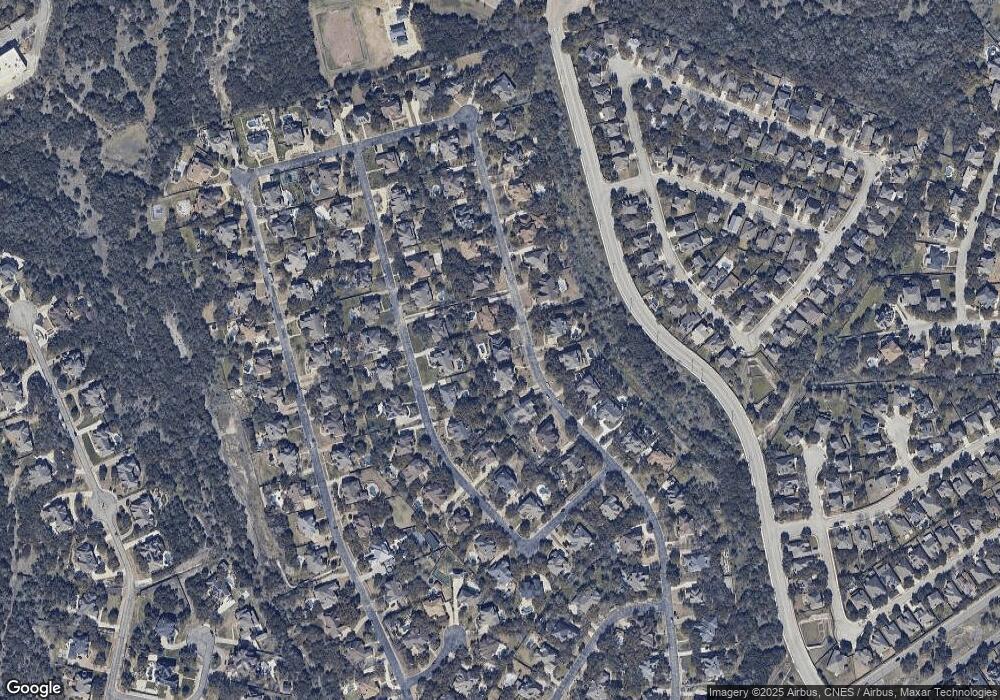

Map

Nearby Homes

- 22418 Roan Forest

- 22415 Roan Forest

- 139 Impala Cir

- 8 Sable Forest

- 131 Impala Cir

- 134 Gazelle Ct

- 24 Sable Forest

- 3007 Sable Creek

- 21934 Ruby Run

- 21930 Tower Terrace

- 3515 Edge View

- 2927 Winter Gorge

- 3330 Edge View

- 2902 Winter Gorge

- 22422 Sierra Blanca

- 23126 Lexington Park

- 2818 Winter Gorge

- 2703 Rio Brazos

- 2922 Kentucky Oaks

- 2611 Rio Brazos

- 3315 Sable Creek

- 3230 Roan Way

- 3234 Roan Way

- 3226 Roan Way

- 3318 Sable Ck

- 3327 Sable Creek

- 3311 Sable Creek

- 3318 Sable Creek

- 3314 Sable Creek

- 3322 Sable Creek

- 3238 Roan Way

- 3220 Roan Way

- 3310 Sable Creek

- 3331 Sable Creek

- 3307 Sable Creek

- 3326 Sable Creek

- 3214 Roan Way

- 3242 Roan Way

- 3227 Roan Way

- 3235 Roan Way