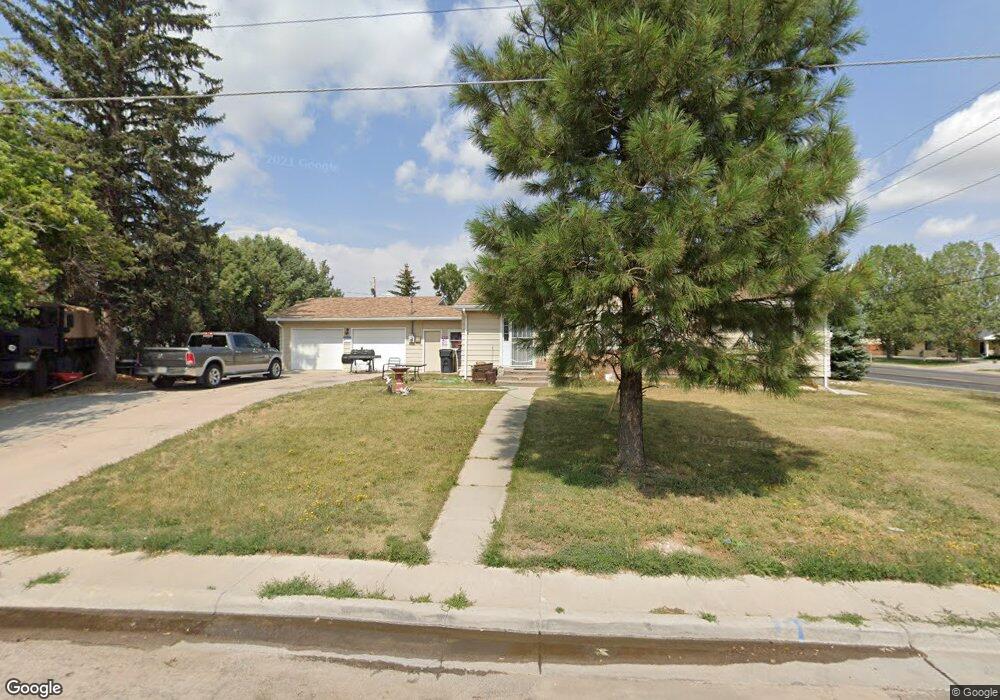

3320 Charles St Cheyenne, WY 82001

Estimated Value: $356,760 - $374,000

5

Beds

2

Baths

1,294

Sq Ft

$284/Sq Ft

Est. Value

About This Home

This home is located at 3320 Charles St, Cheyenne, WY 82001 and is currently estimated at $366,940, approximately $283 per square foot. 3320 Charles St is a home located in Laramie County with nearby schools including Baggs Elementary School, Carey Junior High School, and East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 5, 2021

Sold by

Anthony Reihl Jr Joseph and Stella Laura

Bought by

Stiles Shawn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$73,875

Outstanding Balance

$67,712

Interest Rate

3.01%

Mortgage Type

Commercial

Estimated Equity

$299,228

Purchase Details

Closed on

Jan 27, 2012

Sold by

Martin Steven and Martin Luanne

Bought by

Fierro Martha Lidia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,817

Interest Rate

3.5%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stiles Shawn | -- | First American Title | |

| Fierro Martha Lidia | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stiles Shawn | $73,875 | |

| Previous Owner | Fierro Martha Lidia | $160,817 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,345 | $25,077 | $2,665 | $22,412 |

| 2024 | $2,345 | $33,157 | $3,554 | $29,603 |

| 2023 | $2,274 | $32,153 | $3,554 | $28,599 |

| 2022 | $1,974 | $27,344 | $3,554 | $23,790 |

| 2021 | $1,837 | $25,396 | $3,224 | $22,172 |

| 2020 | $1,617 | $22,419 | $3,224 | $19,195 |

| 2019 | $1,474 | $20,409 | $3,224 | $17,185 |

| 2018 | $1,488 | $20,801 | $3,224 | $17,577 |

| 2017 | $1,400 | $19,402 | $3,224 | $16,178 |

| 2016 | $1,285 | $17,799 | $3,039 | $14,760 |

| 2015 | $1,254 | $17,356 | $3,039 | $14,317 |

| 2014 | $1,292 | $17,778 | $3,039 | $14,739 |

Source: Public Records

Map

Nearby Homes

- 3207 Cheyenne St

- Proposed Lot 3 Ridge Rd

- Proposed Lot 2 Ridge Rd

- Proposed Lot 4 Ridge Rd

- 3315 Grove Dr

- 3711 Rawlins St

- 3802 Mccann Ave

- 3316 Rock Springs St

- TBD Rock Springs St

- 3820 E Pershing Blvd

- 3820 E Pershing Blvd

- 4002 Cheyenne St

- Lot 1 Block 2 N College Dr

- Lot 1 Block 1 N College Dr

- 2334 Mccann Ave Unit 56

- TBD Atkin St

- 1804 Laurel Dr

- 3248 Acacia Dr

- 4315 Bevans St

- 2775 Olive Dr

- 3514 Ridge Rd

- 3452 Ridge Rd

- 3300 Charles St

- 3507 Birch Place

- 3513 Birch Place

- 3446 Ridge Rd

- 3519 Birch Place

- 3524 Ridge Rd

- 3442 Ridge Rd

- 3525 Birch Place

- 3438 Ridge Rd

- 3525 Ridge Rd

- 3531 Birch Place

- 3427 Birch Place

- 3500 Birch Place

- 3506 Birch Place

- 3512 Birch Place

- 3529 Ridge Rd

- 3434 Ridge Rd

- 3508 Luther Place