Bridgepoint Condominiums 334 Padre Blvd Unit 2700 South Padre Island, TX 78597

Estimated Value: $794,000 - $1,016,000

2

Beds

2

Baths

2,103

Sq Ft

$432/Sq Ft

Est. Value

About This Home

This home is located at 334 Padre Blvd Unit 2700, South Padre Island, TX 78597 and is currently estimated at $908,430, approximately $431 per square foot. 334 Padre Blvd Unit 2700 is a home located in Cameron County with nearby schools including Garriga Elementary School, Derry Elementary School, and Port Isabel Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 1, 2020

Sold by

Slovak Martinez Holdings Series 3 A Sepe

Bought by

Spence Allan Barwise

Current Estimated Value

Purchase Details

Closed on

Jun 20, 2016

Sold by

The Tooth Place Pa

Bought by

Slovak Martinez Holdings Series 3 and Slovak Martinez Holdings Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$420,000

Interest Rate

4.1%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 27, 2013

Sold by

Myer Robert L

Bought by

Slm Consolidated Investments Lp

Purchase Details

Closed on

Mar 1, 2001

Sold by

Myer Sharon K

Bought by

Myer Robert L and Robert L Myer Qualified Personal Residen

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Spence Allan Barwise | -- | Stewart Title Company | |

| Slovak Martinez Holdings Series 3 | $420,000 | None Available | |

| Slm Consolidated Investments Lp | -- | None Available | |

| Lam Consolidated Investmets Lp | -- | None Available | |

| Myer Robert L | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Slovak Martinez Holdings Series 3 | $420,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,462 | $889,247 | $112,047 | $777,200 |

| 2024 | $13,462 | $824,514 | $112,047 | $712,467 |

| 2023 | $14,136 | $824,514 | $112,047 | $712,467 |

| 2022 | $12,019 | $634,277 | $102,988 | $531,289 |

| 2021 | $12,806 | $636,751 | $97,872 | $538,879 |

| 2020 | $13,047 | $644,342 | $97,872 | $546,470 |

| 2019 | $13,447 | $651,201 | $97,142 | $554,059 |

| 2018 | $12,440 | $602,864 | $97,142 | $505,722 |

| 2017 | $12,482 | $609,608 | $97,142 | $512,466 |

| 2016 | $12,423 | $606,745 | $97,142 | $509,603 |

| 2015 | $12,573 | $613,364 | $97,142 | $516,222 |

Source: Public Records

About Bridgepoint Condominiums

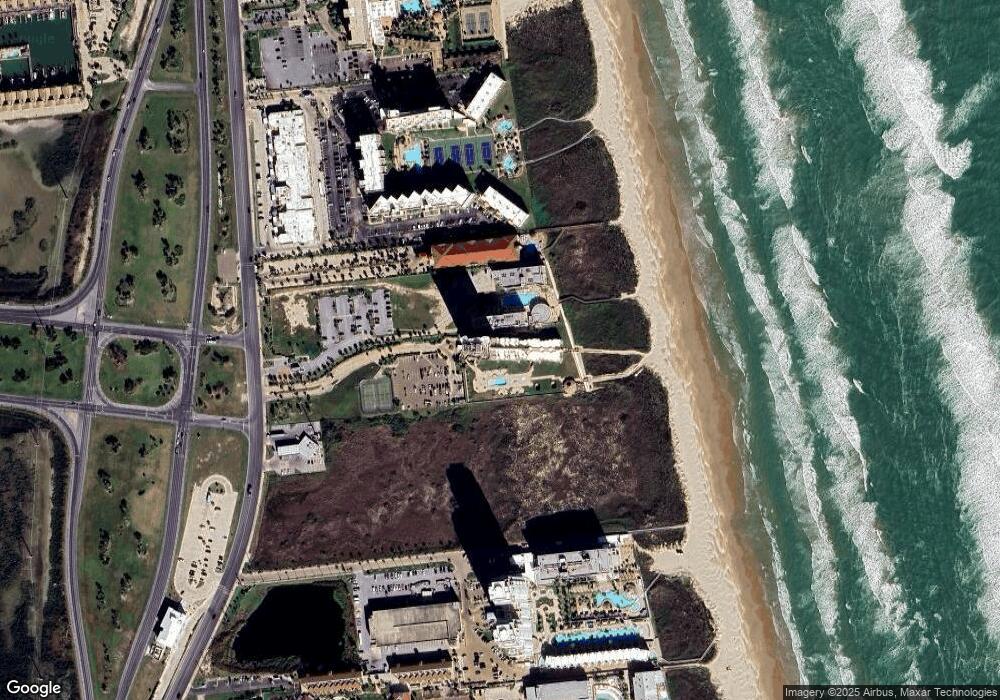

Map

Nearby Homes

- 334 Padre Blvd Unit 801

- 334 Padre Blvd Unit 2401

- 334 Padre Blvd Unit 1500

- 334 Padre Blvd Unit 803

- 334 Padre Blvd Unit 1200

- 334 Padre Blvd Unit 2800

- 402 Padre Blvd Unit 303

- 402 Padre Blvd Unit 505

- 402 Padre Blvd

- 402 Padre Blvd Unit 301

- 402 Padre Blvd Unit 101

- 406 Padre Blvd Unit 904

- 406 Padre Blvd Unit 207

- 406 Padre Blvd Unit 408

- 310 Padre Blvd Unit 1215

- 310 Padre Blvd Unit 204

- 310 Padre Blvd Unit 707

- 310 Padre Blvd Unit 523

- 310 Padre Blvd Unit 2305

- 310 Padre Blvd Unit 201

- 334 Padre Blvd Unit 2902

- 334 Padre Blvd Unit 2901

- 334 Padre Blvd Unit 2900

- 334 Padre Blvd Unit 2802

- 334 Padre Blvd Unit 2801

- 334 Padre Blvd Unit 2702

- 334 Padre Blvd Unit 2701

- 334 Padre Blvd Unit 2602

- 334 Padre Blvd Unit 2601

- 334 Padre Blvd Unit 2600

- 334 Padre Blvd Unit 2502

- 334 Padre Blvd Unit 2501

- 334 Padre Blvd Unit 2500

- 334 Padre Blvd Unit 2402

- 334 Padre Blvd Unit 2400

- 334 Padre Blvd Unit 2302

- 334 Padre Blvd Unit 2301

- 334 Padre Blvd Unit 2300

- 334 Padre Blvd Unit 2202

- 334 Padre Blvd Unit 2201